Forex Strategy «3 Bar» — a simple forex trading strategy is based on the assumption that, after three successive bull bars (bar closing occurred higher than its opening) in the forex market is dominated by the bulls and therefore the price will continue to grow after 3 consistently bearish bars ( close of the bar there was lower than its opening), the price in the market continue to fall, because the forex market is dominated by the bears. This forex strategy was sent Evgeny Zorin, for which I am very grateful to him!

Such strategies forex trading (on a sequence of 3 bars or candles) on the site have been considered previously: 1 I: Forex Strategy «3 Bar Buy / Low Set Up», 2-I: Forex Strategy, which requires 15 minutes a day

Forex Strategy «3 bar» is effective for the time interval H1 and the currency pair EURUSD (although it is possible to use it on other currency pairs, but the parameters of the indicators to be collected manually (!)).

To use the strategy of «3 bar» must be a trading platform Metatrader 4 forex indicators to establish the following:

1) Weighted Moving Average WMA (56) — Moving Average Linear Weighted Moving Average with the parameter 56, with reference to Close — gives a signal to buy or sell, depending on the position relative to its price bars.

2) The MACD with parameters (94,13,78), applied to a Close — confirms a signal to buy or sell.

Deal for a purchase of forex strategy «3 bar»:

1) formed on 3 successive bull bars on the chart are displayed in blue.

2) All 3 bars are above average WMA (56), or at least the closing price of the last bar (candle) is above the moving average of WMA (56).

3) Signal SMA MACD indicator closed above the previous bar.

4) The deal opens the opening price the next bar (the bar)!

5) Stop-loss is calculated as follows:

Stop-loss = 2 * Minimum of the first bar — Maximum third bar

6) Take-profit is calculated as follows:

Take-profit = The opening price + (price discovery — Stop-Loss) / 2

Conclusion of a deal to sell at a forex strategy «3 bar»:

1) The closing price of the last bar (candle) is below the moving average of WMA (56).

2) formed on 3 successive bear bar in the chart are displayed in red.

3) Signal SMA MACD indicator closes below the previous bar.

4) The deal opens the opening price the next bar (the bar)!

5) Stop-loss is calculated as follows:

Stop-loss = 2 * Most of the first bar — at least a third bar

6) Take-profit is calculated as follows:

Take-Profit = Price discovery — (Opening price — stop loss) / 2

Note:

- You can set a stop loss and take profit on their own for local minimum or maximum, or to use for setting goals Fibonacci extension.

- As in any forex strategy, I recommend trading in accordance with the rules of Money Management

Forex indicators do not spread because they are in every terminal MT4 default and will be installed immediately after installation template 3bar_plus.tpl

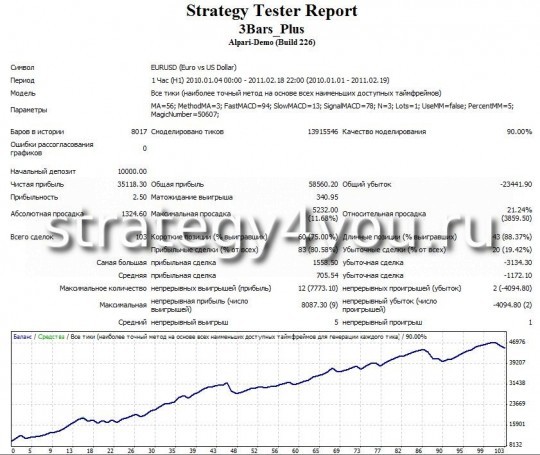

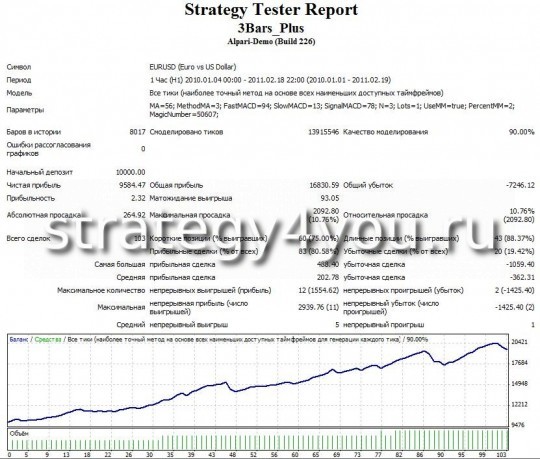

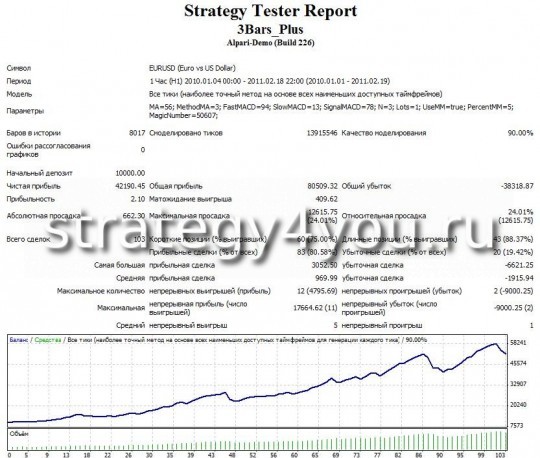

If you strictly follow the rules of the forex strategy «3 bars», over the period from January 2010 to February 19, 2011 are obtained about the following graphs of return:

1) Test forex strategy «3 bar» on the currency pair EURUSD (H1), with the help of advisor forex 3Bars_Plus.

Permanent Lot — 1.0:

2) Test forex strategy «3 bar» on the currency pair EURUSD (H1), with the help of advisor forex 3Bars_Plus.

Dynamic lot, risk 2% of the deposit:

3) Test forex strategy «3 bar» on the currency pair EURUSD (H1), with the help of advisor forex 3Bars_Plus.

Dynamic lot, risk 5% of the deposit: