Forex Strategy — Martingale method.

Imagine a forex strategy that is 100% profitable — would you interested in this strategy FOREX? Almost all Forex traders, most quickly, would answer with a resounding «of course» but not strange, but the strategy of trade and truth exists, and there is an 18 th century. This trading strategy is based on probability theory and if your deposit on the forex is large enough, and you are trading with the relatively small lot, this forex strategy gives the probability of making a profit — about 100%!

This forex strategy, known in the world of financial trading, as the Martingale, before frequently used in gambling halls casinos in Las Vegas and it is this strategy and was the main reason why in all the casinos now have minimums and maximums for gambling bets, and why now roulette has 2 green field (0 and 00).

But all the shortcomings of this system lies in the fact that to obtain a 100% return you have to have very big pockets full of money. Much to our regret, no one can have infinite wealth, and theoretically, one missed a bargain can lead to complete bankruptcy. In addition, the risk of transaction is sometimes very much larger than the potential profit on it also.

But despite these drawbacks, of course, there are many ways to improve the strategy of «Martingale». Let’s look at ways we can improve your chances when dealing with this very high-risk and difficult trading strategy.

What does the «Martingale Strategy?

Strategy «martingale» was opened by French mathematician Paul Pierre Levy. Originally, martingale was just kind of style gambling bets, which was based on «doubling down». It is tempting to what a lot of works devoted to the martingale strategy, were written by American mathematician Joseph Leo Doob, who tried to refute the likelihood of 100% profitable betting system.

The essence of the system, of course, requires one initial bet, but every time a bet is lost or closed with a loss, the stakes are doubled so that a winning deal blocked all the previous losing trades. The introduction of new numbers 0 and 00 on the roulette wheel was made precisely in order to completely break down the mechanics of martingale, in the process of the game, roulette has been more than 2 options, but even-odd or red / black. This eventually led to the fact that the expectation of profit by using Martingale roulette turned negative and, in a manner prevented the full meaning of its use.

To finally understand the basics of Martingale, let’s look at an ordinary example. Imagine we toss a coin and bet on falling only eagles or tails with an initial rate of $ 1. There is a 50% chance that the coin will fall or an eagle or tails and each shot is independent, ie each previous shot or does not affect the outcome of the next. As long as you stick to one path, you can still end up, but given an infinite amount of available money you have, wait for the necessary loss of the coin, and thus win back all their losses received + $ 1. This strategy is based on the premise that we need only 1 deal, so our loss again turned into profit.

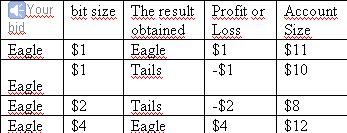

Option number 1 (Eagle or Tails, the odds — 50/50):

Imagine that you only have $ 10 to bet, starting from 1 st to $ 1. You bet on what will appear eagle coin falls exactly eagle and you win $ 1, while increasing its assets to $ 11. Each time, as soon as you win, continue to put exactly the same $ 1 until you lose it. The next shot and you lose your asset was $ 10. Now, on the next roll you already put $ 2 in the hope that if the coin comes up a nickel with an eagle, you will be able to recover past losses and bring the net profit and loss back to zero. For if not sorry, but the coin falls tails again and you lose these $ 2, reducing its expense to $ 8. Thus, under this system, Martingale, the next Your bid must be equal to twice the previous rate — $ 4. And then you have won and received $ 4, bringing its total assets to $ 12. Now you see what you need to return all its previous losses — only a single win.

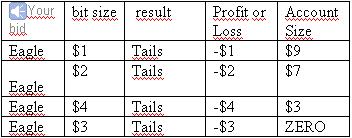

But, let’s look at what happen, if suddenly will fall into the losing streak, as a possible scenario number 2:

And so, you have $ 10. In this scenario, you will immediately lose the first of its headquarters and reduce its assets to $ 9. Now you double your bet on the next roll, you lose again and stay with is $ 7. On 3-meter roll of your current bid has been — $ 4, and after losing to you there are only $ 3. And now you absolutely do not have enough money to double down, and now the best thing you can do — is to put all that you have. If you suddenly lose you — a complete bust, but even if you suddenly win, then to the initial capital of $ 10 will still be very far away.

Application of the method (strategy) Martingale in trading Forex:

You can assume that the longest string of losses, as in the example above, is a very rare bad luck, but as soon as you trade currencies, they tend to their trend and trends can last a very long time, and it is more noticeable when you signed transaction in the wrong direction (against the trend).

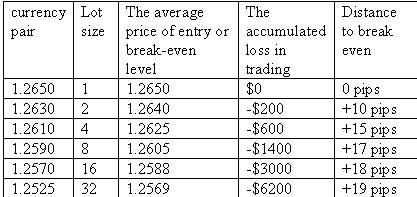

However, an important property of the martingale strategy in applying to trading forex is that «doubling down», you will significantly lower your average entry price into the market. In the example described below, for 2 lots, to go into the break-even, at the conclusion of the transaction, you need to the currency pair EUR / USD has increased in value from 1.2630 to 1.2640.

Because price moves lower and you add four lots, to break even you now want to increase the value price of only up to 1.2625 instead of 1.2640. The greater the number of lots you add, the trade, the lower your average entry price. And even though you can easily lose 100 pips on the first prisoner lot EUR / USD, if the price for this goes to 1.2550, you will need only to currency rose to a level of 1.2569 to the total capital in this case went to the zone breakeven.

It is also a good example of why the need deep pockets. And if you have a trading account was only $ 5,000, you would have been bankrupt before the moment when the currency pair EUR / USD has reached the level of 1.2550. The currency pair may eventually turn around, but when using the martingale system is often so that you may not have enough money to stay in the foreign exchange market requires a long time. So if you are trading in the forex Martingale, then obviously nichinayte with small lots.

Why do Martingale still works better on the forex market (FOREX):

One of the main reasons why the trading strategy martingale so popular on the market, is that, unlike stocks, currency pairs rarely go to zero. Trading companies can easily go bankrupt, and the state — can not. There are periods when a currency pair is devalued, but even with vareante slump, the value of currencies will never reach zero. This is not just impossible, and for this it is necessary that there was something very awful thing to even consider this option is not desirable.

The main essence of the strategy forex trading on the martingale method is that the price can not indefinitely be in the same range and sooner or later, will be out of this range. And if you calculate the over all quality indicators in forex trading terminal, for example — metatrader 4, but when this happens the output, then you can safely put the pending orders to enter the market and wait for profit.

And even if one or two deals will close with a loss, then all the same series of warrants in forex trading will close at a profit and the main thing that you had the size of your deposit:

Currently, there are plenty of forex companies offering advanced trading signals forex mechanical trading systems which are based on the method of Martingale. Developer’s company, making a huge number of improvements and additions, as well as all sorts of instructions are sent to trade forex signals over existing methods that allow fewer risks when trading in the forex market. But the main thrust of these strategies — all the same method of Martingale.

And I’m not arguing that these improvements allow traders to make money and at the same time a decent amount, and I personally know a few traders who successfully traded on these signals and MTS (automated trading systems) but it still did not forget that the size of the deposit must yet can withstand several turns of the market.

To one of the transactions still closed profit and you get your increase to the deposit. And for this we must first do not be greedy and open small lot …Forex — Market also offers one a unique advantage, which makes it even more attractive to traders who have sufficient assets to work on the Martingale system. Opportunity to make a difference in interest rates, allows traders to offset the trading losses of their income as a percentage.

This means that a trader can sell the martingale strategy only on the currency pairs in the direction of a positive swap on your trading account. Mean that he should buy a currency with high interest rates, while earning interest, and sell a currency with a relatively low level of interest rates. With a large number lots traded interest income can be quite noticeable and, thus, will work on reducing your average entry price into the market.

Always be aware of the risks involved in Forex trading strategy Martingale:

Martingale strategy may seem attractive to some traders, but I want to warn those traders who tries hard to practice this method of forex trading. Remember that the main problem of this system lies in the fact that sometimes one single trade deal can completely reset your trading account before the moment you get some political gain, or even be able to cover the losses. Trading the trader must always be ready for the option that it may lose most of the assets on the trade account by only a single transaction. Given this need to avoid the fact that we should not strive for very profits when trading on the Martingale method. Therefore, forex trading strategy on the martingale method is not suitable for all traders.