Forex strategy «TR-Gold» is based on the classic 200-day moving average signals. In principle, there are not so many signals on the trading system, especially since trading is carried out on only one instrument. However, thanks to a very impressive profit to loss ratio, this system has proven itself quite well.

Statistics:

- The instrument is XAU/USD (gold).

- The senior time interval is D1.

- Junior Time Interval — H1.

Indicators:

- Simple moving average with a period of 200.

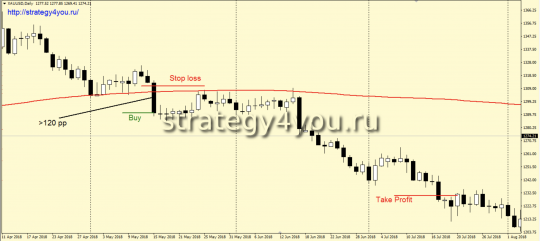

Conditions for purchases under the «TR-Gold» strategy

Option «A»:

1) The price was below the moving average and then it crosses from the bottom up.

2) The very first daily candle, the body of which is white and with a body of more than 120 points ($12), gives a signal to conclude a deal to buy at the opening of the next day.

3) Stop-loss order is placed beyond the minimum of this candle, but not more than 200 points.

4) After passing 200 points in the positive zone, the transaction is transferred to breakeven.

5) Take profit — 600 points.

Option «B»:

1) The price is above the moving average.

2) The next daily candle closes with a white body and with a body size of more than 120 points.

3) The next day, a candle is formed with a relatively small body in relation to the previous candle. (This is the most controversial moment of this system, but we more or less determined for ourselves that the closing of the candle should not be lower than 50 fibonacci from the body of the previous candle).

4) The tail on top of this candle should not be larger than the body. If the maximum of the previous candle is rewritten, then this should not be a large value, but a purely formal one.

5) If all these conditions are met, then at the opening of the next day a buy deal is concluded.

6) Stop-loss is set below the low of the previous day (not less than 30 points).

7) After passing 80 points in the positive zone, the transaction is transferred to breakeven.

8) Take profit is 300 pips.

9) If on the same day the deal is stopped out, then a re-entry is quite possible. To do this, you need the price to again go above the low of the previous candle and form a candle with a white body, the size of which is more than 20 points. At the opening of the next candle, a buy deal is concluded. All other conditions are the same.

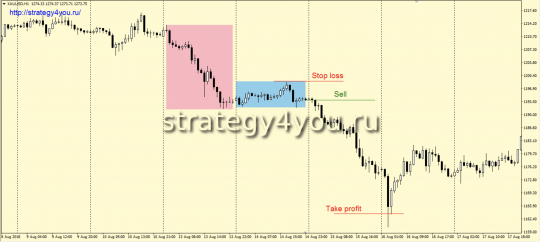

Conditions for sales

Option «A»:

1) The price was above the moving average and then it crosses from top to bottom.

2) The very first D1 candle, the body of which is black and with a body greater than 120 points ($12), gives a signal to open a sell trade at the opening of the next day’s candle.

3) Safety stop loss must be set for the maximum of this candle, but not more than 200 points.

4) After the price has passed +200 points, the transaction is transferred to the breakeven point.

5) Take profit is set at a distance of 600 points from the market entry point.

Option «B»:

1) The price is below the moving average.

2) The daily candlestick closes with a black body and its body size is greater than 120 pips.

3) The next day, a candle is formed with a small body in relation to the previous candle. (This is a controversial point, but we assume that the closing of the candle should not be higher than 50% fibonacci from the body of the previous candle).

4) The bottom tail of this candle should not be larger than the body. In cases where the minimum of the previous candle is rewritten, then this should not be a large value, but purely formal.

5) If all the above conditions are met, then at the opening of the next D1 candle, we conclude a sell deal.

6) Order for reinsurance — stop loss must be set above the MAX of the previous day (but not less than 30 points).

7) If the price has passed +80 points, we transfer the deal to breakeven — the opening point.

8) Profit-taking order — take profit = 300 points.

9) If on the same day the transaction was closed by stop loss, then you can consider re-entry. To do this, it is necessary that the price again go below the MAX of the previous candle and form a candle with a black body, the size of which is more than 20 points. After that, at the opening of the next candle, we conclude a deal to buy. All other conditions remain unchanged.

Video version of the TR-Gold forex strategy:

- Download MT4 template — tr_gold (archived)

- Strategy test for 24 months — here +362,72% ⇒