Today we will look at another model from Price Action — the Outside Bar Pattern, which is also called for short: OB.

- Earlier on this site we looked at what an Inside Bar is. So the External is the opposite of the internal situation.

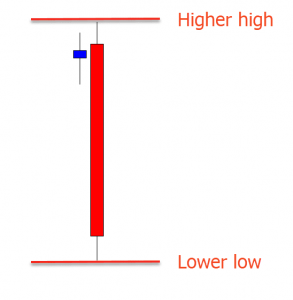

A Price Action candlestick pattern consists of at least two bars/candles, where the last signal candle completely engulfs the body of the previous candle. An important point in the formation of an Outside bar: the opening/closing price of the candle, as well as the Low/High points of the first bar, do not go beyond the range of the candle (external) that absorbs them.

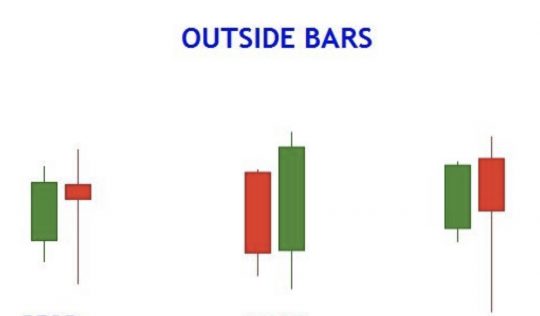

Outside Bar Models

There is a bullish pattern — Bullish Outside Vertical Bar, abbreviated as BUOVB (the green bar follows the red bar, completely engulfing it).

Bearish – Bearish Outside Vertical Bar / BEOVB (the red bar completely absorbs the green bar preceding it).

You should also beware of Outside bars with a very large body, usually these are “impulse” / news candles, trading on them is dangerous, so it’s better to skip.

Features of the formation of an Outside bar

It is important to pay attention to the following characteristics of the Outside bar:

- What is the size of the Absorbed Bar — it should not be too small.

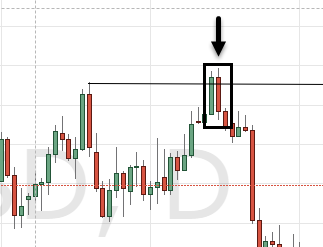

- Where does this bar form on the chart?

- General direction of the trend.

- The presence of strong levels or other Price Action setups.

Another interesting feature:

- If the Outside bar is bullish, the bulls dominate.

- The outside bar candle is closed as a bearish candle — the bears dominate.

Therefore, usually the opening of a transaction occurs according to the principle of this dominance: to sell or buy, depending on the color of the VB (but not always)!

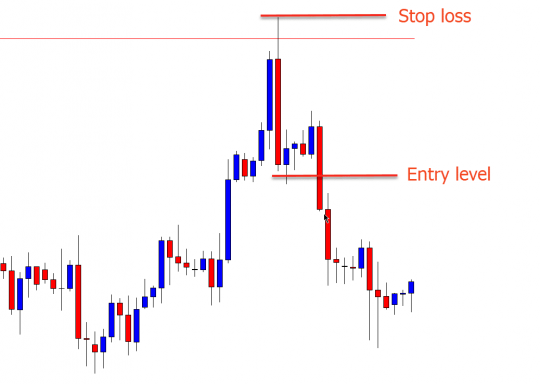

Rules for concluding a deal when trading an Outside bar

1) After the formation of the WB, set a couple of points above it — Buy Stop, below it — Sell Stop.

2) Stop losses are a couple of points below pending orders.

3) There are options for setting profit:

- We set the outermost bar at a distance of 2-3 times.

- To the nearest important level, including Fibonacci.

See the figure for examples: