Forex Strategy Daily Breakout System — one more profitable, break-forex strategy, something that is similar to Forex Strategy «10 points for the EURUSD «: taken as a basis in exactly the same breakdown of the maximum and minimum of the previous trading day, but this strategy is also additional terms of re-entry into the market in cases of price reversal, as well as conditions for entry into the market in Fleta.

Thus, we roughly know the price if the market broke through the maximum (minimum) of the previous trading day,

Then it will behave in one of the following scenarios:

1) will work stop-loss traders on day intervals (steady stop-loss under low or higher Haya daily candle), allowing movement of prices, the forex market will continue for a certain number of points in the direction of penetration — for example, 10 -30 points and the price will go down in fletovoe movement.

In this case, the algorithm is implemented forex strategy «10 points for the EURUSD »

2) Once the price breaks daily maximum (minimum), it is quite possible that she should turn round and go in the opposite direction.

3) The maximum and minimum will be sharply punched a strong movement of prices and price to this level will not come back (if the price does not break its maximum or minimum for a minimum of — 3days).

Based on the above options, we’ll trade for this strategy, depending on the situation on the forex market.

1. In the same way as in the above strategy, «10-point …» we put two pending orders at the highs and lows of the previous day — on the 1 st in each direction.

2. Set profit target at 25-40 points.

3. Set stop-loss at 15-20 points.

4. Important: pay attention only to the 1 st intersection of high or low during the trading day (ie vsluchai order closing the stop-loss or profit, the order of the day do not expose!)

5. Once the price breaks the level of maximum or minimum, and passed away a fixed number of items — such as 10-15 (depending on the chosen currency pairs), we will rearrange our stop-loss orders in an open-level «zero» (or record profits, while ensuring that a / 2 Sledkov and the remainder of the remainder of the transaction to transfer to breakeven).

6. Once the order is repositioned to zero and shut down half of the transaction — and at the same level (the level of the opening of the transaction — see Figure 2 — Sinian bold line) are putting another order, but now in the opposite direction (if originally exhibited BAY, then we set Sella and vice versa), raschittyvaya the fact that there was just hang on the level, rather than its penetration.

NOTE:

- If Correction is the trend, then a few days in a row may not work pending orders in the direction of ground motion, and usually after Correction there are strong movements in the direction of the trend (see Figure 3), that is, the candle body the next day perekvyvaet highs / lows korektsionnyh candles . Based on this — did not work one day a warrant warrant will not delete the same day and 2 days after their installation. But if one of the 3 orders triggered, then at the end of the day removing all nesrabotavshie orders in this direction (buy or villages).

- Also, it makes sense to put perevorotny order (as in Figure 2) only in the breakdown of extremes only the previous day. If one day worked for only one order of 3 orders buystop (or sellstop), the other two orders delivered in the same direction delete!

- If tripped take profit first order breakdown, then remove the warrant reversal!

TESTS:

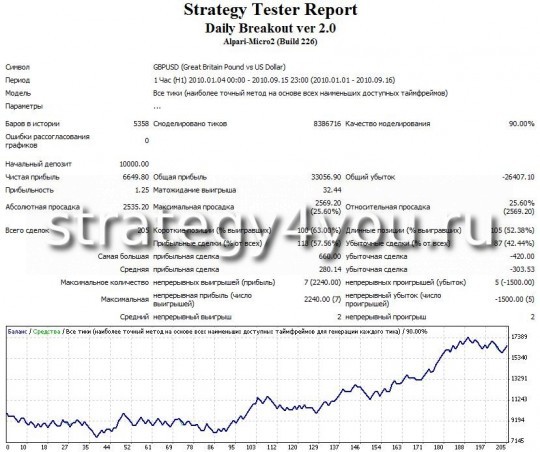

- Currency pair GBPUSD:

- Currency pair EURUSD:

- Currency pair USDJPY:

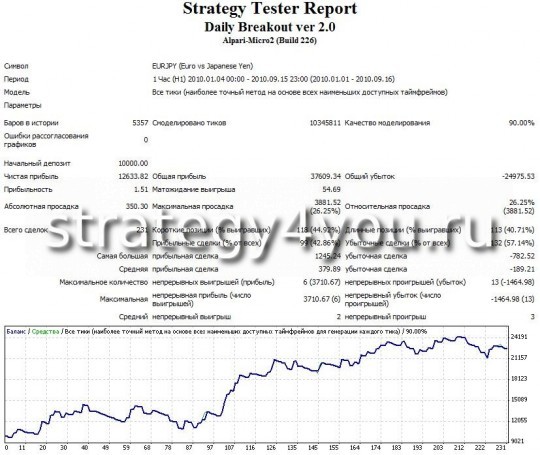

- Currency pair EURJPY