For some traders asked me to publish on its website Trading System Turtles (or as she still calls her — «Turtle System»), and although this strategy is applicable to all markets and is highly acclaimed in the last 30 years, but I still will not be her publish, but only briefly touch on it, and we now consider the strategy of Linda Raschke Turtle Soup and Turtle Soup plus One.

Trading System Turtles — medium-and long-term trading system that was originally invented for the futures markets (including contracts for the Swiss franc, German mark, British pound, French franc, Japanese yen and Canadian dollar) and based on a breakdown of 20-day and 55-day extremes (max and min) — so it certainly can be fully applied in the forex market, but this vehicle is a «but» — rather complex formula for calculating the position in the form of N.

That’s why I will not publish this strategy on its website, and to whom it will be interesting — read it here (opens in a new window in pdf format, which can and save to your computer): Trading System Turtles

Although if desired and modernize this trading system without the quantity N (not risk more than 1-2% of the deposit, the stop-loss set in the next local minima and maxima, and of exactly the same way out of the market in the breakdown of 10-day extremes) — but it will be a completely different strategy …

All I wanted to offer learned from this TA is that this system is FULL Turtle trading system, ie its basic rules cover absolutely every aspect of trading in financial markets and leave no room for intuition or some guesswork when trading!

Here are all the «components of the total trading system» (which must be present, in principle, in any forex strategy and any strategy for financial markets):

- Markets — What to buy or sell

- Position Sizing — How to buy or sell

- Inputs — When buying or selling

- Stops — When to get out of a losing position

- Exits — When to get out of a winning position

- Tactics — How to buy or sell

That is why this trading system and allowed the Turtles to earn in the financial markets for so long!

And now let’s move on to today’s strategies:

1) Strategy L. Raschke Turtle Soup

After the occurrence of the Trading System Turtle (which we discussed above), it was noted that this vehicle are inherent rather large subsidence of the deposit and the low ratio of gains to the loss of the large number of false breakouts in the financial markets. That is why the apparent strategy of «Turtle Soup».

The strategy TURTLE SOUP is to find those cases where a breakthrough in the market wrong, and therefore the price does not roll back or reversal occurs in the financial market (in our case, we will consider the forex market).

And although some of the reversals will only be short term and will close the deal with minimal profit or even to zero «, well, sometimes with a minimum stop-loss, but sometimes, these reversals will be provided by medium-or long-term trend reversal in the market and thus enable us to obtain good profits.

And so we will conclude a deal under the following conditions:

1. Open daily chart of the chosen currency pair (though as for me, then this strategy may well be applied to any time-frames (I recommend no less than M15), but these intervals, the parameters of a trailing stop and indentation will of course differ slightly). If you think that trade on daily charts does not suit you, because you have a fairly small trading account — open a cent from forex.

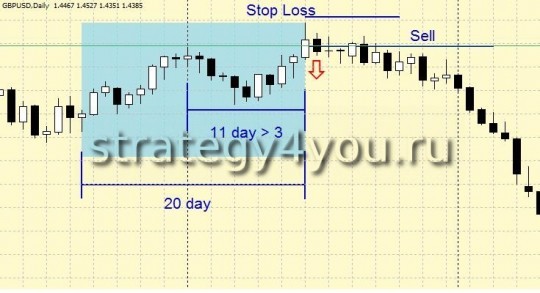

2. Today’s candle will always be the 20 th of the last candle, 20-day range, so reckon on it 20 days ago and are 20-day minimum and 20-day high. Mark them on a chart with horizontal lines (if desired for clarity).

3. The previous day a minimum or maximum should be located at a distance of at least 4 days from today.

4. Once today’s candle, rewritten minimum or maximum (previous 20 days) — place a pending order by price by 5-10 points higher than the minimum price the previous 20-day minimum purchase (eg order a buy-stop). And according to the 5-10 points lower than the maximum closing price of the 20-day high to place an order Sell-stop.

Moreover, this pending order is valid only for today’s daily candle! If it did not work until the close of today’s day candles — delete it.

5. If the order is triggered, you must put a stop loss a few pips above the high prices of the candles for the transactions for the purchase and, accordingly, a few points below the minimum prices for deals on sale.

6. Once the position becomes profitable — translate it into the breakeven point and set it on a trailing stop (Universal trailing stop or a standard MT4), which, for each currency pair should have its own — the more volatility in the market (for example, pairs of GBPUSD, GBPJPY) by a trailing stop above (and, accordingly, the level of translation to breakeven, too) — such as 50-70 points.

If the currency pair is less volatile (USDJPY and EURUSD (though lately it and not be called a less volatile)) — trailing stop-loss of 30-50 points.

7. Also in this trading system there are rules for re-entry into the market:

If during the first or second day after the opening deal, worked a stop-loss — reinstall the pending order on the same level as the first order (see paragraph 4) — but this rule is valid only for the 1 st and 2 nd day of trading !

2) Strategy L. Raschke Turtle Soup plus One

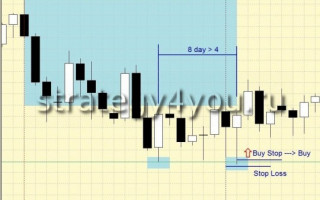

1. Emerging on the market 20 days minimum or maximum, but it must be made not less than 3 candles closed earlier. This at least closes at or slightly below the previous 20-day minimum. Accordingly, the maximum rose to the level or slightly higher than the previous 20-day maximum.

2. Pending order buy stop set on the day following the closing day candles at the level of the previous 20 dnevngo minimum — for transactions for the purchase or at the 20-day maximum for bargains on sale.

Similarly, if the course of the day the transaction is not open — delete a warrant!

3. Stop-loss is set at the opening of a warrant by a few points below the last minimum (1 or 2-day) for transactions for the purchase and, accordingly, a few points above the last peak (1 or 2-day) for transactions for sale.

4. Likewise, we use a trailing stop to exit a position — its value is approximately the same as in «Turtle Soup» and it at will! Because not setting a trailing stop, you can catch and ravorot market prices — you decide (as in the example top)!

Just want to warn you that on the daily charts, these models do not appear frequently, but if analized several currency pairs, the number of transactions will garazdo more!

UPDATE: Just want to add that these models are: Turtle Soup, Turtle Soup plus One is almost always accompanied by diverentsiyami indicators MACD, Stochastic, CCI, so watching the divergence of these indicators, and you can easily find the above-described model.

The results of expert testing Turtle Soup / Turtle Soup plus One — 2 in 1, trades forex strategy «Turtle Soup, Turtle Soup plus One»:

1) Test forex strategy «Turtle Soup» — EURUSD (H1)!

2) Test forex strategy «Turtle Soup» — EURUSD (H4) !

3) Test forex strategy «Turtle Soup» — EURUSD (D1)!

- Download: Report of the expert advisor forex Turtle Soup / Turtle Soup plus One — 2 in 1 — since 2008!

Tests Adviser to provide for the currency pair EURUSD and only strategy «Turtle Soup«, although the adviser provided to switch the 2 nd strategy «Turtle Soup + One«!

If there are new settings for the other currency pairs — they will be sent to all buyers who leave feedback on the EA will put in the shop Plati.ru!