Today we will consider the «Rails» pattern, which is often used in Price Action. The model is a reversal.

- Works on any time intervals, but better on H4 and higher.

- Any instruments are suitable for trading: currency pairs, metals, indices, cryptocurrencies, etc.

Rules for forming the Rails pattern in price action:

- 2 candles directed in different directions should be full-bodied with no shadows at all, or the shadows should not be large.

- This model is formed only after a clearly visible movement consisting of at least 4-5 candles.

- In this pattern, the sizes of the candles are approximately the same and should not differ much.

The «Rails» pattern is very similar to the «Absorption» pattern, but it does not have a mandatory condition for the second candle to absorb the first.

Usually these are just 2 large candles. But at the same time, Absorption is a stronger pattern, compared to rails.

Rails work well in combination with price levels, according to the principle of Pin-bar and PPR bar. And it is also possible to combine well with graphical analysis (trend lines, channels, Fibonacci levels).

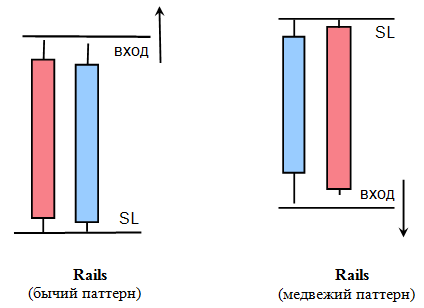

How to make deals on the Rails pattern to buy:

1) The price breaks the level downwards and returns above it in the form of a rail pattern (or at least touches the level).

2) After the 2nd, white candle closes, we place a buy stop order a couple of points above the maximum.

3) We place a stop loss below the minimum of the 1st and 2nd candles.

4) We set the profit at an important price level.

For sell trades, the opposite conditions.

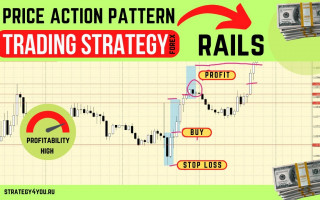

Example of a sell trade: