Pattern «Three traffic» — this graphic model, which appears intermittently in the forex market and its correct identification will allow you as a trader forex, getting their stable income, of course, without forgetting the risks of trading.

This graphical model is called a completely different traders in different ways, but its meaning is identical. So Linda Raschke (its strategy, we have already discussed on the website: A Strategy for 80-20, Strategies Turtle Soup, Turtle Soup plus One) this model is called «3 Indian» in the wave analysis, this model is called the «diagonal triangle» Larry Pisavento call this model «3-step pattern (3-Drive pattern), Gartley — Expanding 5 wave triangle.» We’ll call it: the pattern «Three Movements«.

But regardless of how this pattern is called, its structure and meaning absolutely no change. This pattern forex easy to identify in any financial market (including the currency market), the same way he works very well at all time intervals and in any currency pairs.

Harmonious Pattern Tree movement is often formed on the bottom or on top of the market, before reversing the trend in the opposite direction. But certainly not always, he gives the signal of the main trend reversal. It may also give the signal of completion of the vibrational motion in the current trend and the beginning of the correction, not full reversal of trend in senior timeframes.

We have previously considered the forex strategy, in which the price in contact with the trend line: Forex Strategy for Trendlines, Forex Strategy «Trend Lines», forex strategy «3 Touch» (usually after the third contact) unfolded and this fact allows us to good earn, but in this forex strategy, but rather in a harmonious pattern «3 movement», we will introduce an additional rule with application-level action and Fibonacci (Fibonacci).

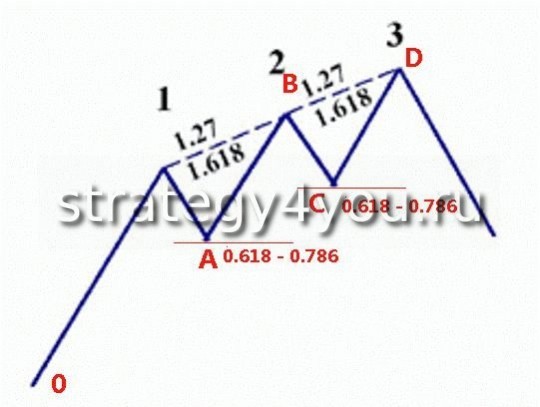

Let us consider the pattern «Three motion» for sale (Fibonacci ratios and terms and conditions):

1) Point A must be placed at a distance — 0,618-0.786 Fibonacci from the segment «0-1» — but it is not required, but if it holds, then it is very good! This fact will be talking about what the price is corrected and move on is not too sharp (pulse), such as when corrected to 23.6% or 38.2% Fibonacci.

2) When you stretch the Fibonacci extension from point 1 to point A, we get point 2 at a distance of 1.27 or 1.618 for Fibonacci.

3) Point C is the same distance 0,618-0.786 Fibonacci from the segment «AB» or «A-2» — it is a prerequisite!

4) If these conditions are satisfied, then at a distance of 1.27 or 1.618 (if point B is located at a distance of 1.27 x 1A — then the distance = 1.27, if B is located at a distance of 1.68 x 1A — then the distance = 1.68) from the segment «B-C or «2-C» is placed pending order Sell Limit, the figure is marked as point 3, or D!

5) The length of AB = CD — as far as possible, but of course ideally this ratio is not so much in the Forex market …

6) Stop-loss place on a few points above the level of 1.68, if B is located at a distance of 1.27 x 1A

and a few points higher than 1.786, if B is located at a distance of 1.618 x 1A

7) Take-Profit:

1 st goal — 61,8% Fibonacci of the segment «0-3» — at this level, you can close the portion of the profits, rearrange the position to breakeven — you decide.

2 nd goal — Expansion 1.27 Fibonacci

The third goal — 1.618 Fibonacci Extension

Where closing the income to you, you can rearrange the position to breakeven and place it on a trailing stop or close a position parts on every important level.

8) And of course do not forget the rules of Money Management in Forex trading!

Here’s an example on the chart — almost perfect pattern of «three movements», but the profit came only to the first goal — the level of 61,8% Fibonacci of the segment» 0-3 «and turned around:

Just like you see on the chart, the price is very well located in a parallel channel, which was also filed an additional signal in contact with trendline at point 3.

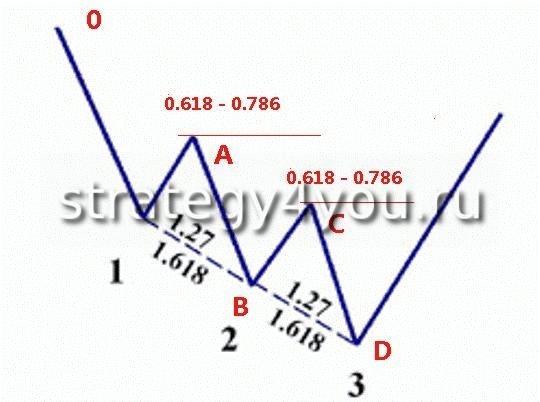

For transactions on PURCHASE pattern of «three movements» is as follows:

For transactions for purchase — the conditions, the reverse pattern of «three movements» on sale!

Of course, we only consider the ideal pattern of «three movements, there are not ideal, in which the Fibonacci ratios do not match. But in such models forex is better not to pay attention too, because and the likelihood that the model is run for an ideal and will allow you to close the income also decreases …