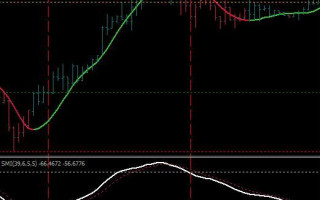

Forex strategies for HMA and SMI — the recommended interval for trade — 4 hours (H4), works best in currency pairs with the yen;

On the schedule set Forex indicators: HMA 25 and SMI (you can download at the end of the strategy).

Terms of Trading Strategy Forex HMA and SMI:

Open a deal to Buy as soon as the line of the indicator rising HMA (colored in green) and SMI indicator crosses its signal (dotted) line from the bottom up, under these conditions, the indicator forex SMI should not be in overbought condition (be higher 70). If it is currently higher than 70, then the transaction must be concluded, after it falls below this level.

Starting a safety stop-loss should be placed under a local minimum.

When the profit of 100-150 points — portable stop-loss at break even.

The deal closed when the reverse lights.

For SELL — opposite conditions.

- Download a template for MT4 — hma_smi.tpl

- download an indicator for MT4 — SMI.mq4

- download an indicator for MT4 — HMA_.rar