Forex Strategy «Antiflet» is based on the indicators and forex strategy, as the author — MopoZ (he is the author of forex strategy SMA108), this forex strategy is stable and for year of trading was only a few losing trades, the basis of the signals at the entrance to the market are taken readings of 3 forex indicators: moving averages, MACD, ATR; currency pair — EURUSD (H1)

First of all, set in the currency pair chart EURUSD (H1) the following indicators forex:

1) Simple Moving Average SMA (200), applied to a close

2) Indicator MACD (21, 33, 18)

3) Indicator ATR (14) with a level of 0.0022

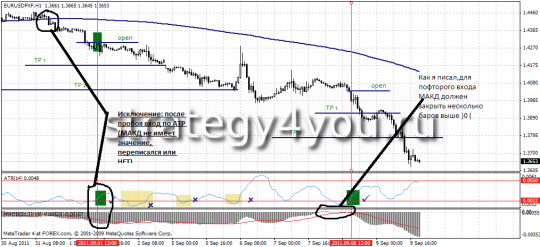

Consider the case of transactions for sale, according to the rules of forex strategy «Antiflet»:

1) The price has broken and closed at least one candle below the moving average SMA (200)

2) The histogram of the MACD indicator falls below its zero line + SMA of the same indicator also fell below the zero line

3) ATR indicator went out and closed above its zone of 0.0022

4) We conclude the transaction equal to two lot to sell at the opening of the next candle after the confirmation of all signals and forex strategy

5) Stop-loss set at a fixed rate of 100 points

As a complement from me personally: the stop-loss orders can be placed above the moving average SMA (200) or above the nearest local maximum, provided that this quantity is also approximately 100 points

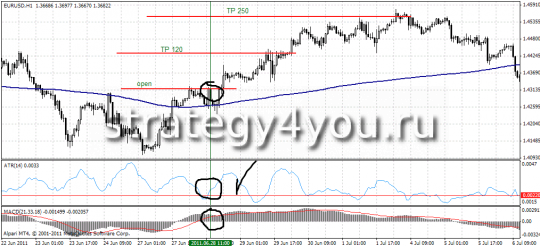

6) Take profits are putting as follows:

TP1 — 120 points

TP2 — 250 points (for the forex broker with 4 characters after the decimal point, such as Forex4you)

For 5-digit brokers (like Alpari), these values are 1200 and 2500, respectively, and stop-loss by analogy — 1000 points

7) When you close the first deal on take-profit, 2-d to move to breakeven (ie, zero)

The following transactions open only if at least the first closing and the 2nd rearranged to break even, although the author recommends a strategy to wait for complete closure of all trades

Several additions to the forex strategy «Antiflet»:

1) SMA (18) of the MACD indicator is not below (for transactions on sale) and not higher than (for transactions for the purchase of) the most histogram MACD:

2) The signals for the transaction is valid for 4 candles after the signal from one of the indicators MACDand ATR:

3) possible re-entry into the market after a long time crossing SMA (200), it needs to wait so the MACD histogram crossed its zero line at least a few bars and went back below zero:

For transactions for the purchase, return conditions, only ATR (14) also has to close above the 0.0022 level!

An example of the transaction to purchase:

Another example of a transaction to purchase, according to the rules of forex strategy «Antiflet»:

As the author of forex strategy «Antiflet» since the beginning of the year a profit on this strategy, about 6,000 items and this year was only 5 losing trades, then there is another strategy forex with low risk.

- This forex strategy you can download the template Metatrader 4 — anti.tpl (note template, you must first unzip it and then zakgruzit or placed in a folder MT4)

- Forex indicators do not spread as they are by default in every terminal MetaTrader 4 forex