Forex Strategy «Indicator salad», based on two moving averages of EMA, Stochastic and RSI represents a fairly efficient and very simple trading system on a combination of popular indicators forex. Analysis of the signals from each of these indicators gives a powerful hint to the opening and closing trading positions in good conditions under which a chance to make a profit is great. This forex strategy works on any time intervals (but preferably more than 15 — 30 minutes) and in any currency pairs.

And so to begin on schedule selected currency pair in Metatrader 4, you must install the following indicators forex:

- 5-day exponential moving average EMA,

- 10-period EMA,

- the stochastic with the following parameters (14, 3, 3),

- RSI (14) with established levels : 30, 50, 70.

Rules of entry into the market in BUY of forex strategy «Indicator Salad»:

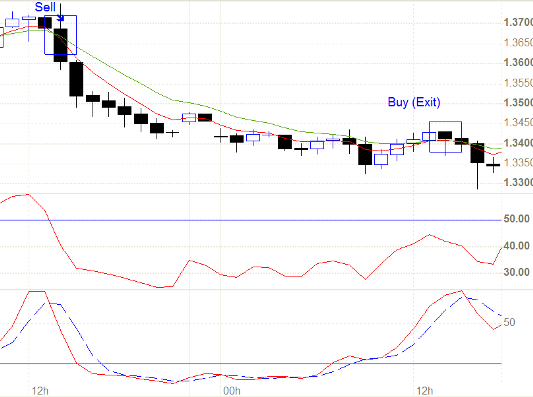

Conclude a deal to buy as soon as the moving average EMA crosses 5 EMA upward average 10 and stochastics indicator line facing up. And as stochastics should not be in overbought condition (that is to be no higher than 80.00). A forex indicator RSI must be above level 50.

Rules of entry into the SELL of forex strategy «Indicator Salad»:

Conclude a deal to sell as soon as the moving average of 5 EMA crosses 10 EMA high down the line and the Stochastic indicator sent down the same way. And as stochastics should not be oversold condition (that is to be no lower than 20.00), and inidicator forex RSI must be below 50.

Rules out of a trading position:

Moving Average 5 EMA crosses 10 EMA high in the opposite direction, or if the RSI indicator forex crosses your level 50 in the opposite direction.

The value of the stop-loss and take-profit is mainly chosen individually in each case, but mainly to navigate to local minima and maxima, as well as remember the appropriateness of the transaction (ie, at the entrance to the market profit should at least be 2 times exceed size stop-loss, and sometimes 3-5 times).

Just a good chance to keep your profit gives a trailing stop (including a trailing stop of 1 point) — the value is selected individually from volatility dependency currency pair and the selected time frame.

So I recommend when trading forex never be greedy, but to close parts of the profits — this will help you and make a profit and does not miss the chance catch a good trend.

Advantages of forex strategy «tracer salad»:

This tactic allows you to trade a very good filter trade signals received from different indicators, forex, and thus deals with greater accuracy.

One drawback of this strategy, Forex, is the fact that the moving averages of 5 and 10 EMA can sometimes give early trading signals on the output of a position.