Displacements moving average (DMA), in most cases are used to move a stop order to exit a position. Using displaced moving average is completely analogous to the use of trade indicator Parabolic SAR (PSAR).

What does the offset moving average: DMA (NxM) or displaced moving averages = SMA (N), then there is usually a simple moving average, which is shifted for a certain number of (M) time periods ahead.

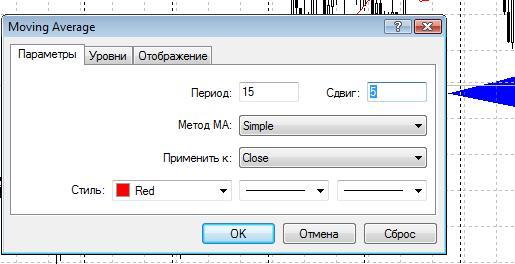

To set the DMA on the chart trading platform Metatrader 4, select Indicator Moving Average, sets the period and the value of M in the «Shift».

According to the theory DiNapoli, Joe (Joe DiNapoli), to hold a trading position and measure the trend makes sense to use the following combinations of DMA, such as:

3 × 3, 7 × 5, 25 × 5.

Specific choice of the displaced moving average depends on the volatility of trading assets, as well as the use of scale, as well as the time period.

To at least consider the 2 medium — offset and unbiased 15-day simple moving average for the rising prices of shares of RAO UES. In this example, the DMA curve shifted slightly to the right parallel transport on the five trading periods.