Quite by chance, we discovered that for unknown reasons, one of the simple classic strategies based on a moving average is missing on our site. This Forex Strategy «Sotochka», which has been working for a very long time and is quite stable. It is suitable for any market, but we will present you with its version for major pairs in Forex.

Statistics:It is also worth noting that the more pronounced the trend, the more reliable the signals, but we checked all situations and did not look back at the strength of the trend.

- Time interval — H1.

- The currency pair is majors, but it was checked on GBP/USD.

- The indicator is an exponential moving average with a period of 100.

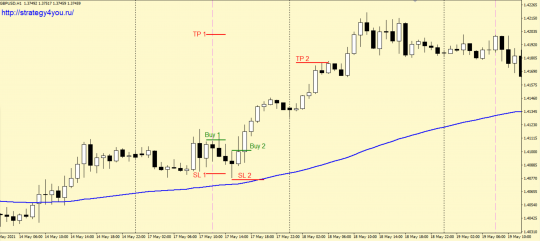

Conditions for purchases according to the rules of the Sotochka forex strategy:

1) The opening price of the first candle of the trading day is above the moving average.

2) Work starts after 12:00 EET (Eastern European Time).

3) If the price is below the maximum of the last black candle at the time of the start of work, then a Buy Stop breakout order is placed behind the maximum. If after that another candlestick with a black body is formed, then a breakout order is placed at its maximum.

4) Stop-loss is set under the last local minimum, but not less than 20 and not more than 45 points.

5) After passing in the positive zone a distance equal to the stop or 30 points, the transaction is transferred to breakeven.

6) Take profit is set in the amount of three stops.

7) If the trade is closed by a stop, but a candle with a black body appears, the maximum of which is lower than the previous entry point, then you can repeat the method of entering the market.

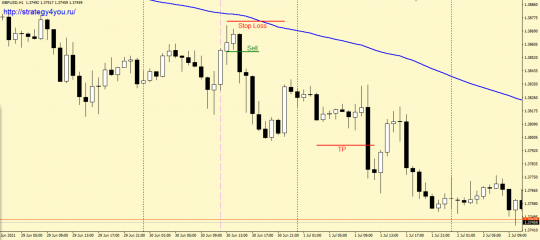

Conditions for sale:

1) The opening price of the 1st hour candle of the trading day is below the moving average on the Pound-Dollar chart.

2) Trading starts after 12:00 EET (Eastern European Time).

3) If at the moment of trading start the price is above the MIN of the last white candlestick, then a Sell Stop breakout order is placed behind the minimum. If after that another candle is formed, with a white body, then a Sell Stop breakout order is placed under its minimum.

4) A safety stop loss is set for the last local maximum, but not less than 20 and not more than 45 points.

5) After the price in the «+» zone passes a distance equal to the size of the stop loss or 30 points, the transaction is transferred to the breakeven point.

6) Profit fixation order — take profit is set in the amount of 3 stops.

7) If the deal is closed by a stop loss, but a candle with a white body appears, the minimum of which is higher than the previous entry point, then you can consider options for re-entering the market for sale.

Video version of the Sotochka forex strategy:

- Recommended to watch with English subtitles!

- Download MT4 template — sotochka_tpl (archived).

- I don’t attach the indicator, it is available in any MT4 terminal and therefore it will be installed automatically after the template is installed on the chart.

- Test results: +484.61% ➜