Forex Strategy «Return to GAP» — a rather simple forex strategy that can be applied to any currency pair, which opens with a gap on Monday — after the market close on Friday, this strategy is quite stable, although the entries into the market are not carried out very often (a report 2007 to 2010, see the end of this strategy forex).

To trade on the forex strategy, we do not need lights or patterns for Metatrader 4 because indicator that signals generated at the opening position will price itself.

The strategy forex «Return to GAP» is very simple:

1) We are waiting for the opening of the forex market on Monday — we will only sell if the market opens with a gap!

2) Check the value of the GAP, whether it suits the following conditions (within the following limits):

- EURUSD — 20-100 points

- GBPUSD — 5-40 points

- USDCHF — 5-90 points

- USDJPY — 10-200 points

For other currency pairs are the parameters must be chosen (and the easiest way to do it with Expert Advisor GAP)!

3) if the value gap is in the range of data, then open the three trading positions in the direction of overlap (closing) gap.

- If the gap down — open 3 deals for the purchase.

- If the gap up — open 3 deals for sale.

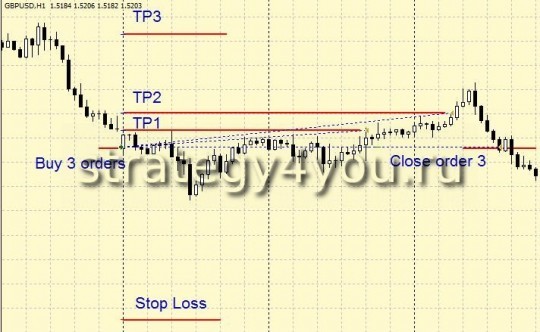

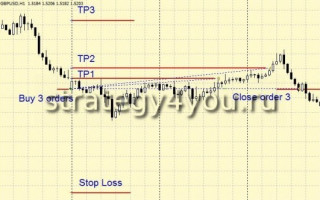

Example see in the picture:

4) Take-profit 1-th order set on the market closing price on Friday!

— Profit 2-th order is equal to 2-m Take Profit-s 1-th order

— Profit third order is set by a fixed amount, equal to 200-300 items (depending on the traded currency pair).

When closing a second order for take-profit, 2-nd and 3 rd order must be changed to breakeven!

5) Stop-loss is set (and required!) At a fixed value, which is approximately 300-400 items (depending on the chosen currency pair).

And although the magnitude of the stop-loss is not small, but statistically, over 3 years trading on the forex strategy, stop-loss on eurusd works only 2 times, gbrusd — 3 times, on usdchf — 2 times and usdjpy — 2 times!

Optionally, you can reduce this amount of stop-loss, but then the probability of closure orders by the stop-loss increase.

So I recommend not to risk too much when trading this strategy because the probability of triggering stop-loss, though small, but still there!

6) As soon as the third order is transferred to breakeven, its translation into a trailing stop is equal to 50-100 points and wait until it closes on positive stop loss (stop-trade), or take-profit.

- report on the trade on the currency pair EURUSD for the periodfrom 2007 to 2010:

report on the trade on the currency pair GBPUSD over the period from 2007 to 2010:

report on trafficking of USDCHF for the period from 2007 to 2010:

report on trafficking in USDJPY currency pair over the period from2007 to 2010:

Download: Report of the expert advisor GAP for the period 2007 — 2010!