Today we look at forex & Crypto trading strategy on a rather well-known figure charting: The pattern «head and shoulders» — is a reversal pattern (fracture) trends in the forex market, which is formed at the end of the trend movement and the chart after the appearance of this pattern, usually a trend reversal or at least roll back the prices.

I decided today to consider this a graphical model or pattern in other words, because has repeatedly answered questions from readers of this site on this model forex.

Normally, all new traders overlook, or at least try to find this model on the charts, as it is described in almost every book on the forex market, about her lectures all teachers in a course forex, etc. But in spite of the fact that this model is quite popular — it did identify the majority of traders are absolutely wrong, much less know how to apply it to trade.

So today I am in the gap and try to make up: we look at how a pattern itself, «Head and Shoulders,» a sign he usually gives the trader forex strategy consider the transaction under consideration when forming a pattern, and most importantly, an exit strategy out of the deal when you see this pattern of forex.

First of all, it should be noted that the pattern is «head and shoulders» — this is a reversal in the financial market, ie if we see this model, after its formation in the forex market is usually a complete or partial reversal of the trend. Therefore itself a graphical model Head and Shoulders is formed on the peaks or troughs.

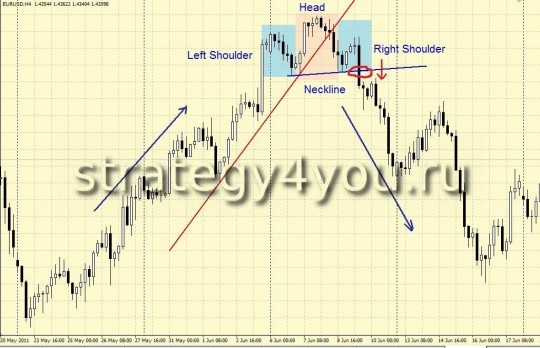

This pattern is formed from the forex 3 vertices and 3 basins, examples, please see chart below:

The main feature of this graphical model is the presence of an uptrend, with the figure on the top!

The figure of Head and Shoulders is made up of several components:

1) Left Arm (Left Shoulder)

2) Head (Head)

3) Right Arm (Right Shoulder)

4) The neckline (Neskline)

5) The line of the main trend

And as a reversal pattern «head and shoulders» at the top is formed from the 3 vertices, which is higher than the average of the other 2. It should be noted that at least the right «head» must be placed a little higher, the minimum ratio left top. Ie the neckline of our pattern, «head and shoulders» at the top should be slightly prepodnyata left to right! Although this condition is idealizing the model, there are times when the neckline is located horizontally and even slightly tilted from left to right … These models also work, but the probability of failure they have a little higher than that of classical patterns.

Now let’s consider the features of trade entry and exit from the graphic model of «head and shoulders»:

1) Usually, I break the neck line is a signal to sell!

But I would even say the opposite — «Closing the candle below the neck (on the range at which you are trading) and is a signal to sell.»

2) The minimum target for take-profit is equal to the distance from the top of the head to the neckline, but very often these reversal patterns make more profit garazdo this distance. Example look at the chart above. Therefore, when the take-profit, the best option would be closing of the transaction and the balance of the transaction is best to install on a trailing stop or to calculate the Fibonacci targets, for example.

3) The stop-loss should be set as a minimum above the right shoulder for the transactions for the sale.

It is also an important role in shaping the model of «Head and Shoulders» are the volume of trade, but because they are determined by the platform Metatrader 4 is not true, it will only describe what to look for, although the amount of use we will not:

1) The formation of the «heads» trading volumes should be greater than the formation of the «Left Shoulder»

2) At the peak of the «right shoulder» trading volume should be less than in the other 2 peaks — «left shoulder» and «Head»

3) at the break neck line trading volumes have increased.

4) and if the price does retest the neckline, the volumes are falling, and then at otboe — again increasing

In spite of all the formation popular Forex (graphical model or pattern), «Head and shoulders», I personally believe that the best time to enter the market you can find garazdo before using trading rules of graphic constructions and technical analysis. Examples of trading using charting forex, look at my forex research reports.

Let’s look at an example version of the transaction, which was obtained garazdo more signals to enter the market, where they were received garazdo before the entrance to the breakdown of the neckline! All these entries are based on the strategies of the forex of this site, which I also have repeatedly said in its research reports the forex market.

This entry I described in my past forex forecasts, now want to consider several options for entry, which provide an excellent entry point before the entrance to the breakdown of the neckline.

Point 1: retest the blue line coincidence channel + 61.8% Fibonacci level with stop loss above 76.4% — a great entry point!

Point 2: If you are not logged in at 1 for sale, enter to retest the trend line is now red + noticing that formed the divergence of MACD, the stop-loss the same

Point 3: Let’s missed entry of limit order at 1 and 2, and hence on the breakdown of the green trend line entering the market!

Point 4: Breakdown of the green and blue trend line, closing the candle below them again retest the blue line from the bottom up + all signals above — for points 1, 2 and 3

And only after all of these signals, we would get input on the breakout of the neckline pattern, «Head and Shoulders» and it would have been even worse than point at a price point of about 1!

Ie conclusion is this: do not wait and look for this particular model and enter the forex market at a worse price, because if you use in your forex trading technical analysis and graphics, you can enter the market garazdo before. At the same Head and Shoulders pattern is already a final figure to enter the market, which can not catch …

While still a good entry point into the market for pattern «head and shoulders» can be just retest the neckline from the bottom up, although he does not always happen.

For transactions on sale — the same rules and schedule an inverted pattern here, «head and shoulders»:

Considering this model, forex, I want to say again: although this model Forex and gives very good entry point, but do not have to invent it yourself and try to see every movement, in fact, the ideal model of «head and shoulders» appear less frequently in price charts, although they may appear at any intervals and in any currency pairs. So I would recommend paying attention to it on the basis of ideal models of Head and Shoulders on the form as they have more chances to work out garazdo well and get to the TP!

![H&S Pattern [Head And Shoulders Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/be/77dc91e2eb578be_320x200.jpg)