Wolfe Waves Pattern [Forex & Crypto Trading Strategy] — profitable strategy is a unique and extremely effective trading system because:

- Although it takes its roots from the Elliott wave theory, it is much easier to trade it.

- Since the Wolfe Wave pattern is subject to the strictest rules, its signals are the most accurate and profitable compared to other reversal patterns.

Wolfe Waves was developed and introduced by Bill Wolfe, who has been trading the S&P for over 10 years. Thanks to his son Brian, this system has spread to other markets.

Video with an example of trading on Wolfs waves with the Wolfe Waves Find indicator:

- Indicator WolfeWavesFind price — 50 USD

- How to buy — see the end of this article! ⬇︎⬇︎⬇︎

Wolfe wave can be:

- bullish

- bearish

It is based on Newton’s 3rd law: «For every action there is an equal and opposite reaction.»

They are exactly the same except for the direction of movement. The «Bullish Wolfe Pattern» is an uptrend formation, while the «Bearish Wolfe Pattern» is a downtrend.

How to spot a «Bullish Wolfe Wave»

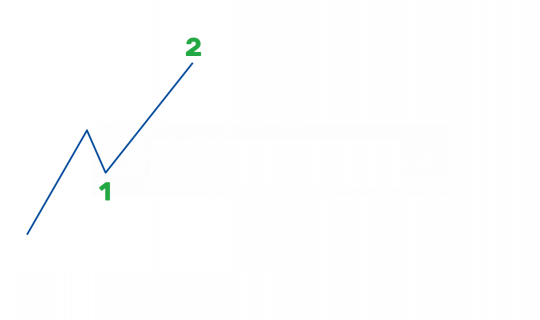

It all starts from «point 1», which is the foundation of the whole figure. «Point 2» originates from it — the first significant peak, which may or may not be higher than the previous maximum:

The connection of these points forms the «wave 1-2», which is the basis from which the entire model comes.

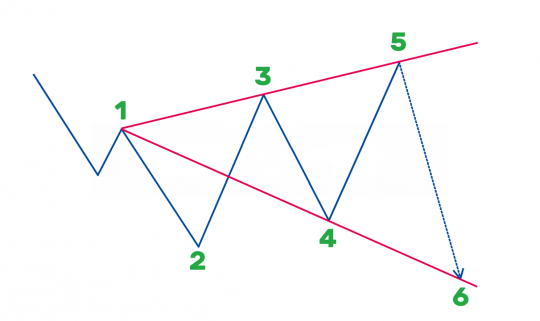

Then «point 3» is formed — a new significant minimum, which MUST be «below point 1»:

After that, «point 4» is formed, which should be higher than points «1» and «3», but lower than «point 2»:

The connection of points «3» and «4» forms a «wave 3-4», which is the second wave of our model.

Finally, a new significant minimum is formed — «point 5», which is below «point 3». It will be located on the line drawn between points «1» and «3»:

It is at «point 5» that we buy and hold the position until reaching «point 6», which is formed on the line drawn between points «1» and «4»:

The connection of points «5» and «6» forms a «wave 5-6» — the strongest and widest among all, and the only one that we trade.

The line connecting points «1» and «4» is also called the Estimated Price at Arrival (EPA). It allows you to project the expected target for the price movement.

We set the initial stop loss just below the «point 5». In the course of a favorable price movement, we will move it to the breakeven point.

In order not to forget:

«Point 3» must be below «Point 1».

«Point 4» must be above «Point 1»

…this is when we are looking for the ideal Wolfe wave.

How to spot a «Bear Wolfe Wave»

It all starts from «point 1», which is the basis of the whole figure. «Point 2» originates from it — the first significant trough, which may or may not be lower than the previous low:

The connection of these points forms the «wave 1-2», which is the basis from which the entire model comes.

Then «point 3» is formed — a new significant maximum, which MUST be «above point 1»:

After that, «point 4» is formed, which should be lower than points «1» and «3», but higher than «point 2»:

The connection of points «3» and «4» forms a «wave 3-4», which is the second wave of our model.

Finally, a new significant maximum is formed — «point 5», which is above «point 3». It will be located on the line drawn between points «1» and «3»:

It is at «point 5» that we sell and hold the position until reaching «point 6», which is formed on the line drawn between points «1» and «4»:

The connection of points «5» and «6» forms a «wave 5-6» — the strongest and widest among all, and the only one that we trade.

We set the initial stop loss just above the «point 5». In the course of a favorable price movement, we will move it to the breakeven point.

In order not to forget:

«Point 3» must be above «Point 1».

«Point 4» must be below «Point 1»

…this is when we are looking for the ideal Wolfe wave.

The most important thing when trading Wolfe Waves is practice. The more you practice, the easier it is to learn how to find this figure, not only in Forex, but also in other financial markets.

That is why you should study the examples below, specially selected for different financial instruments…

Examples of the «Wolfe Wave»

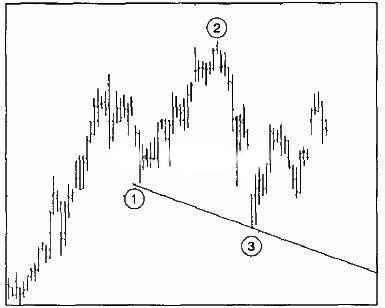

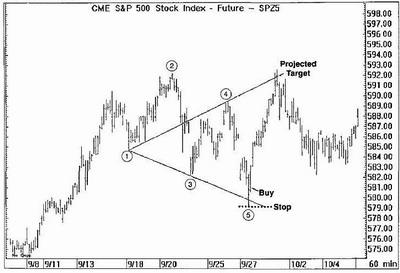

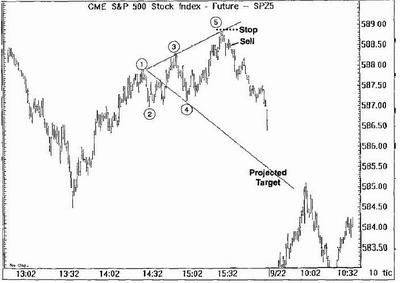

On the hourly S&P chart, we see how our pattern is starting to form: there are points «1», «2» and «3». «Point 2» is a high, indicating a bullish pattern. «Point 3» is, as it should be, below «Point 1» and «Point 4» is above:

It remains for us to draw a line between «1» and «3» to find the future «point 5»:

This is where we will start to buy, placing a stop loss a little lower. Our target is «point 6», located on the line between points «1» and «4»:

The price hits its target and our profit is 12 pips.

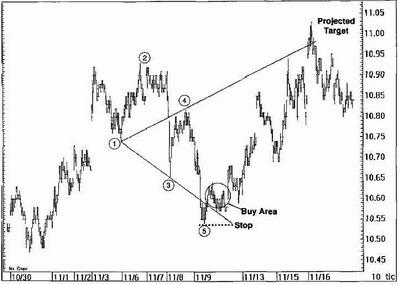

Wolf figure in sugar trading

We see a similar situation on the Sahara chart: points «1» and slightly above «2» are formed (a bullish pattern). Also, there is «point 3» below «point 1» and point «4» above it:

Everything is perfect! It remains only to draw a line between points «1» and «3», and then wait for the formation of «point 5». At this point we start shopping. placing a stop loss a little lower. Take profit is set at «point 6», which will be on the line between points «1» and «4».

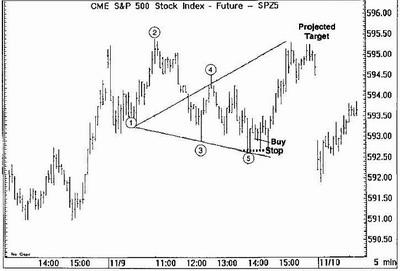

Example on M5 S&P chart

We see another example on the 5 minute S&P chart. Interestingly, by trading 5 minutes on the S&P, we could meet the pattern 5-6 times a week. As usual, we buy at «point 5» and take profit at «point 6»:

We earn 2 points, which is a very good indicator for this instrument.

An example on the USD/CAD pair

Here we see a bearish pattern (point 2 is a local low):

Usually, we find point 2 only after points «1» and «3» are formed. «Point 2» does not have to be a long-term trend reversal. The main thing is that it should be the high or low of a major swing in the market.

Unfortunately, in this case, the market did not reach the predicted line a little.

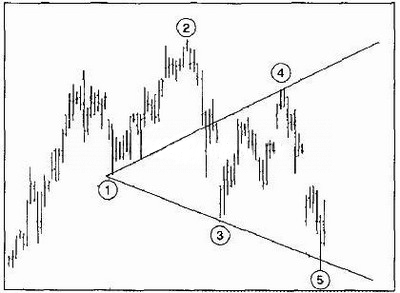

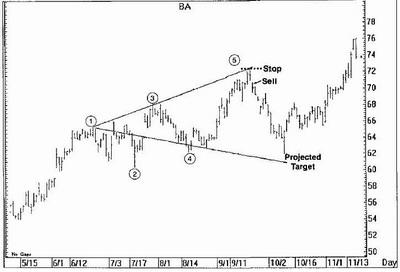

Boeing stock example

Here «point 2» is the low of a fairly large swing in the market. Importantly, «point 4» is below «point 1» and «point 3» is above:

The line that connects points «1» and «3» predicts «point 5» for us — the place where the market reaches its price target to within a tick! Again, the trade does not fully reach the predicted target on the downside. But on this 10 pip dip, there were plenty of opportunities to take very good profits from the market.

S&P stock example

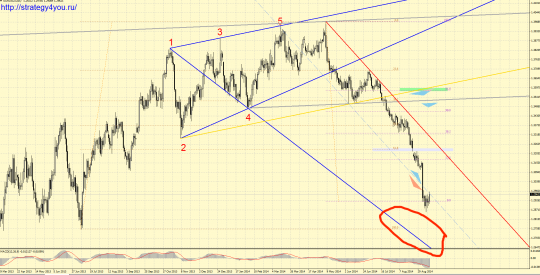

«Wolfe Waves» are sometimes also formed on the «Three Little Indians» graphical model:

Important Notes

In summary, we can say:

- Wolfe Waves in the FOREX, Crypto, Stock market works well at any time intervals.

- Also, it is quite easy to find and implement for those traders who are familiar with graphical analysis.

- Wolfe Waves constantly appear on all instruments, including Forex and all its currency pairs.

All actively trading traders should pay attention to this forex strategy. I myself trade it very often. It allows you to earn good profits with minimal risks.

And OUR development will help you in this — a paid indicator for MetaTrader 4 — Wolfe Waves Find! They are popular and recommend it to everyone.

Wolfe Waves Find indicator — advantages and how to buy?

More examples of Wolfe waves built by our paid indicator:

which you can buy and install in the MetaTrader 4 terminal on a PC with Windows or running on a Crossover MAC:

This indicator is the only one I’ve ever come across that draws Wolfe Waves correctly!

- You only need to wait for the formation of the correct wave,

- check it for signs of ideality

- and start the entry point!

After payment, you will receive:

- compiled indicator for Metatrader 4 — WolfeWavesFind

- Installation instructions in English

- Table showing the best entry signals

- Wave ideality table to determine the best waves to trade

- After installing the indicator in the terminal, you order up to 5 keys for your MT4 logins (per 1 account / login — 1 key) — a demo account or a real one.

You can order keys at any time — the terms are not limited (you can order 5 at once or 1 as needed).

Attention, the indicator does not work on MT4 mobile terminals! Does not work on other terminals (MT5, etc.).

If you do not use MT4 for trading, then you can open an account, download the MetaTrader 4 of any broker, install an indicator in it and use this terminal as a signal terminal, and trade with your broker on any terminal!

Payment is possible by PayPal or cryptocurrencies (USDT, USDC or other cryptocurrency).

![Wolfe Waves Pattern [Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/2d/d2c0d1f27f7a92d_320x200.jpg)