The forex strategy «Costik» is inherently trendy, however, in a modified version, this system generates entry points quite well at the time of a trend reversal. This is the version we present to you.

Statistics:

From October 2020 to October 2021, the strategy showed an impressive result of +4100 pips with a stop of 35 pips. The maximum drawdown was 140 points.

- Time interval — H1.

- Currency pair — GBP/USD.

Indicators:

MTF Stochastic v2.0 indicator with parameters 60; 22; 22; 22; 0; 0.

Indicator STR_Conf_1 with parameters 21; 0; 1; 50; 0.

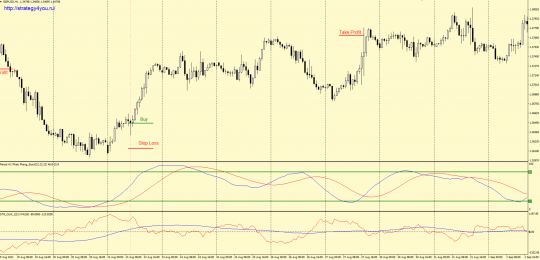

Terms for purchases:

For convenience and understanding, we will divide the entry conditions into two options.

Option 1.

1) The red line of the STR_Conf_1 indicator is above the blue line and above its level 0.

2) The lines of the MTF Stochastic v2.0 indicator intersect and its red line is below the blue one. Both lines are in the range from 20 to 80.

3) If at the moment of crossing at least one of the lines is below level 20, then the entry signal will be a candle, at the close of which both lines will already be above this level.

Option 2.

1) The red line of the MTF Stochastic v2.0 indicator is below the blue one. Both lines are in the range from 20 to 80.

2) At the close of the next candle, the red line of the STR_Conf_1 indicator is above the zero mark and crosses the blue line from the bottom up and turns out to be higher.

3) At the opening of the next candle, a buy deal is concluded.

4) Stop loss for the trade is set at 35 pips.

5) After passing 30 points in the positive zone, the transaction is transferred to breakeven.

6) Take profit is 120 pips.

7) A repeated signal in the same direction can be traded only if the previous transaction was moved to breakeven.

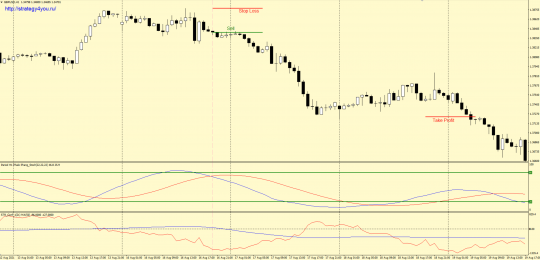

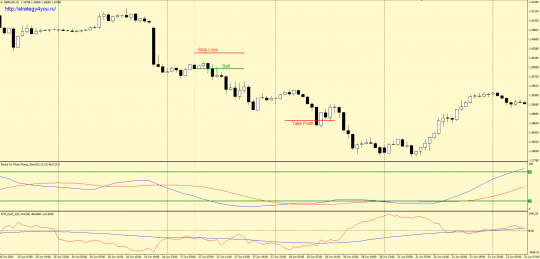

SELL conditions:

For convenience and understanding, we will divide the entry conditions into two options.

Option 1.

1) The red line of the STR_Conf_1 indicator is below the blue line and below its own level 0.

2) The lines of the MTF Stochastic v2.0 indicator intersect and at the same time, the red one is higher than the blue one. Moreover, both lines are in the range from 20 to 80.

3) If at the moment of crossing at least one of the lines is above its level 80, then the signal to enter the trade will be a candle, at the close of which both lines will already be below the same level.

Option 2.

1) The red line of the MTF Stochastic v2.0 indicator is above its own blue one. These two lines are in the range from 20 to 80.

2) At the close of the next candle, the red line of the STR_Conf_1 indicator is below the “0” mark and crosses the blue line from top to bottom and turns out to be lower.

3) At the opening of the next hourly candle, a sell trade is made.

4) Safety order — stop loss is set at a distance of 35 points from the entry point into the transaction.

5) After the price passes +30 points, the transaction is transferred to the breakeven point.

6) We fix the profit on the take profit, which is set at a distance of 120 points from the entry.

7) A repeated signal in the same direction — for sale, you can trade only if the previous transaction has already been transferred to breakeven.

Video version of the forex strategy «Costik»:

- Recommended to watch with English subtitles!

- Download indicators for MT4 in archive — costic_indicators.

- Download template for Metatrader 4 — costik_tpl (also in the archive).

- 12 Month report here ➜ (+662.29%)