Forex Strategy «White Ladder» is used to trade in the direction of the main trend and mainly medium and is based on finding trading signals an overbought or oversold, with further shopping at the lows and selling at the highs of the market.

Forex strategy is suitable for trading on all time frames and in all dealing centers, but you should always remember that a decrease in the time scale may lead to increased noise in the market.

The currency pair may also be arbitrary.

And so to trade forex strategy «White Ladder», it is necessary for the selected schedule, set the following indicators forex:

- Simple Moving Average SMA (50)

- Simple Moving Average SMA (200)

- Forex Indicator William% R (14) — you can download it at the end of this forex strategy

- Indicator MACD, but it’s better MACD-combo (with standard options)

Rules for the opening of trading positions for the purchase of forex strategy «White Ladder»:

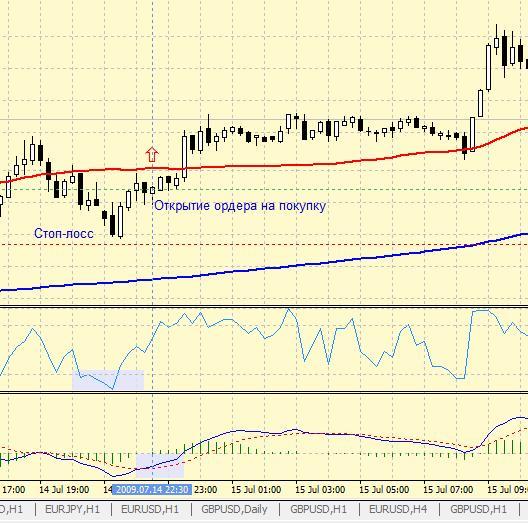

1) Transactions are opened only when the moving averages of the 50 SMA and 200 SMA are directed upward. Beware fletovyh markets.

2) Trading signal is generated as soon as the Williams% R indicator refers either to go below -80.

3) Histogram MACD (MACD) has until the signal from the Williams% R to be below zero and go up from the bottom (ie, the intersection of the medium), to confirm the fact that the price has formed a bottom.

Place a pending order buy stop at 1 point above the maximum of the last candle with a stop-loss order under the lowest low of the past few candles. And waiting for the opening of a warrant to buy stop. Either enter the market with his hands on digging the next candle.

4) The output is mainly done later, 7.3 bars, profit target (take profit) at the same time should be 2-3 times greater than accepted risk (stop-loss, you want to install a local minimum). Very well when trading this strategy to use a trailing stop.

For trading positions for SELL — use inverse rules.

This trading technique provides excellent levels of traders entering the market with strict stop-loss and well-defined settings.