BREAKDOWN — RETURN [Forex & Crypto Trading Strategy] is based on the breakdown of the equidistant channel and the return of the price, today we will cover this topic more widely, also note that this is a rather strong and original signal of graphical analysis — if you know all the intricacies of price behavior in such situations, already with the help of this signal alone you can direct the trading process in a stable direction.

- Since the signal of this strategy is based on graphical analysis, in principle it can be used on any trading instruments. However, in practice, all the information described below was obtained by trading and studying on two currency pairs: EUR/USD and GBP/USD. In case of application on other instruments, we recommend to observe the price for some time in order to identify the individual features of the selected instrument.

- The time interval also does not really matter, but it is still better to consider charts from an hourly and higher.

Next, we’ll look at:

Conditions for entering the market for a BUY according to the Forex Strategy «Breakout — return»

(for SELL, the conditions are the same only in the opposite direction):

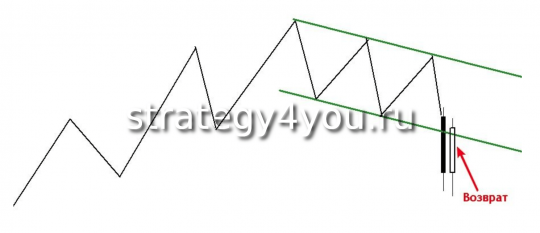

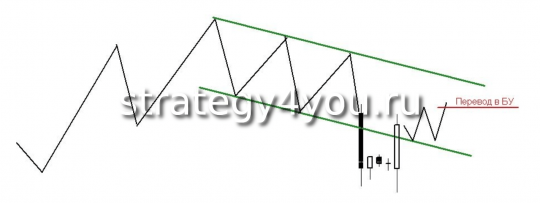

1) On the upward movement, there is a downward correction inside the channel.

2) At the next approach to its lower border, the price breaks it down.

3) After that, on a sharp impulsive movement, the price returns to the channel.

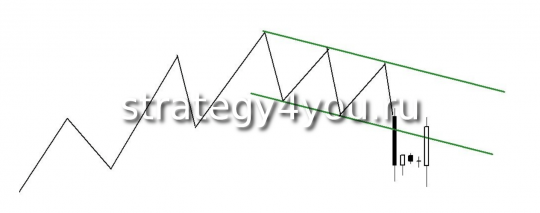

4) After a downward breakdown, the price may not return to the channel immediately, but after a small consolidation.

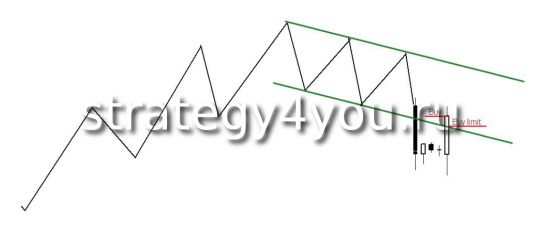

5) As soon as the return to the channel candle burrows inside the channel, we have two options for entering the market:

1. at the market price, if the closing price is close to the breakout point;

2. and, more preferable, by a pending limit order, which should be set, for example, at the breakdown level. (or: which is desirable to be set at the breakdown level)

You can enter at the market price if the closing price of the candle is not far from the channel border. Otherwise, it is more profitable to use a limit order.

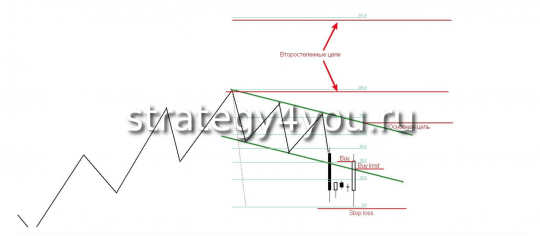

6) A safety order (stop-loss) is set under the previous minimum value.

7) The main target is located on the opposite side of the correction channel. If desired, you can fix profit in parts, where the following goals will serve:

1. census of the last high within the main trend;

2. Fibonacci extension level 161.8 from the last corrective movement.

It is better to consider the second and third targets in the case of the presence of amplifying signals according to graphical analysis (ABC, flag + ABC, and so on), but at the first target level it is still better to fix the majority.

8 ) You should filter out transactions, the risk of which is not covered by the potential profit at least twice.

It is rather risky to move a trade to breakeven in the early stages of the bounce in the expected direction, since in many cases, after the bounce in the right direction, the price may try to return to the lower border of the channel, thereby closing the trade with a zero result. For this reason, it is better to wait for the formation of the next highs after the release and at its census already transfer the order to used.

In most cases, when the price still does not bounce up, but breaks the channel down again, at least a moment of uncertainty begins, which significantly reduces the chances of making a profit. Therefore, in these cases, you should exit the market.

At first glance, this strategy seems quite simple, but we still strongly recommend that you first practice on demo accounts or forex cent accounts.

Below are some real examples of entry using this strategy:

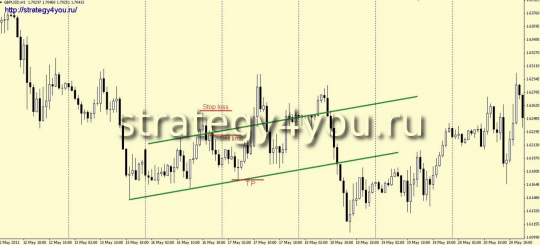

Example 1 — GBPUSD:

Example 2 — GBPUSD (H1):

Example 3 — EURUSD (H1):

Video forex strategy «Breakout — return»:

- MT4 template as it is a graphical forex strategy

![BREAKDOWN — RETURN [Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/d5/556a3ba81a556d5_320x200.png)