Forex Strategy «Turn curry» is long and is designed for traders who want to trade in the direction of positive curry (or other Slovan earn difference interest rates or in other words to swap).

- To trade on the forex strategy suitable only Carry-currency pairs, ie currency pairs, which is a big difference in interest rates — for example: AUDJPG, NZDJPG.

Although the forex strategy at the time of world crisis and a bit lost its relevance, but even so I deem it necessary to tell about it on his website. Moreover, that the global crisis will not last forever, and hopefully in the near future strategy «Turn on the curry» again be popular.

Principles of trade on forex strategy «Turn curry»:

Remember, we need only to trade in the direction of Curry, ie, in the direction of positive interest. For example, if the Australian dollar (AUD) gives a higher percentage than the Japanese Yen (JPY), the currency pair to trade AUDJPY should only be a long way. Similarly, if the British pound (GBP) is of great higher rate than for example the euro, the currency pair EURGBP — should trade only in the short side. Ie the basic rule is that the forex trader should enter into transactions only in the direction of the currency pair with a higher interest rate at the moment.

When trading on the strategy of «turning curry» should be used only daily charts and indicator Bollinger Bands with parameters 2SD (standard deviation) and 1SD. Dunn’s time span is needed to help Forex traders make money on the daily overnight (SWAP), while remaining profitable at the side of the trend in the market. In addition, because we are primarily looking for a deeper trend reversals, the breakthrough zone 2SD-1SD Bollinger is a must for trading signal to a deal. And after that follow the basic rules for the setup mode «twist on curry».

Opening of the transaction to BUY:

(Open to be, if the base currency is considered a currency pair has a higher interest rate)

1. Place on D1 schedule for the chosen currency pair, 2 sets of indicator Bollinger bands. 1 — pair of Bollinger Band should have installed 2SD, and the 2 nd pair of Bollinger bands should be installed — 1SD.

2. When the market price breaks through and closes above the lower channel Bollinger 2SD-1SD, enclose an equal volume of 2 deals to buy at market price (eg 1 lot a lot) — if your deposit does not allow trade in such volumes — I recommend to open a micro-or Cent accounts forex trading.

3. Place safety stop-loss at a minimum of vibration or minus 5 pips and calculate your risk of prisoner deal (risk of the transaction = The opening price of the transaction — price fixed stop-loss).

4. Set profit target for the 1 st Open Lot level of 50% of the resulting «risk of the transaction (that is, if your risk of prisoner deal 100 points, then place a profit target for the first of them at a distance of 50 pips from the entry point in the market).

5. Move the stop-loss «zero» (the breakeven point) when the market reaches a second profit target.

6. Close the deal on the 2 nd lot once the price on the market closes above the upper limit of 2SD Bollinger band indicator either in the break-even, depending on market conditions.

Opening of the transaction for SELL:

(Open to be, if the base currency is considered a currency pair has a lower interest rate)

1. Place on D1 schedule for the chosen currency pair, 2 sets of indicator Bollinger bands. 1 st pair of Bollinger bands indikatara should be the parameter 2SD, and the second pair of Bollinger bands — 1SD.

2. When the market price breaks through and closes below the upper channel Bollinger 2SD-1SD, enclose an equal volume of 2 deals to buy at market price (eg 1 lot a lot).

3. Place safety stop-loss at the maximum level of vibration plus 5 pips and calculate its resulting risk of the transaction (Transaction Risk = The opening price of the transaction — price fixed stop-loss).

4. Set profit target for the 1 st Open Lot level of 50% of the resulting «risk of the transaction (that is, if your risk of of Business — 100 points, then put a profit target for the first of them at a distance of 50 pips from the point entry into the market).

5. Move the stop-loss order to breakeven when price reaches vashshey first goal arrived.

6. Close the deal on the 2 nd lot as soon as the market price closes below the lower limit of 2SD Bollinger band indicator either in the break-even, depending on market conditions.

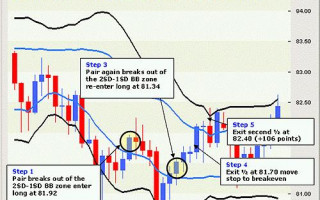

Example 1: Turn on the curry for the currency pair AUDJPY

Step 1 — A currency pair goes out of the Bollinger Bands 2SD-1SD, conclude a deal to buy at a price of 81.92

Step 2 — at a price of 80.89 closing a deal with a loss of -97 pips.

Step 3 — A currency pair again goes out of the Bollinger Bands 2SD-1SD — again open trading position to buy at a price of 81.34

Step 4 — Closing the 1 st open auction trading position at a price of 81.70, reposition the stop-loss point of «break even»

Step 5 — Close 2 nd open auction trading position at a price of 82.40.

Despite the fact that the first transaction was closed by stop-loss, at the opening of the 2 nd of the transaction — a pair for 3 trading days of growing up, and after exchanging a «zero» and the closure of part 1 of revenue — it continues to move again in the right direction for us a few more trading days, and meantime we look forward to — and interest over the removal of trade position (positive SWAP-s) grow!

After a couple AUDJPY reaches the top — 2SD Bollinger band indicator — we close the 2 nd lot of the transaction. As a result of closing of the transaction was a gain of $ 141 pips, and as additional income — we still get about 22 pips on a percentage (positive SWAP-ah) for the entire range of stay in the bargain.

Example 2: Turn on the curry — the currency pair AUDJPY

Step 1 — the currency pair goes out of bands Bollinger 2SD-1SD — conclude a bargain purchase price 83.55

Step 2 — Profit on the 1 st lot trading position at a price of 84.00, reposition the stop-loss «zero»

Step 3 — Profit on 2 nd lot trading position at a price of 85.36.

After a trade at the opening of a new bar after receiving a signal, the currency pair AUDJPY within a few trading days of moving against our trade position, but she did not knock us on the stop-loss, and we remain in the trade deal, increasing the interest of our open positions.

Hold position for about two weeks — we got 25 additional pips profit at the expense of interest (SWAP-s). As a result, we got on this deal — 251 pips profit.