Forex Strategy «YinYang» comes from scalping trading and, in principle, is still successfully used in this type of trading. However, we still chose a more classic version of it. In this variant, it gives signals, both trend and reversal.

Statistics:

From September 2020 to March 2021, the strategy showed a positive result of +1860 points. The maximum drawdown reached 150 points.

- Time interval — M15.

- The currency pair is multi-currency. Tested on the GBP/USD pair.

Indicators:

- Envelopes indicator with a period of 21 and a deviation of 0.18%.

- Parabolic SAR indicator in 0.02 increments; maximum 0.7.

- Awesome Oscillator indicator.

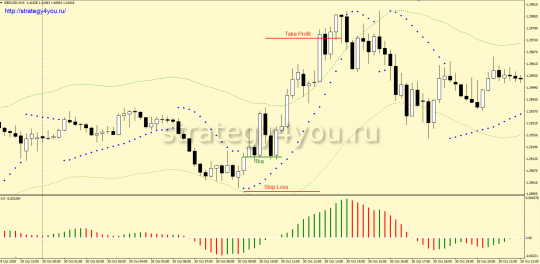

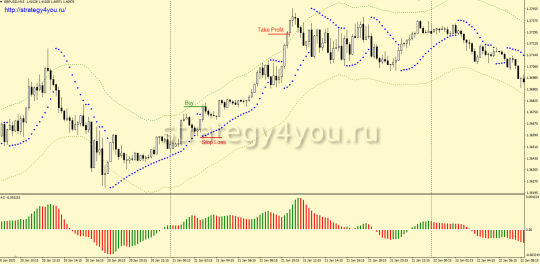

Conditions for purchases under the terms of the forex strategy «YinYang»:

Option A

(This option is used only once a day. Only when receiving the first such signal since the beginning of the day.)

1) The price bounces off the lower line of the envelopes indicator and is above. The top line has not yet been reached.

2) We are waiting for the candles, on which the Parabolic SAR indicator will go under the price.

3) On the same candle, the AO indicator is colored green and is below zero.

4) At the close of the same candle, a buy deal is concluded.

Option B

1) The price is between the lines of the envelopes indicator.

2) The Parabolic SAR indicator jumps under the price.

3) The AO indicator is above zero. Dyed red and then dyed green. You can only wait two candles for the last confirmation.

4) At the close of the candle, a buy deal is made.

5) Stop loss is set below the Parabolic SAR indicator. But not less than 15 points. If the size of the potential stop exceeds 30 points, then the trade is skipped.

6) After passing 20 points in the positive zone, the transaction is transferred to breakeven.

7) Upon receipt of a reverse signal in the negative zone, the transaction is closed at the market price.

8) It is possible to conclude a deal in the same direction only if the previous one has already been transferred to breakeven.

9) Take profit: option «a» 60 points, option «b» 50 points.

10) In the last 1.5 hours of the trading day, the signals are not traded.

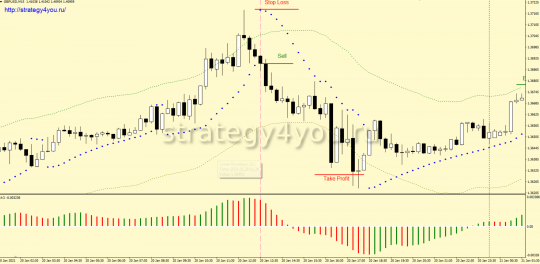

Sales conditions:

Option A

(This option must be used only once a day. Only when receiving the 1st such signal since the beginning of the trading day.)

1) The price bounces off the upper line of the envelopes indicator and is below it. At the same time, the price has not yet reached the bottom line.

2) We are waiting for a candle, on which the Parabolic SAR indicator will be higher than the price on the chart.

3) On the same candle, the AO indicator is colored red and is above its zero mark.

4) At the close of the same candle, a sell trade is opened.

Option B

1) The price on the chart is between the lines of the envelopes indicator.

2) The PSAR indicator is above the price.

3) The AO indicator is below zero. It is dyed green and then dyed red. You can wait only 2 candles for the last confirmation of the signal.

4) At the close of the candle, a sell trade is opened.

5) A safety stop loss is set above the PSAR indicator. But at a distance of not less than 15 points. If the size of the potential stop loss exceeds 30 points, then the transaction is not opened.

6) After passing 20 points in the «+» zone, the transaction is transferred to the breakeven point.

7) Upon receipt of a return signal in the «-» zone, the transaction is closed at the current market price.

8) You can open a deal in the same direction only if the previous one has already been converted to zero.

9) Profit taking order — take profit: option «a» — 60 points, option «b» — 50 points.

10) In the last 1.5 hours of the current trading day, signals are not traded at all.

Video version of the forex strategy «YinYang»:

- Recommended to watch with English subtitles!

- Download MT4 template — Yinyang (archived).

- I do not attach indicators, since they are present in any MT4 by default.