The Alligator Forex & Crypto trading strategy is very popular and makes it possible to successfully conclude transactions at the moments of the market transition from a state of stability and calm to the stage of active trend development, as in Forex and binary options trading.

The general rule says that the most serious movements occur after a period of complete calm — a flat, when the price varies in a very narrow range. And the longer the market is at rest, the more active and strong the future movement will be.

In calm moments, a trader should be ready at any moment to enter the market and work on the emerging trend, entering into transactions as early as possible and taking the maximum from the trend. And the Alligator indicator, created by Bill Williams as one of the components of his chaos theory, will be invaluable help in such a situation.

To use this Forex strategy, it is enough to set any currency pair on the chart:

- indicator «Alligator» — select from the list of technical instruments, set on the chart.

- Moving Average (simple moving average) with a period of -233 is also set.

- Stochastic Oscillator indicator.

- And Fractals.

For ease of installation, use this template for MT4 — Alligator_shablon_mt4 (archived).

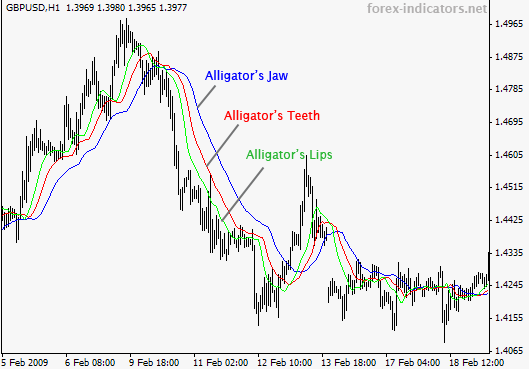

Jaw, teeth, lips and other graphics components

The indicator itself allows you to capture beginning price fluctuations as early as possible. The instrument is built on the basis of a combination of three balance lines — 5-period, 8-period and 13-period moving averages.

In the process of using the «Alligator», they are guided by the indicators of these three Movings, each of which has its own name:

- Jaw – a blue line that determines the balance of the current situation in real time. Blue moving and smoothed, with an average period of 13 and a forward shift of 8 bars.

- Teeth is red, which shows the balance that exists until now. This is an average with a period of 8, with a forward shift of 5 bars.

- Lips – green, with a small period of 5 points and a forward shift of 2 bars.

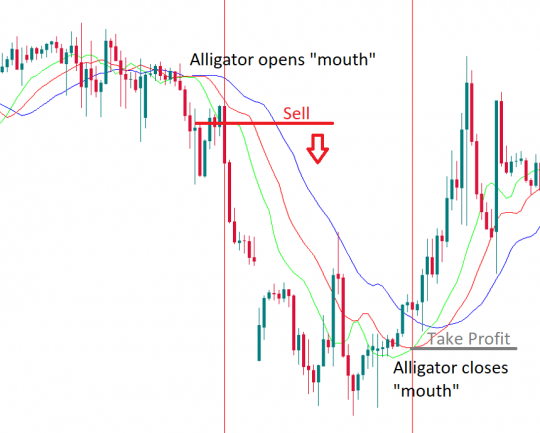

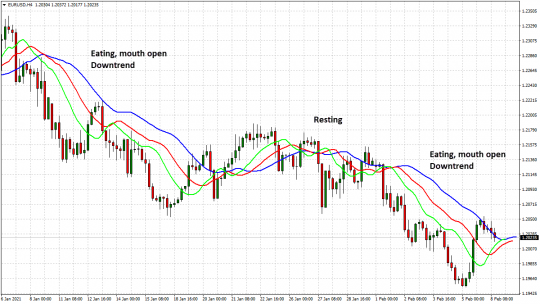

If all three MAs on the chart are closely pressed against one another and the value of the currency moves horizontally, fluctuating around the lines, the market is in a correction phase (flat). The price is unchanged, since there is no new information, and the previous one was taken into account and worked out.

As soon as new information appears, the market will react: first, the green 5-period moving average will signal — its line will reverse from the direction of the previous movement towards the emerging price impulse.

If the information that has appeared still affects the market, then after the green line, the red one will react, changing the direction of its movement, and then the blue one will work. If all of them have changed their original direction and are moving in price, crossing one another in turn (first green crosses red, then green and red cross blue, then blue reverses), and the price has left the flat and reverses, crossing the indicator lines, going lower or higher them, this indicates the beginning of an active movement and requires the trader to be ready to conclude transactions.

System trading, main features and stages

As you can see in the descriptions or on the video, Alligator Forex strategy involves some nuances:

1) When the market enters an active phase, the trader does not seek to immediately get down to business. First, you need to wait for the formation of a fractal, which is created as a result of price movement below or above the three moving averages of the Alligator indicator. The price breaks the range of the flat, goes below its lower border or above its upper one, rolls back a little.

2) The minimum or maximum breakdown level in this case will contribute to the appearance of a fractal. The price value of the fractal is the level of the future first entry into the market. The opening of the first transaction is performed only after the price forms a fractal and rolls back, and then again crosses the price level of the appeared fractal (2-3 points below or above it).

3) If, after the price left the flat borders, the fractal appeared in the interweaving of moving averages, it should be ignored and wait until it appears below or above the chart and the SS plexus.

4) After opening the first position, each subsequent fractal can be used to open new positions in the same direction. If the price is above the SS plexus, buy (up) fractals are used to enter the market, if it is below the MA plexus, only sell (down) fractals are used.

5) Be sure to look at the position of the value in relation to the average-233: if the price is above it, this is an additional strong signal to buy, if it is higher — to sell.

6) Before opening deals, false movements are filtered using the Stochastic: if it confirms the downward trend of the price, then after the price breaks through the level of the previous fractal, a sell position is opened, if the Stochastic confirms the going up, then after the price breaks through the level of the previous fractal, a buy position is opened.

7) The stochastic oscillator gives the following signals: buy if the indicator falls below the level of 20, to the oversold zone of the base currency, and then goes above it; sell if the oscillator first goes above the 80 level, to the overbought zone, and then falls below.

What else you need to remember when trading the system

The Alligator Forex trading strategy is suitable for different time frames, both for M15 and H4, although it is generally accepted that it gives the best results on large timeframes.

When trading, remember that:- Mandatory monitoring of moving averages: they always turn in the direction of movement: the more actively and strongly the price goes, the more the «fan» of lines will open and they will be located correctly in regarding the price chart.

- You need to take profits correctly and exit trades in time: when the price reverses and starts to cross the Alligator lines again, when enough profit is made, when the price has passed 5 descending / ascending bars and reluctance to take risks.

- It makes sense to close positions on the signals of the indicator about the market leaving in the opposite direction.

The effectiveness of the method increases significantly when a bearish or bullish reversal is formed on the chart: the first appears at the top of an uptrend in the form of a bar with a higher maximum (in comparison with previous uptrend bars) and the closing price at the bottom of the bar; A bullish reversal appears at the peak of a downtrend as a bar with a lower low (compared to previous downtrend bars) and a close at the top of the bar.

The main idea of the strategy is clear enough: wait until the alligator is sleeping and start trading when it opens its mouth. The main thing is to see the beginning of an active trend in time, eliminate all the noise and make profitable deals, fixing profits in a timely manner and closing positions.

If desired, this strategy can also be used for binary options trading — we determine the direction where the price will go in MT4, and trade for an increase or decrease in the binary options trading platform.