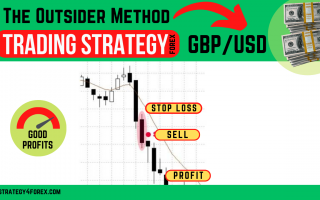

Today we will consider the trading algorithm using the Forex strategy The Outsider Method:

- We insert on the chart of the Metatrader 4 trading terminal — EMA (exponential moving average) with a period of 9 for a 15-minute chart

- Currency pair — GBPUSD.

After that, we follow the candles on the chart, which should take the following form in order to conclude a deal:

1) The body and shadows of the Japanese candlestick do not touch our EMA with a period of 9.

2) Ideally, the High or Low of the candle should be at least 1 point away from the EMA (9).

3) The closing price of the candle must be above the previous High (bullish trend) or below the previous Low (bearish trend).

Rules for entering the market according to The Outsider Method strategy:

In a bull market: we make a deal to buy at the opening of the next candle.

In a bearish market: to sell at the open of the next candle.

Market exit rules:

1) When the deal is open, immediately, without slowing down, we put SL and TP.

2) SL should be set on the Low (bullish market) or High (bearish market) of the previous Japanese candle (alternatively, if the Low or High are very close to the market entry point, you need to use the Low and High of the previous candle).

3) TP must be set at a distance equal to the size of the body of the previous trading candle.

4) If the price went sharply and we have a profit of 20 or more pips, we move the SL by the value = (breakeven + spread).