Forex strategy «4 strings» is quite logical and at the same time simple trading system. It does not provide for the use of indicators.

Statistics:Over the past year, from December 2019 to December 2020, the strategy, with a risk of 2% of the initial deposit for each individual transaction, showed a positive result of 172%. The maximum drawdown was 12%.

- Currency pair — EUR/AUD; EUR/NZD.

- The senior time interval is D1.

- The younger time interval is H1.

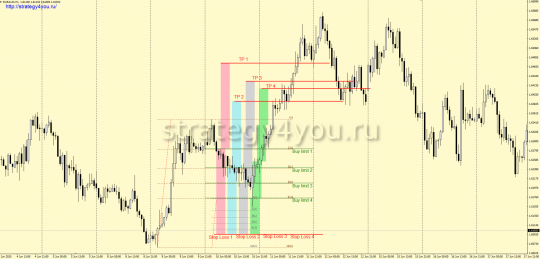

Conditions for buying on the Forex strategy «4 strings»:

1) On the daily interval, pronounced levels should be noted for the bodies of sections. For purchases, we will be interested in the levels built on the points from which there was a rollback up.

2) These levels must be «live». That is, the price after the formation of the level could break through them so far only in one direction (down).

3) After it breaks down, the next daily candle still closes above this level.

4) After that, go to the hourly interval.

5) From the low to the high of the previous day, the fibonacci grid is stretched.

6) If the opening price of a new day is above the level of 23.6, then pending buy limit orders are placed on all lower fibonacci levels from 23.6 to 61.8.

7) If the opening price of a new trading day is below the level of 23.6, but above the level of 38.2, then pending buy limit orders are placed on all lower fibonacci levels from 38.2 to 61.8.

8) If the opening price of a new trading day is below the level of 50, then trading is not conducted on this day (orders are not placed).

9) If the price continues to grow before the activation of the first order, then the maximum fibonacci grid point should be rebuilt (limit orders should be moved accordingly). However, after the activation of the first order, all other orders no longer move, regardless of the price behavior.

10) From the level of 100 to the level of 61.8, one more fibonacci grid should be stretched. Above the level of 61.8 of this particular grid, a stop loss is set for each individual transaction.

11) The level of transfer to breakeven for:

— orders from 23.6 are two times less than the size of his own stop-loss order.

— orders from 38.2 when the price reaches level 0.

— orders from 50 upon reaching the level of 23.6.

— orders from 61.8 upon reaching the level of 38.2.

12) Profit fixation level:

— orders from 23.6 is equal to the size of his own stop-loss order.

— orders from 38.2 are twice the size of his own stop-loss order.

— orders from 50 are three times the size of his own stop-loss order.

— orders from 61.8 are four times the size of his own stop-loss order.

13) If the distance from the level of 100 to the level of 61.8 of the main fibonacci grid is less than 50 points, then the stop loss is set for the low of the previous day.

14) After the end of the trading day, inactive orders should be deleted.

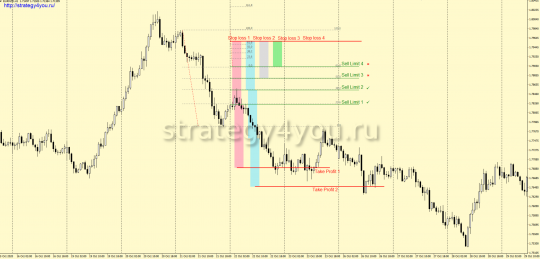

Conditions for sales using the «4 strings» trading system:

1) On the D1 interval, it is necessary to note the pronounced levels on the bodies of sections. For sell trades, we will be interested in the levels built on the points from which there was a rollback down.

2) These levels must be «live». That is, the price after the formation of this level could break through them so far only in one direction (upwards).

3) After the upward breakdown of this level, the next D1 candlestick still closes below it.

4) After these conditions are met, go to the hourly interval.

5) From MAX to MIN of the previous day, the fibonacci grid is stretched.

6) If the opening price of a new day is below the level of 23.6, then pending sell limit orders are placed on all upper Fibo levels from 23.6 to 61.8.

7) If the opening price of a new trading day is above the level of 23.6, but below the level of 38.2, then pending sell limit orders are placed on all upper Fibonacci levels from 38.2 to 61.8.

8) If the opening price of a new trading day is above the level of 50, then no trading is conducted on this trading day at all (orders are not placed).

9) If the price continues to decline before the opening of the first order, then the minimum Fibo grid point should be rebuilt (respectively, limit orders should be moved). But, after the activation of the 1st order, all other orders no longer move, regardless of the price behavior.

10) From the level of 100 to the level of 61.8, one more Fibonacci grid should be stretched. Above the level of 61.8 of this particular grid, a safety stop loss is set for each individual transaction.

11) The level of transfer to the breakeven point for:

— orders from 23.6 are 2 times smaller than the size of its own stop-loss order.

— orders from fibo 38.2 when the price reaches level 0.

— orders from Fibo 50 upon reaching the level of 23.6.

— orders from the level of 61.8 upon reaching the level of 38.2.

12) The level of profit taking according to the rules of the strategy:

— orders from 23.6 is equal to the size of his own Stop-loss order.

— orders from 38.2 are 2 times the size of his own stop loss.

— orders from 50 are 3 times larger than the size of his own stop loss.

— orders from 61.8 are 4 times the size of his own stop loss.

12) If the distance from level 100 to level 61.8 of the main Fibo grid is less than 50 points, then the stop loss is set for the MAX of the previous day.

After the end of the trading day, all inactive orders must be deleted.