The forex strategy «Acceleration with the trend» is quite simple and does not require absolutely any indicators for trading and market analysis, which is based on the acceleration candle. To search for a deal, it is enough just to identify the acceleration candle on the daily chart and then look for a market entry point in the direction of the older movement on a smaller interval.

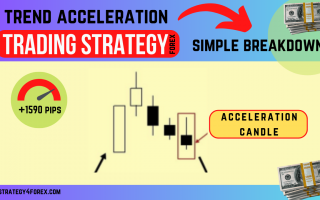

Some statistics on forex strategy:

For the GBP/USD and EUR/USD currency pairs, this strategy from the beginning of 2015 until today (September 24, 2015) has shown a profit of + 1590 points (by 4 digits). Taking into account the fact that in this strategy it is recommended to lay 1% of the risk from the deposit every 10 points, the profit for incomplete 9 months was 159%, which is not even bad.

Moreover, it should be noted that the strategy does not take much time. During this period, there were only 24 trading signals: 6 of them were closed by zero result, 5 by stop and the remaining 13 by take profit, and this is taking into account the fact that one stop is two to three times less than the profit received by 1 take profit.

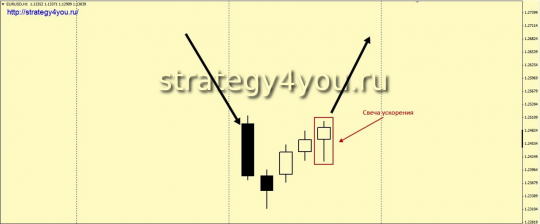

First, let’s recall how to determine the acceleration candle.

Bullish Acceleration Candle Definition:

After a downtrend, a reversal occurs and at least one white candle is formed. When moving up, a candle whose white body is less than or equal to the lower tail is considered an acceleration candle. In turn, the upper tail should not be too long. The upper tail should not be below the local minimum, after which the reversal began.

Definition of a Bearish Acceleration Candle:

After the upward movement, a reversal occurs and at least one black candle is formed. When moving down, a candle whose black body is less than or equal to the upper tail is considered to be an acceleration candle. In turn, the lower tail should not be too large. The upper tail should not be higher than the local maximum, after which the reversal began.

Time interval for trading:

- On the daily interval (D1), an acceleration candle is identified.

- On the hourly interval (H1) the market is entered.

Currency pair:

- can be any (!) — multi-currency strategy.

Conditions for entering the market for purchases according to the «Acceleration with the trend» strategy:

1) On the daily interval, we expect the formation of a bullish acceleration candle and after that, on the next trading day, we move to the H1 chart. (It is allowed to wait for a signal on H1 for a maximum of two days).

2) After switching to the hourly chart, you should immediately place a buy-stop order above the maximum of the acceleration candle by exactly 5 points.

3) If a bullish acceleration candle is formed on the hourly chart before the pending order is triggered, then a buy order is opened at its close. Accordingly, the pending order in this case should be deleted. (If the deal is closed by a stop loss, then on this day you can still expect an entry by a pending order, that is, it should then be restored already.)

4) To enter a pending order, the stop loss is 50 points.

5) To enter on the acceleration candle on H1, the stop loss is set for the last local minimum, but not less than 30 points.

6) After passing in the positive zone a distance equal to half of the entire size of the acceleration candle on the daily chart, the deal should be transferred to breakeven.

7) Take profit is set at a distance equal to the entire acceleration candle on the daily chart + 40 points.

8) If at the close of the daily candle the price is at a distance from the entry point equal to the size of the acceleration candle, then you should no longer wait for the take profit to be reached, but you need to take profit at the market price.

Conditions for entering the sell market:

1) On the daily interval (D1), we expect the formation of a bearish acceleration candle and after that, on the next trading day, we move to the H1 interval. (It is allowed to wait for a signal on the H1 time frame for a maximum of two days).

2) After switching to the hourly chart, you should immediately place a sell-stop order below the minimum of the formed acceleration candle by exactly 5 points.

3) If a bearish acceleration candle is formed on the hourly chart before opening a pending order, then a sell order is opened at its close. Accordingly, the pending order in this case should be deleted. (If the deal is closed by a safety order — stop loss, then on this day you can still expect an entry by a pending order, that is, it should then be restored already.)

4) To enter a pending order, set the stop loss at a distance of 50 points.

5) To enter on the acceleration candle on H1, the stop loss is set for the last local maximum, but not less than a distance of 30 points.

6) After passing in the positive zone a distance equal to half of the entire size of the acceleration candle on the daily chart, the trade should be transferred to the breakeven level (rearranged to zero).

7) Take profit is set at a distance equal to the entire acceleration candle on the daily chart + distance of 40 points.

8 ) If at the close of the daily candle the price is at a distance from the entry point equal to the size of the acceleration candle, then you should no longer wait for the price to reach take profit, but you need to take profit at the current market price.

Video:

Forex strategy video «Acceleration with the trend»:

- Recommended to watch with English subtitles!

- There is no template, because there are no indicators …

- Strategy Test: +145.1% HERE ➜