Forex strategy «True Trend» is a trading method based on one of the basic rules for determining a trend: a sequence of closing highs and lows, relative to previous extremes.

Often, studying the market in depth over a long period of time leads to smoothing out in memory the basic rules that were studied at the very beginning. That is, the more complex models, combinations and forex strategies a trader studies, the less he pays attention to the primary rules of the market, which often leads to incorrect conclusions on the current situation. The basics of the market are its pillars, the foundation, without which the price movement on the chart will seem chaotic and incomprehensible to the trader.

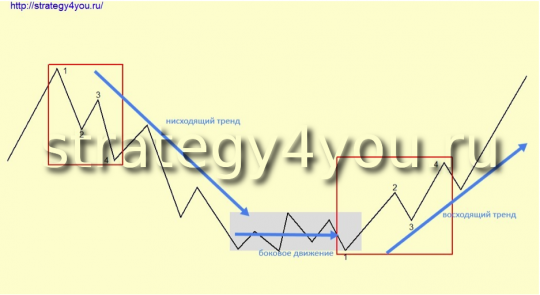

And so these are the rules for determining the trend:

— in an uptrend, each subsequent high is higher than the previous one, and each subsequent low is higher than the previous low;

— in a downtrend, each subsequent minimum is lower than the previous one, and each subsequent maximum is lower than the previous maximum;

— in lateral movement, these conditions are not met.

Thus, to determine the trend, we need to identify the last four extremes (two lows and two highs). Unlike the 1-2-3 model, this rule allows you to protect yourself from the possible formation of an ABC correction.

This trading method can be used on any instrument and on any time interval, but you should not go below the 15-minute interval, but it is better to trade starting from the hourly chart.

To obtain additional strategy signals, an exponential moving average with a period of 24 is used.

Conclusion of deals to buy according to the Forex Strategy «True trend»:

1) After some downward movement (not necessarily a strong downtrend), the price rolls back up from the lows and two ascending highs and two ascending lows are formed on the chart. Thus, we define the current trend as an uptrend.

2) On the last high, we draw a horizontal line.

3) As soon as the next candle closes above the horizontal line, we open a buy order:

4) If the price is already far from the horizontal line, then you can wait for a rollback to it and only then enter the market with a limit order.

5) Stop loss is set under the last low.

6) As soon as the next candle closes after entering the market, we move the stop order under the moving average (provided that the price is above the MA) and then after each candle we move the stop order under the corresponding MA value, but not closer to the opening price than 40 points (for 4 digits!) (these rules apply to time intervals starting from H1).

7) After the price passes in the positive zone of the distance, which is equal to the size of the initial stop, we transfer the deal to breakeven.

8 ) Take profit is equal to two stop losses — 20%. That is, if the stop size is 50 points, then the profit is 2 x 50-20% = 100 — 20% = 80 points.

Profit can also be fixed according to the moving average, that is, constantly continue to rearrange the stop order (even in the positive zone) under the moving average.

Sales according to the rules of the trading strategy «True trend»:

1) After a pronounced upward movement (not necessarily a strong uptrend), the price rolls back down from the maximum values and two descending lows and two descending highs are formed on the chart. Thus, we define the current trend as down.

2) On the last low, we draw a horizontal line.

3) As soon as the next candle closes below the horizontal line, we open a sell trade.

4) If the price is already far from the drawn horizontal line, then you can wait for a rollback to it and only then enter the market with a limit sell order.

5) A safety stop loss order is placed above the last high.

6) As soon as the next candle closes after entering the market, we move the stop order beyond the moving average (provided that the price is below the MA) and then after each candle we move the stop order beyond the corresponding MA value, but not closer to the opening price than 40 points (these rules are for time intervals from H1 and above).

7) After the price passes the distance in the positive zone, which is equal to the size of the initial safety stop, we transfer the deal to the breakeven level.

8) Take profit is equal to two stop losses — 20%. That is, if the stop size is 50 points, then the profit is 2 x 50-20% = 100 — 20% = 80 points.

Profit can also be fixed according to the moving average, that is, constantly continue to rearrange the stop order (even in the positive zone) beyond the set moving average.

Additions to the forex strategy:

1) In principle, the considered model is a reversal, but it can also be traded upon exiting the sideways movement, provided that the last high/low has broken through the maximum/minimum value of the side corridor.

2) Of course, at first it will be quite difficult for novice traders to accurately determine this or that minimum or maximum, however, we do NOT recommend using the Zig-Zag indicator to facilitate this task, since the size of the waves is different and the indicator may not see or incorrectly see an already formed model . Be patient and with time and practice you will be able to independently and easily recognize the necessary extremes.

3) With an aggressive trading style, you can enter the market on the census of each high in an uptrend and on the census of each low in a downtrend. BUT THIS OPTION IS HIGHLY RISKED!