The forex strategy «Two highs/lows in one day» or 2 MAX / MIN in 1 DAY [Forex & Crypto Trading Strategy] is based on the use of horizontal levels, which are described in almost every tutorial for beginners, however, in practice, very often there are difficulties in determining the importance of a particular level, and, accordingly, in trading on these levels.

Today we will consider some conditions under which the level can be considered strong and trading from it becomes much safer. In principle, this is a certain price pattern with its own trading rules. In the market, this pattern or chart pattern is not fully formed so often and for this reason it is better to track it on several instruments. It should also be taken into account and known to fans of graphic trading.

In 63% of cases, the price reaches its target level after entry, but the next indicator is more important for safe trading. When moving against an open position, in 78% of cases the price returns to testing the broken level even before the stop order is triggered, which allows us to exit the market without losses.

- Time interval — H1.

- Currency pair — any. On cross-rates, this model is formed more often.

How to find this level?

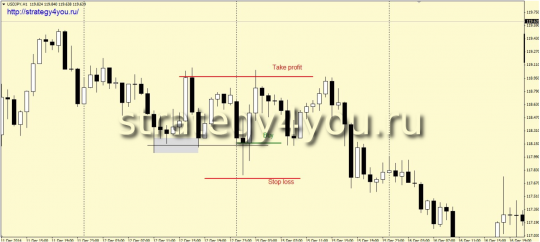

We need to find the day during which two highs or lows were formed at the same level, exactly during one trading day. Extremes should be clearly expressed and separate from each other. In the middle of the distance from the nearest body to the maximum / minimum of the farthest tail, we draw a horizontal line, this is our level.

Conditions for entering a BUY according to the Forex Strategy «Two highs / lows in one day»:

Rebound from the level:

1) During the next two days, if, when approaching this line, the price draws a breakout candle (a small body and a long tail from below), we conclude a deal at the market price.

2) Stop-loss is set below the minimum value, taking into account the shadows of the signal day, but not less than 15 points (for 4 signs).

3) Take profit is set at the previous high (after the formation of the level) or at the high of yesterday, depending on which of them is next. That is, we choose a more distant level of these two.

4) After passing the distance equal to the stop loss order, it is better to transfer the deal to breakeven.

Level breakdown:

1) For trading in case of breakdown of this level, it is necessary that the price breaks through it the next day, not later. After that, at least three candles must close higher and only then can a limit buy order be placed at this level.

2) To determine the size of the stop-loss order, you should measure the distance from those same two highs to the minimum rollback between them. Half of this distance is our stop loss, but not less than 15 points.

3) Take profit is set at a distance equal to the entire retracement between two highs.

Conditions for entering the SELL:

Rebound from the level:

1) Within two days, if, when approaching this line, the price draws a breakout candle (a small body and a long tail on top), we conclude a deal to sell at the market price.

2) A safety stop-loss order is set above the maximum value, taking into account the shadows of the signal day, but not less than 15 points.

3) Take-profit is located at the previous low (after the formation of the level) or at the low of yesterday, depending on which of them is further. That is, we choose a more distant level from these two described.

Level breakdown:

1) For trading in case of breakdown of this level, it is necessary that the price breaks through it the next day, not later. After the fact of the breakdown, at least three candles must close lower and only then you can set a limit order to sell at this level.

2) To determine the size of a safety stop-loss order, you should measure the distance from those same two lows to the maximum rollback between them. Half of this distance is our stop loss, but it should not be less than 15 points.

3) A take profit order is set at a distance equal to the entire retracement between two lows.

Additions to the strategy:

1) Be sure to check trades before entering for compliance with money management rules.

2) Sell-off breakouts are twice as common as all other options.

3) Be sure to pay attention to the current trend before entering the market. The signals received by the trend are much more profitable and profitable.

4) Don’t get greedy and keep deals longer than described. The strategy is not meant for taking big moves.

5) After passing the distance equal to the stop loss order, it is better to transfer the deal to breakeven.

6) When trading after a breakout, it is better that testing from the reverse side occurs on the third day. If this did not happen on the third day, then it is better to delete the limit order.

![Forex strategy «Two highs / lows in one day» or 2 MAX / MIN in 1 DAY [Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/3a/5e60e75da25ea3a_320x200.png)