The ELEPHANT & PUG [Forex & Crypto Trading Strategy] is based on Japanese candlesticks and is designed for daily charts, which allows you to devote a minimum of time to it, and this is very important for those who cannot constantly be at the monitor. There are also no indicators in it, which means that novice traders can quickly adapt to it.

Some statistics:

8 out of 10 entrances are closed with a positive result. Over the last year (from July 2014 to July 2015), the strategy for only three currency pairs (EUR/USD; GBP/USD; USD/JPY) showed a profit of 1890 points for 4-digit quotes (although more instruments are allowed) .

- Time interval — D1.

- Currency pair — all major currency pairs with the US dollar.

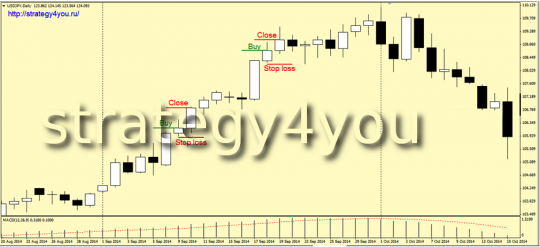

Conditions for entering a BUY according to the Forex Strategy «Elephant and Pug»:

1) After a black candle (or a doji candle), a white confident candle is formed.

2) After the formation of the first white candle, you need to wait for the second white candle, the body of which should be less than the first white candle and not be more than 60 points. Also, the closing price of the second white candle must be greater than or equal to the high price of the first candle (tail high).

3) At the opening of the next candle, a buy trade is opened.

4) Stop loss is set below the opening price of the second candle (if the lower tail is not far, then it is better to put a stop below it). The minimum stop is 35 points, the maximum stop is 65 points.

5) After passing 35-40 points in the positive zone, we transfer the deal to breakeven.

6) The deal is closed at the market price at the close of the first day after entering the market.

Conditions for entering the SELL under the Strategy «Elephant and Pug»:

1) After the formation of a white candle (or doji candle), a black confident candle appears.

2) After the formation of the first black candle, you need to wait for the second black candle, the body of which should be less than the body of the first black candle and at the same time not be more than 60 points. Also, the closing price of the second black candle must be less than or equal to the low price of the first candle (low of the tail).

3) At the opening of the next daily candle, a sell trade is opened.

4) Stop loss is set above the opening price of the second candle (if the upper tail is not far, then it is better to put a stop behind it). The minimum stop is 35 points, the maximum stop is 65 points.

5) After passing 35-40 points in the positive zone, the transaction must be transferred to the breakeven area.

6) The deal is closed at the market price at the close of the first day after entering the market.

Additions to the forex strategy:

1) Models formed at the end of the correction in relation to the previous trend work well.

2) There is also a version of the strategy, where transactions that were concluded in the first half of the month are only partially fixed, and the rest is fixed at the end of the month (with a take profit of 400 points), but this is still more food for thought, not call to action.

Video forex strategy «Elephant and Pug»:

![ELEPHANT & PUG [Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/bc/cb13b849ddee4bc_320x200.png)