Forex strategy «Quantum» is not trendy, but it is difficult to attribute it to reversal trading systems, as well as flat trading systems. Signals work equally well both inside the trend and inside the sideways ranges.

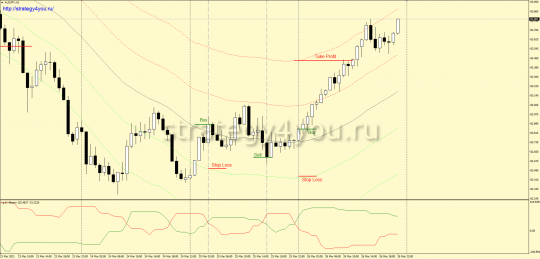

Statistics:From March 2020 to March 2021, the strategy showed a positive result of +1900 points. The drawdown was 110 points.

- Time interval — H1.

- Currency pair — any, multi-currency strategy. Various cross-pairs of majors are recommended for trading. But we tested on the AUD/JPY pair.

- Indicator dNonLagTMA eMOD with parameters: 0; 56; 100; 2.0; 2.5.

- Indicator dNonLagTMA eMOD with parameters: 0; 56; 100; 4.0; 4.5.

- Quantum indicator with default parameters.

Conditions for purchases using the Quantum strategy:

1) Another candlestick crosses the central line of dNonLagTMA eMOD indicators from bottom to top and closes higher.

2) The green line of the Quantum indicator crosses the red line upwards and grows in relation to its previous value. If there is no growth, then this signal is skipped.

3) The order in which signals are received does not matter.

4) As soon as the signals are received, a buy deal is made at the opening of the next candle.

5) Stop loss is set beyond the upper green line of the dNonLagTMA eMOD indicator, but not more than 40 points.

6) After the price reaches the lower red line of the dNonLagTMA eMOD indicator, the trade is moved to breakeven.

7) Take profit is set at the level of the upper red line of the dNonLagTMA eMOD indicator, which is formed at the time of the transaction.

8 ) If a return signal is received, the previous signal closes at the market price.

9) In the same direction, a transaction can be considered if the previous one has already been transferred to breakeven.

Conditions for transactions for sale:

1) The candlestick crosses from top to bottom the central line of dNonLagTMA eMOD indicators and closes below it.

2) The red line of the Quantum indicator crosses the green line upwards and grows in relation to its previous value. If there is no growth, then this signal is ignored.

3) The order in which the signals are received does not matter.

4) As soon as all the signals are received, a sell trade is opened at the opening of the next candle.

5) Loss fixation order — stop loss is set behind the lower red line of the dNonLagTMA eMOD indicator, but it should not be more than 40 points.

6) After the price reaches the lower green line of the dNonLagTMA eMOD indicator, the trade is moved to the breakeven point.

7) We fix the profit on the take profit, which is set to the level of the lower green line of the dNonLagTMA eMOD indicator, at the time of the transaction.

8) If you receive a return signal, then the previous signal closes at the current market price.

9) In the same direction, an additional transaction can be considered only in cases where the previous one has already been transferred to the breakeven point.

Video version of the forex strategy «Quantum»:

- Recommended to watch with English subtitles!

- Download forex indicators — Quantum_indicators (archived).

- Download MT4 template — quantum_tpl (archived).