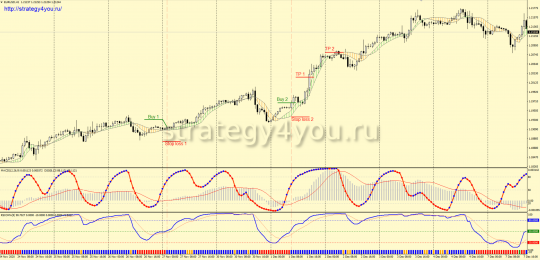

Forex strategy «The Dragon Fly» generates signals using a large number of indicators and filters. The signals are different and it is difficult to classify this trading system as trend or reversal. However, the variety of signals received makes this system independent of the current development of events and the prospects for the development of the trend, or its reversal.

Statistics:

From May 2020 to May 2021, the strategy showed a positive result of +1700 points. The maximum drawdown was 65 points.

- Time interval — H1.

- Currency pair — EUR/USD.

Indicators:

- Ribbon indicator with parameters 12.0; 0; 0; 26; 0; 0.

- MACD 12 indicator; 26; 9.

- Robby DSS Bressert Colored indicator with 8 parameters; 13 (the second and third indicators are combined in one window).

- RSIOMA v2 indicator with default parameters.

Conditions for buying according to the strategy «The Dragon Fly»:

1) The Ribbon indicator is green. The price is above its bottom line.

2) The MACD indicator is above its zero level. Its signal line is growing relative to its previous value.

3) The Robby DSS indicator is above its level 50, but has not yet reached level 80. Its signal line is growing relative to its previous value (the dot is colored blue).

4) The RSIOMA v2 indicator is above its level 50 but below its level 80. Its signal line is below it.

5) The order in which the signals are received does not matter.

6) At the opening of the next candle, a buy deal is concluded.

7) Stop loss is set at a distance of 30 points from the entry point.

8) After passing 30 points in the positive zone, the transaction is transferred to breakeven.

9) Take profit is set at 110 points.

10) When receiving a repeated signal in the same direction, the signal can be considered only if the previous transaction has already been moved to breakeven.

11) If two candles close below the bottom line of the Ribbon indicator, and the deal is in the negative zone at that moment, the deal should be closed immediately at the market price.

Sales conditions:

1) The Ribbon indicator is orange. The price is below its upper line.

2) The MACD indicator is below its «0» level. At the same time, its signal line decreases relative to its previous value.

3) The Robby DSS indicator is below its level 50, but has not yet reached level 20. Its signal line is decreasing relative to its previous value (that is, the dot is colored red).

4) The RSIOMA v2 indicator is currently below its level 50, but below its level 20. Its signal line is above it.

5) The order in which the signals are received is absolutely irrelevant.

6) At the opening of the next hourly candle, a sell trade is opened.

7) A stop loss order is set at a distance of 30 points from the market entry point.

8) After the price passes +30 points, the transaction is transferred to the breakeven point.

9) We fix profit by take profit, which is set at a distance of +110 points from the entry.

10) When receiving a second signal to enter the market in the same direction, the signal can only be considered if the previous open transaction has already been transferred to the breakeven point.

11) In case of closing of 2 candles above the upper line of the Ribbon indicator, if the open transaction is still in the «-» zone at that moment, it should be immediately closed at the current market price.

Video version of the forex strategy «The Dragon Fly»:

- Recommended to watch with English subtitles!

- Download indicators for the MetaTrader 4 terminal — Indicators_the_dragon_fly (archived).

- Download the MT4 template — The_Dragon_Fly_tpl (also in the archive).

- Test results: +337,77% ➜