Forex strategy «TSS Filter» is based on an unusual combination of complex indicators. This trading system often generates reversal signals that have overestimated risks, however, the stop/profit ratio (almost 1/5) indicates that «the game is worth the candle.» Signals are also generated along a stable trend, which allows the strategy to show a smooth and stable positive result.

Statistics:

From March 2020 to March 2021, the strategy showed a positive result in the region of +3900 points. The drawdown was 175 points.

- Time interval — H1.

- Currency pair — GBP/USD.

Indicators (download link at the end of this strategy):

- TSS indicator [S]. Default settings.

- FTLM-STLMMxAMm indicator.

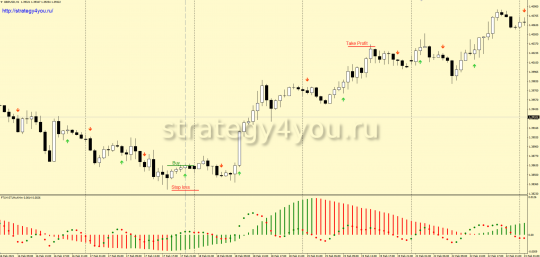

Conditions for buying on the forex strategy «TSS Filter»:

1) The TSS [S] indicator draws a green arrow below the price.

2) On the same candle, the scale of the FTLM-STLMMxAMm indicator is green.

3) On the same candle, the FTLM-STLMMxAMm indicator draws a green circle.

4) If all conditions are met, then at the opening of the next candle, a buy deal is concluded.

5) Stop loss — 35 points.

6) After passing 30 points in the positive zone, the transaction is transferred to breakeven.

7) Take profit — 170 points.

8 ) If the price is in the negative zone, and a full-fledged reverse signal has formed on the chart, then the previous transaction is closed.

9) If the price is in the positive zone, and a full-fledged reverse signal has formed on the chart, then the previous transaction is transferred to breakeven.

10) If the body of the signal candle is more than 80 points, then such a signal is skipped.

11) The signal in the same direction can be considered if the previous transaction has already been moved to breakeven.

12) 2 hours before the end of the trading week, signals are not accepted.

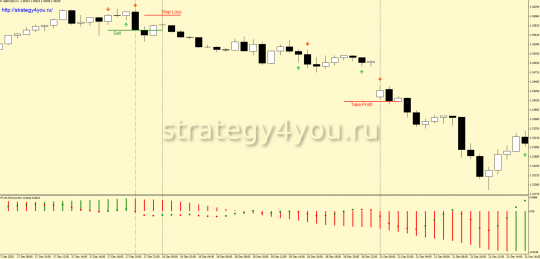

Sales conditions:

1) The TSS [S] indicator draws a red arrow on the chart above the price.

2) On the same H1 candle, the FTLM-STLMMxAMm indicator scale turns red.

3) On the same hourly candle, the FTLM-STLMMxAMm indicator draws a red circle.

4) If all the conditions described above are met, then a sell trade is opened at the opening of the next candle.

5) Loss fixation order — stop loss is equal to 35 points.

6) After the price passes +30 points, the transaction is transferred to the breakeven point.

7) We fix the deal at the take profit, which is equal to 170 points.

8 ) If the price is in the «-» zone, and a full-fledged reverse signal has already formed on the chart, then the previous transaction is closed at the current price.

9) If the price is in the «+» zone, and a reverse signal has formed on the chart, then the previous transaction is transferred to the breakeven point.

10) If the body of the signal candle turned out to be more than 80 points, then such a signal is simply ignored.

11) A second sell signal can be considered if the previous transaction has already been moved to the breakeven point, that is, to zero.

12) 2 hours before the end of the trading week (on Friday), signals are no longer perceived and we do not trade them!

Video version of the forex strategy «TSS Filter»:

- Recommended to watch with English subtitles!

- Download indicators in the archive — TSS_Filter_indicators.

- Download the MT4 template — tss_filter_tpl (also in the archive).

- Forex strategy test «TSS Filter»: +708.29% for GBP/USD for 12 months ➜