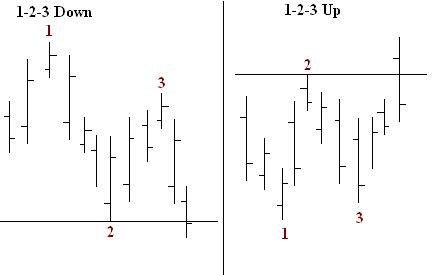

1-2-3 pattern — fairly common reversal formation on the forex market, which is more likely to conclude a profitable transaction and, therefore, often used most part of forex traders to enter the market and out of it, is found in all timeframes and all currency pairs, including number and the futures market.

This pattern, in spite of its simplicity, allows the trader to find a surprisingly precise levels to enter the market and exit from it.

Examples 1-2-3 pattern, you can see in the picture below (1-2-3 Down — pattern, aimed down and 1-2-3 Up — ascending pattern):

Basic rules for transactions on the 1-2-3 pattern:

1) after the formation of points 1, 2 and 3 — set a pending order Buy Stop above (for sale) or a Sell stop — below (for sale) points 2. Preference should be given to patterns, where the point 3, is located at a distance from 23,6% to 50% (maximum 61.8%) on Fibonacci deferred from point 1 to point 2.

2) Stop-loss order is placed over the point 1. As prices move in the direction of the transaction, stop-loss can be moved to point 3. It is possible, and initially put the stop loss at point 3, if Point 3 pushed off of 50% or 61,8% of Fibonacci between 1-2.

3) The minimum take-profit is equal to the distance 1 — 2, pending in the direction of price movement from point 3. Maximum take-profit can be calculated using the Fibonacci extension. Ie it may be equal to the distance 1.68 from 1-2, a distance of 2 and 2.68, etc.

Alternatively, you can conclude, for example, 2-3 of the transaction equal to the lot and fix the take-profit at a distance of 1 from 1-2, 1.68 1-2, and 2.68 from 1-2. At the same time when profit-taking on the minimum goal, the rest of the transaction can be moved to breakeven and wait for further developments (if you wish, you can use trailing stops), if the price moves further — we fix the following take-profit, not moving — will be triggered stop-loss to breakeven.

Example see in Figure 1:

For more aggressive traders, the entrance to the market can be implemented on breakdown of the trend line, after the formation of point 3 — Figure 2:

Figure 3 — Example of fixation TP Extensions Fibonacci:

where, Sell 1, and Sell 2 — possible entry points into the market for sale, TP 1, TP2, TP3 — possible profit-taking on the pattern 1-2-3.

![Pattern 1-2-3 [Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/4f/b24ab3cea92354f_320x200.png)