The essence of forex strategy «Break of range» is reduced to finding a market that is in the flat, narrow ranges of price fluctuations and the disposition of pending orders on both sides (Buy Stop and Sell Stop). In this case, the market will determine when and what kind of a pending order to activate it.

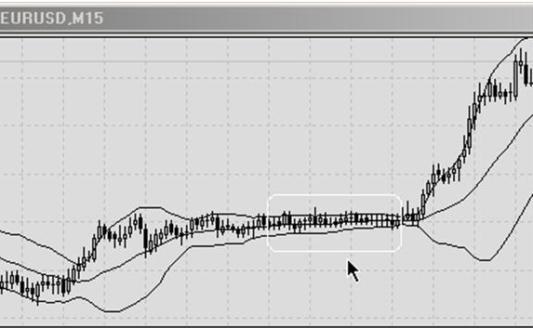

Stop-loss orders must be placed on the opposite side of the consolidation channel for each order. The best indicator for determining the appropriate market to us and points allocation pending orders are Bollinger Bands (Bollinger Bands). If a specific timetable for the consolidation channel has at least a small slope, Bollinger bands diverge, if the market price fluctuations slow down, bands Bollinger converge. Ideal in our case for the deal would be a situation where the bands are parallel (see Fig. 1).

Figure 1. Job indicator forex Bollinger Bands to determine entry points.

Although determine the ideal parallel horizontal channels is not always possible, but if you scroll down the price chart with this indicator in the story — you can easily identify all areas that are suitable for entry into the market.

Very carefully and slowly look at a few currency pairs, it can spend on a day or, if need be (I personally have both earned their first money in forex, when spent some days trying to find patterns in the market — and I found them in the end got my first strategy forex «Flag ABC» and as a result — my first profitable trades …) and you’ll easily identify such price channels on the eye. However, remember that these quiet areas happen, after all, not very often — even in a flat market forex market a little storm. In this case, simply go to the next more senior time range — as largely between the price chart, namely, the parallel bars!

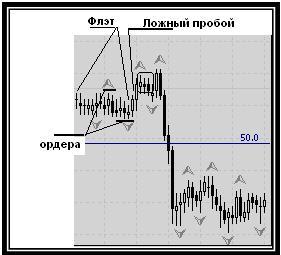

Figure 2. The strategy of entering the market from a flat market.

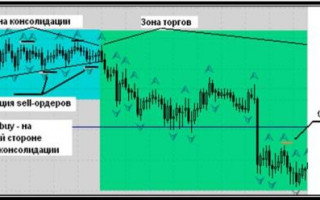

In addition, with this method of entry into the market and the small size of the trading account, you need to move the stop loss at the opening price a bargain at once — as soon as it enables you to make the market (for this very good fit trailing stop on a trip), t . k. sometimes false breakdowns fletovogo price channel, as you can see in Fig. 3.

Figure 3. Market enables us to deliver a deal to breakeven — this should take.

Re-entry into the market in the opposite direction can be run from the 2 nd of a pending order, but it can and move to the next fractal on the right. About this indicates the possibility of re-formed flat, which immediately began after the breakdown — it is marked in the figure frame.

Take-profit is better not to, and trail position and if possible, close the position often.