Forex Strategy for 3-EMA + Bollinger works well in any currency pair, for the transaction must first investigate the 2 time intervals: 30 min + 5 min, and then make a decision on the opening of trading positions.

Set the following schedule for the selected indicators Forex (all of them are present in the trading terminal Metatrader 4):

- Exponential Moving Average EMA with a period of 14

- Moving Average EMA with a period of 21

- Exponential Moving Average EMA with a period of 50

- an indicator Bollinger Bands with the parameters (20, 2)

-

I recommend to select the trade center Dealing with Forex trading terminal Metatrader 4.

Terms of the transaction on the forex strategy at the 3-EMA + Bollinger Bands (must be met all the conditions):

1) Open 5 minute schedule and conduct an analysis of the schedule:

5 minute price schedule when directed upwards trend: moving averages EMA 14 EMA 21 above average, and moving averages 14 EMA and 21 EMA 50 EMA above average, and if the exponential moving average, 50 EMA is located inside the tape Bollinger.

2) When these conditions are met, go to 30-minute price schedule.

And if it is moving average EMA 14 EMA 21 above average, and average 14 EMA and 21 EMA moving average above 50 EMA and 50 EMA is located inside the tape Bollinger.

Only then will need to open a position on the purchase of Trade.

To conclude the trading position for the sale should be that all the conditions accurate to the contrary.

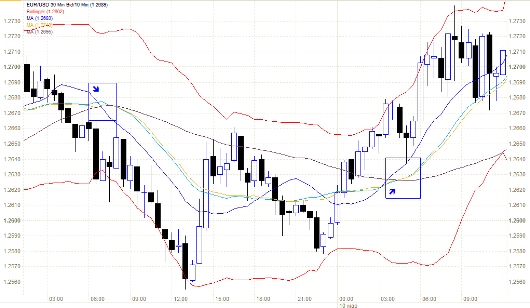

Example in the picture

I recommend to use this strategy forex trailing stop (trailing size depends on the chosen currency pair and the volatility in the market).

Closing trading position as soon as any of the conditions is violated, or as soon as the profit is high, to close the deal (can also cover parts of profit).