Forex Strategy «Pivot Candle» is based on candlestick patterns — «Hammer» and the levels of support and resistance prices (reference levels) — pivot;

1) Pattern «Hammer»

And so an ideal pattern «hammer» can be identified by the following characteristics:

1. The tail of the candle (the lower or upper shadow), at least 2 times should be longer than the body of the candle and the top of her shadow.

2. «The Hammer» is at an important level of support or resistance.

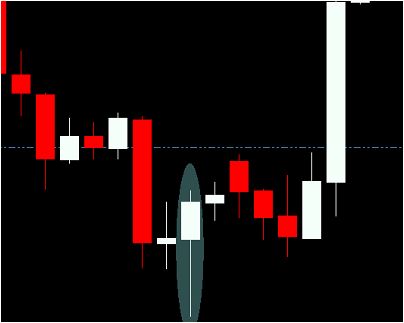

The picture shows an example of «hammer»:

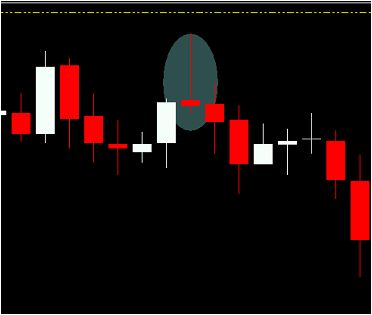

The figure below — an example of «inverted hammer»:

2) pivot (reference levels):

Reference level usually work as a magnet for the price of the financial markets. Price is often slows their movement or stop altogether to the «reference levels» before they resume their further movement.

Daily reference rates are calculated on the closing prices of the previous trading day on the following formula:

The central reference level (pivot points) — (P) = (High + Low + Close) / 3

Resistance № 1 — (R1) = 2xP — Low

№ 2 — (R2) = P + (R1 — S1)

№ 3 — (R3) = High + 2x (P — Low)

The level of support № 1 — (S1) = 2xP — High

№ 2 — (S2) = P — (R1 — S1)

№ 3 — (S3) = Low — 2x (High — P)

For the weekly levels of support — all the same, just need the prices of the previous trading week, instead of the previous trading day.

But for convenience, we will not expect imazetapir-levels according to the formula, and ready to use indicators forex (which you can download at the end of the strategy forex).

Trading Signals enter and exit forex strategy «Pivot Candle»

- This strategy is used to trade in ranges: M15 and H4.

At 15-minute interval should be used daily pivot points (Pivot point). A 4-hour intervals, use one weekly pivot points.

Entering the market strategy forex Pivot Candle:

To enter the market to BUY must be fulfilled 3 conditions:

1) Price is above the exponential moving average EMA (20), and she in turn has broken up EMA (50).

2) Price has broken any of these pivot points-levels: S1, S2, S3, P, R1, R2 or R3 and returned again to him the same.

3) was formed a hammer ( «hammer» is already closed).

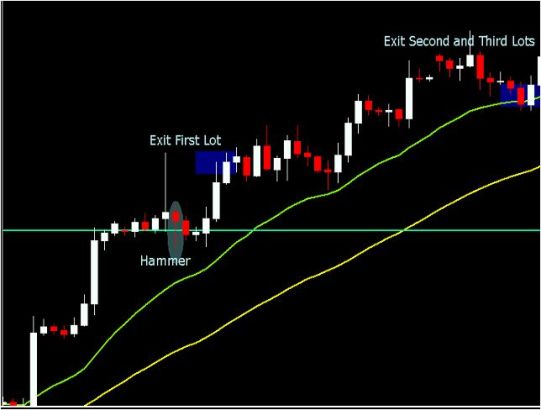

In the example below, the option of the interval H4 (with a weekly pivot):

If all conditions have been met — we are opening a trading position to Buy at the market price of 3 lot (or respectively 0,3 or 0,03 — for micro-billing or Cent accounts forex — Alpari, E-global).

A safety stop-loss should be placed on 10-20 points below the minimum (tail) formed «hammer» or under the EMA (20) + (5-10 points).

Trading signals out of the market:

1) Close one lot trading position (or 1 / 3 of the open position) as soon as the price goes toward the open position a distance equal to the value set by stop-loss.

2) For the remaining 2 lots a safety stop-loss move the middle under the EMA (20) + (5 or 10) points as we move up the closing price on the trading position of stop-loss in the positive area.

For transactions on SELL — the opposite rule.

The example can be seen where there was a closed 1 st lot:

Closure of the remaining 2 open lots.

- Download forex indicator for Metatrader 4 — PivotWeekly.mq4 (used at intervals up to W1)

- Download forex indicator for Metatrader 4 — PivotDay.mq4 (used only for intervals up to H1)