Forex Gambit strategy was developed by the American chess player Walter T. Downes and is quite widespread among traders. This strategy, in principle, is quite simple and logical, the entry is carried out in the direction of the main trend at the moment the correction is completed. The disadvantage of this strategy is a small number of signals even for the daily chart, although for some this may be a solution to the problem of lack of time.

Some statistics:

In 2016, there were only 12 transactions for 5 pairs. The profit amounted to a little more than +1000 points (for 4-digit quotes), but it can be increased, since this strategy is multi-currency.

- Time interval — D1.

- Currency pair — any, multi-currency trading system.

Indicators:

- Bollinger Bands with a period of 30 and a deviation of 1.

- Bollinger Bands with a period of 30 and a deviation of 2.

Conditions for purchases using the «Forex Gambit» strategy:

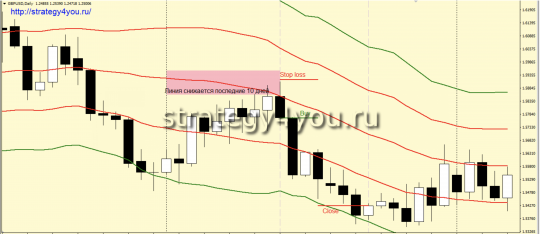

1) Inside the upward movement, there is a rollback to the central line of the Bollinger Bands indicator.

2) The next candle must meet the following conditions:

— the minimum price of the candle must be lower than the minimum of the previous candle.

— the maximum price of the candle must be lower than the maximum of the previous candle.

— the closing price of the candle should be above the central line of the Bollinger Bands and below the upper line of the Bollinger Bands indicator with a deviation of 1.

— The closing price of the candle must be above the middle of the trading range (from high to low) of the previous candle.

3) If all these conditions are met, then at the opening of the next candle a buy deal is concluded.

4) Stop loss a few pips below the low of the signal candle.

5) If at the close of the second candle after the entry the price is in the negative zone, then the deal should be closed at the market price.

4) 3 days after the entry, the transaction is transferred to breakeven.

5) The deal is closed when the price, having reached the upper line of the Bollinger Bands indicator with a deviation of 2, draws the first black candle.

Sales conditions:

1) Inside the downward movement, there is a rollback to the central line of the Bollinger Bands indicator.

2) The next candle must meet the following conditions:

— the maximum price of the candle must be higher than the maximum of the previous candle.

— the minimum price of the candle must be higher than the minimum of the previous candle.

— the closing price of the candle should be below the central line of the Bollinger Bands and above the upper line of the Bollinger Bands indicator with a deviation of 1.

— the closing price of the candle should be below the middle of the trading range (from high to low) of the previous candle.

3) If the conditions are met, then a sell trade is made at the opening of the next candle.

4) A safety stop loss should be set a few pips above the high of the signal candle.

5) If at the close of the second after the entry of the daily candle the price is in the negative zone, then the deal should be closed at the current market price.

6) 3 days after the entry, the transaction in any case is transferred to the breakeven level.

7) The deal is closed if the price, having reached the lower line of the Bollinger Bands indicator with a deviation of 2, draws the first black candle.

Video version of the Forex Gambit strategy:

- Download MT4 template — forex_gambit (archived)

- I do not attach indicators, as they will be installed automatically after the template is installed on the chart of the selected pair.

- Strategy test: +125,07% ⇒