The Forex & Crypto strategy «Absorption and rollback» can be attributed to graphical strategies, since it uses the «Absorption» candlestick pattern and the principle of returning the price to the previous candle for its retest, from which we will make a deal, but in more detail — in the description below:

As you know, the “engulfing” candlestick pattern very often turns out to be a reversal point, or at least signals the beginning of a corrective movement. However, the entry point at the end of the model formation (closing of the engulfing candle) is far from always profitable and safe, and the lack of clearly defined target levels and rules does not allow this pattern to be used in system trading as a separate and independent signal.

At the same time, the engulfing pattern is a very strong signal and it is not acceptable to miss such a trading opportunity. This publication describes a trading strategy based on this model with some additional rules that have been formed as a result of long-term observation and analysis.

At its core, this strategy is multi-currency, but still, trading on cross-rates using it was not always justified.

- Recommended currency pairs are GBP/USD, USD/JPY, it also performed well on EUR/USD.

- The recommended time interval, as with other candlestick patterns, is daily (D1).

Conditions for buying on the forex strategy «Absorption and rollback»:

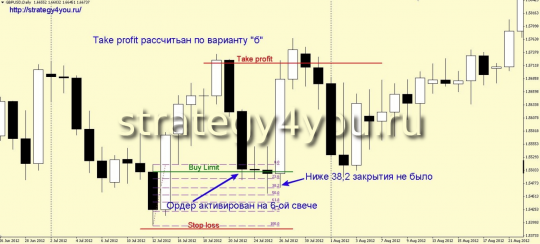

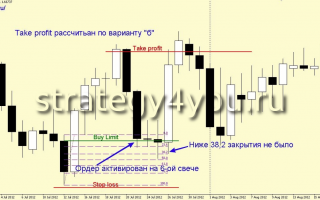

1) Entry into the market is carried out using a pending Buy Limit order.

2) As soon as we notice on a downward movement that the next black candle is completely absorbed by one white candle, we place a Buy Limit order at the opening level of the last black candle.

3) Stop-loss is set under the last received minimum.

4) Take Profit:

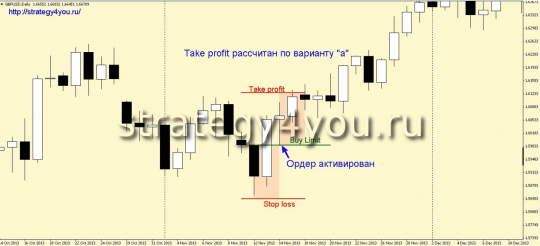

a) If the Buy Limit order is activated already on the next candle and the distance to the last high is not very large, then the first target can be calculated in the size of the stop loss.

b) If the order is activated in a few days (candles) and the resulting distance to the last high suits us, it is at the census of this maximum that we set the Take Profit. This level is the main and primary target point.

If desired, you can fix only part of the deal at the first level, while the rest of the deal can be fixed by fibonacci extensions, stretched by the last corrective movement.

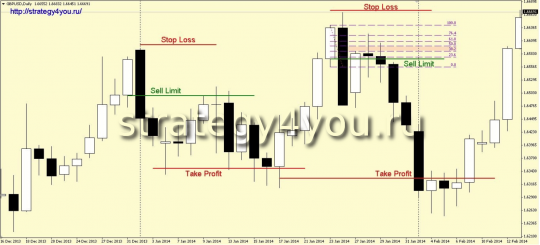

Conditions for selling by strategy:

1) Entry into the market is carried out using a pending Sell Limit order.

2) As soon as we notice on an upward movement that the next white candle is completely absorbed by one black candle, we place a Sell Limit order at the opening level of the last white candle.

3) Stop-loss is set above the last received maximum.

4) Take Profit:

a) If the Sell Limit order is activated already on the next candle and the distance to the last low is not very large, then the first target can be calculated in the size of the stop loss.

b) If the order is activated in a few days (candles) and the resulting distance to the last low suits us, it is at the census of this low that we set the Take Profit. This level is the main and primary target point.

If desired, you can fix only part of the deal at the first level, while the rest of the deal can be fixed by fibonacci extensions, stretched by the last corrective movement.

Important additions to the strategy:

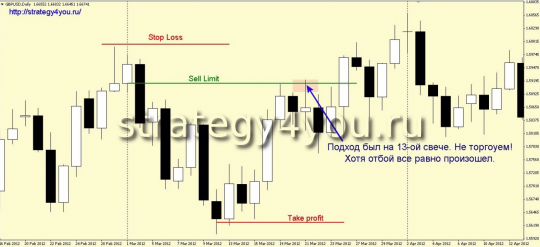

1) An unactivated order should be held for 7 to 10 days (candles) from the moment of installation. Although, if the first approach to the entry point occurs at later stages, this level continues to influence price movements, but still there are less chances for a full-fledged development of targets.

2) If our order is activated, but the price does not reverse and the next candle closes above/below the 38.2% fibonacci level extended by the absorbed candle (for purchases, this is the last black candle), we should consider exiting the market with minimal losses.

3) To determine the directional movement, the reversal of which we will expect, ideally, the last three candles should be in line with the trend. That is, for a downward movement, there are three black candles before the white engulfing candle.

4) The absorbed candle should not have a reversal shape like doji and similar models, it is better that the movement before the absorption is confident and systematic.

5) If the closing price of the engulfing candlestick is almost equal to the opening price of the engulfed candlestick, then it is better not to use such an entry point. In this case, you can wait until the price goes a sufficient distance and only then place an order. And from a security point of view, it is generally better to ignore such points.

6) After passing a distance equal to the stop loss in the positive zone, the order should be transferred to the breakeven level. In most cases, this can be done earlier, but it’s up to you.

According to this strategy, it was noticed that almost twice as many sell signals are obtained, and they work out better.

A couple more examples:

Example 1:

And example 2:

There are no MT4 templates and indicators for the strategy, that’s why I don’t attach them.

Video 1:

Video 2 — PPR pattern: