The forex “Explosion” strategy is not a new trading system at all, we have already considered several similar breakout strategies on this site, one of the first published here is the 4-7 GMT Breakout forex strategy, but so far this type of trading systems have entered the market after the breakdown of the «box» allows you to make a profit with good discipline, which indicates its stability.

The breakdown of a price level or a range or a “box” quite often gives a chance to make good money, but the whole problem is in accurately determining these levels and entry points.

Some statistics:

In 2014, the strategy made it possible to earn about 1450 points on a four-figure broker. Only one month was closed with a minus, although it was purely symbolic — 10 points. Like most breakout strategies, the burst strategy is very easy to use.

- Currency pair — GBP/JPY

- It is convenient to track on a 15-minute chart.

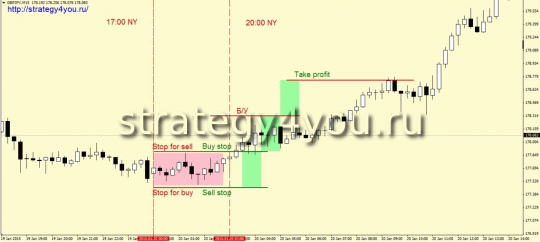

In the strategy, we will use the term «box» — this is a price range limited by 2 horizontal and 2 vertical lines, and this is how they should be built:

Vertical: this is the time period from the close of the US market to the opening of the Asian market — this is from 17:00 to 20:00 New York time (it is currently 00.00 — 3.00 Alpari, or RoboForex).

Horizontal: maximum and minimum values for this period of time (by tails of candles).

Options for concluding transactions according to the Explosion strategy:

An example of a triggered buy order:

1) After the “box” is formed, a “buy stop” order is placed three points above the high, and a “sell stop” order is placed three points below the low.

2) Stop loss for both orders is set behind the opposite side of this price range.

3) When passing a distance in the positive zone in the amount of the same price range, the transaction should be transferred to breakeven.

4) Profit is fixed at a distance equal to two sizes of the price range, on the breakdown of which we entered the market.

It is also possible to split the profit into 2 parts:

— closing Take Profit 1 at the distance of the first box + rearranging the deal to zero.

— closing Take Profit 2 — the remainder of the transaction at a distance of the second box.

We get a stop loss 2 times less than profit, therefore, the rules of Money Management are fulfilled with us!

An example of a triggered sell order:

Additions and filters to the forex strategy «Explosion»:

1) After triggering one of the orders, the opposite order should be deleted! (For those who like to increase rates in the opposite direction! The price only in one of three cases, after the stop order is triggered, continues to move. In other cases, the price goes into sideways movement.)

2) If none of the orders was activated within three hours after placing (from 20:00 to 23:00 New York time), then both orders should be deleted.

3) If the price range is more than 100 points, then nothing should be done on this day.

4) If at the beginning of the next time period (17:00 New York time) the deal is in the positive zone, then it should be transferred to breakeven in any case. If the price at that time is in the negative zone, then the deal should be closed at the market price. It is also worth paying attention to another topic.

5) You can also place a trade on a trailing stop in the amount equal to the stop loss. However, this method was not applied during testing.

6) If the range is less than 20 points (for 4 digits), then there is no trading on that day.

![EXPLOSION [Forex Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/c2/0520ab5417533c2_320x200.png)