The EvgEna Simple Forex Strategy is one of the simplest trading systems that does not use indicators at all. Also, this trading system does not require graphical tools, the strategy does not particularly depend on the direction of the trend, although the probability of making a profit in a trend is still much higher.

Some statistics:

From January 2017 to January 2018, the strategy showed a result of +2300 points (by 4 digits). There were no unprofitable months during this time. There was a month with a zero result.

- Currency pair EUR/JPY.

- Time interval H1.

- Indicators are not required.

At the close of D1 candles, breakout orders should be placed on both sides of this day. When one order is activated, the second one is not deleted. See below for details.

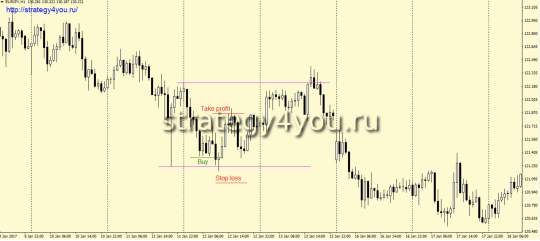

Conditions for buying according to the Simple forex strategy «Evgena»:

1st login method.

1) For the maximum of the closed day, a Buy Stop order is set a couple of points higher.

2) Stop loss 35 points.

3) After passing 30 points in the positive zone, the transaction is transferred to breakeven.

4) Take profit is 60 pips.

5) If at least one candlestick closes above the high of the previous day, then if it returns below the same level and receives from it a candlestick with a small body and a long host on top (a bounce candlestick), the trade is closed at the current price.

6) If at the close of the day the transaction is in the negative zone, then it is closed at the market price.

7) If at the close of the day the transaction is in the positive zone, then it should be transferred to breakeven.

2nd login method.

1) If the price tried to break below the level of the previous day’s low, but still closed above the breakout candle, and the closing price of this candle did not move from the level of more than 10 points, then a buy deal is concluded at the close of this candle. It is important that not a single candle before this closes below the level.

2) If the above candle first activated a sell order, then at its close and before the purchase itself, the previous sale should be closed at the current price.

3) Stop loss is 30 points.

4) After passing 30 points in the positive zone, the transaction is transferred to breakeven.

5) Take profit is 50 pips.

6) If the price still goes down and forms a candle that will test the level from below (pull down candle), then the deal should be closed at the current price.

7) If at the close of the day the transaction is in the negative zone, then it is closed at the market price.

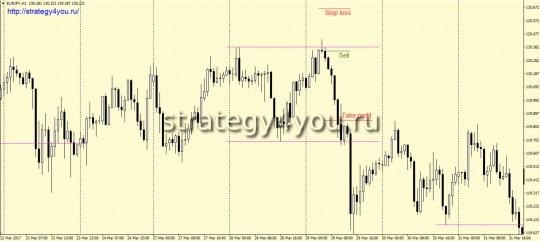

Sales conditions:

1st sell entry method.

1) For the minimum of the closed day, a pending Sell Stop order is set a couple of points lower.

2) Stop loss safety order is equal to 35 points.

3) After the price passes 30 points in the «+» zone, the transaction is transferred to the breakeven point.

4) Profit-taking order — take profit is equal to 60 points.

5) If at least 1 candlestick closes below the high of the previous trading day, then in case of a return above the same level and receiving from it a candlestick with a small body and a long tail from below (a bounce candlestick), the deal is closed at the current market price.

6) If at the close of the trading day the transaction is in the «-» zone, then it is closed at the market price.

7) If at the close of the day the transaction is in the «+» zone, then it should be transferred to the breakeven point, that is, to zero.

2nd method of entry to sell.

1) If the price tried to break above the level of the previous day’s high, but still closed below the breakout candle, and the closing price of this candle did not leave the level of more than 10 points (for 4-digit quotes), then a deal is concluded at the close of this candle for sale. It is important that not a single candle before this closes above the educated level.

2) If the above candle first activated a buy order, then at its close and before the sale itself, the previous purchase should be closed at the current market price.

3) Stop loss order for the trade is 30 pips.

4) After passing +30 points, the transaction is transferred to the point of opening the transaction.

5) To fix the profit, we set a Take Profit order, which is equal to 50 points.

6) If the price still goes up and forms a candle that will test the level from above (a bounce candle up), then the deal should be closed at the current price.

7) If at the close of the day the transaction is in the «-» zone, then it is closed at the market price.

Video version of the Evgena forex strategy:

- Recommended to watch with English subtitles!

- I do not attach indicators and templates, as they are not needed.

- Strategy test: +438.34% for 12 months — HERE >>

![EvgEna [Simple Forex Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/79/0a7895c66e93d79_320x200.png)