Forex strategy «Indy» is a fairly active trading system, related to scalping. The strategy is not at all complicated, but you still need to understand that it is suitable only for traders with the ability to constantly monitor charts.

Statistics:

From May 2021 to November 2021 (6 months), the strategy with a risk per trade of 2% showed a positive result of +170%. The maximum drawdown during this time was 12%.

- Time interval — m15.

- Trading is conducted from 8:00 to 21:00 terminal time.

- Currency pair — EUR/USD.

Indicators:

Exponential moving average with a period of 10 — EMA10.

MTF Moving Average indicator with a period of 10, time frame 60 minutes.

Indicator Color RSI v1.01 with a period of 3.

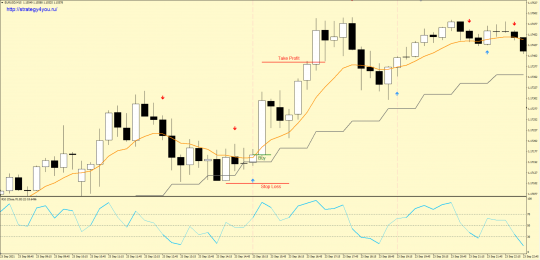

Conditions for buying using the scalping strategy «Indy»:

1) The price on the M15 chart is above the MTF Moving Average indicator.

2) Moving average with a period of 10 is above the MTF Moving Average indicator.

3) The next candle after a rebound or exit above the moving average, closes above it and with a white body (often a blue arrow helps to identify this candle, but sometimes it does not appear).

4) The Color RSI v1.01 indicator has come out from under level 30 and is above level 50. Level 70 has not yet been reached.

5) At the close of the next candle, a buy deal is concluded.

6) Stop loss is set below the last low, but not less than 4 points.

7) If the estimated stop is more than 15 points, then the deal is not concluded.

8 ) After passing a distance equal to the size of the stop in the positive zone, the transaction is transferred to breakeven.

9) Take profit is equal to three stop loss order sizes.

10) At 21:00 all active transactions are closed at the market price.

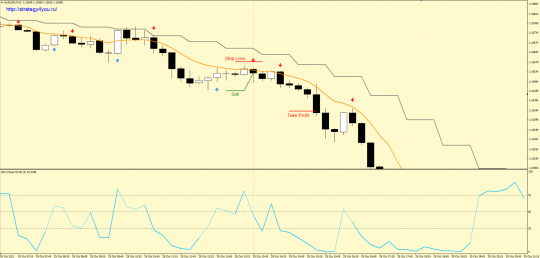

Conditions for sales according to the rules of the Indi trading system:

1) The price is below the MTF Moving Average indicator.

2) EMA10 (orange) is below the MTF Moving Average indicator.

3) The next candle after a rebound or exit below the moving average closes below it and has a black body (the red arrow on the chart often helps to identify this candle, but sometimes it does not appear and this must be taken into account).

4) The Color RSI v1.01 indicator went below its level 70 and is below level 50. But level 30 has not yet been reached.

5) At the close of the next candle, after all the conditions are met, a sell deal is made.

6) A safety order — stop loss, is set above the last maximum, but it must be at least 4 points.

7) If the estimated stop-loss is more than 15 points, then the deal is not concluded at all.

8 ) After the price in the «+» zone passes a distance equal to the size of the stop loss, the transaction is transferred to the breakeven point.

9) We fix the take profit at a distance equal to 3 sizes of the set stop loss order.

10) At 21:00 all active trades are closed at the current market price.

Video version of the Forex strategy «Indy»:

- Recommended to watch with English subtitles!

- Download indicators for MetaTrader 4 — indi_indicators (archived).

- Download the MT4 template — indi_tpl (also in the archive).

- Test for 6 months: +428.74% — here ➜