Forex Strategy Day Open Fibo — very simple but very profitable trading strategy for the currency pair GBPUSD another highly volatile pair, it is based on using the opening prices of the trading day and on static Fibonacci numbers: 34, 89, 144, 233.

Explain the essence of strategy Forex Day Open Fibo an example:

Suppose that the opening day of the pair GBPUSD 1.6447

To determine the critical levels are calculated by static Fibonacci numbers — these numbers will add and subtract them from the price of the market opening that day:

We obtain the following levels:

- HL1 = 1.6447 0.0034 = 1.6481

- HL2 = 1.6447 0.0089 = 1.6536

- HL3 = 1.6447 0.0144 = 1.6591

- HL4 = 1.6447 0.0233 = 1.6680

- HL5 = 1.6447 — 0.0034 = 1.6413

- HL6 = 1.6447 — 0.0089 = 1.6358

- HL7 = 1.6447 — 0.0144 = 1.6303

- HL8 = 1.6447 — 0.0233 = 1.6214

Forex Indicator DayOpenFib.mq4, calculated and drawing these levels on a chart, you must apply to the chart 2 times:

For the first time set the up = true (building levels above the opening price)

The second time — up = false (building levels below the opening price).

Ease of installation can download the template for the Metatrader 4 forex strategy together with the indicator at the end of the strategy.

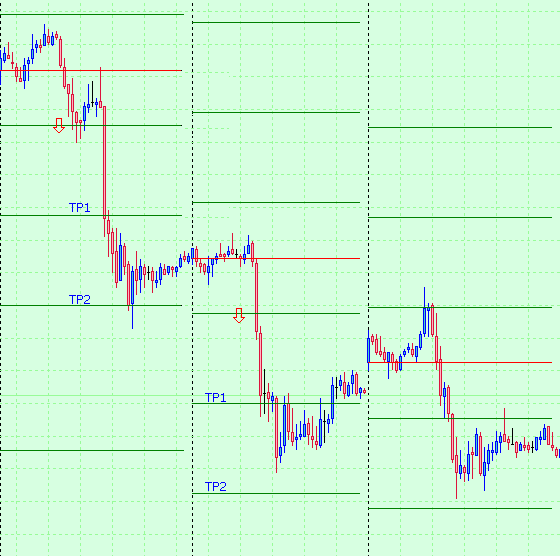

To enter the market, you need to install 3 pending orders to buy and 3 pending sell orders, after the discovery of new trading day:

1) Install 3 orders Buy Stop equal lots at the level of HL1, safety stop-loss place on the level of the opening of the trading day (red line).

Profit target following: TP1 = HL2, TP2 = HL3, TP3 = HL4.

2) Set 3 Order Sell Stop at HL5, a safety stop-loss place on the level of the opening of the trading day (red line).

Profit target following: TP1 = HL6, TP2 = HL7, TP3 = HL8.

3) If the first triggered Pending Buy Stop order has 2 options:

a) transfer the Sell Stop order on the level of the opening of the trading day, and the levels of profit and stop-loss shifted to one SL = HL1, TP1 = HL5, TP2 = HL6, TP3 = HL7. The converse is true for the case when first worked Sell Stop Order.

Once achieved the goal of profit TP1, resets the remaining 2 warrants to breakeven. Once achieved the goal TP2 — reposition the stop-loss order at TP1.

b) transfer the Sell Stop order on the level of the opening of the trading day, and stop-loss SL = HL1. A 3 profit targets portable to the first level of profit, ie TP1 = TP2 = TP3 = HL5

Additional conditions:

- Upon request, at operation the first pending order for the day — set a trailing stop at 3 orders magnitude of 40-45 points.

- Did not work warrants are removed at the end of the trading day.

- If at the end of the day were not closed by order — they should be close to market price.

Based on their test last month — September 2009 (1 to 18 the number of inclusive) profit is:

- case «a)» — about 1400 pips! — A more risky way to trade.

- case ‘b) — more than 1200 pips! — A more conservative way to trade.

- Download forex indicator for Metatrader 4 — DayOpenFib.mq4

- Download a template for Metatrader 4 — day open fibo.tpl