The Forex & Crypto Strategy «Absorption with Confirmation» is based on the «absorption» candlestick pattern, which is well known among traders as a strong enough signal to reverse or at least start correcting for the last movement, this model is the foundation of all candlestick analysis, and the basic rules for its application are described in many books on the subject.

However, the classical rules do not provide enough data for system trading, for this reason, some traders make their own additional conditions for themselves, such as: model ideality, exact entry point, stop order size, profit-taking level.

On this site, we have already considered the “absorption and rollback” strategy (based on this model), today we will analyze another equally effective strategy, where the “absorption” model plays a key role. If in the first strategy we entered the market using pending orders, which often carries an additional psychological burden, and this has a very negative effect on novice traders, then when trading using this strategy — “Absorption with confirmation”, orders are opened at the market price in case fulfillment of the conditions.

- Time interval — the strategy works starting from the hourly chart, but still the main interval is daily.

- Currency pair — any.

- The percentage of “failures” for working out the strategy is only 12%.

At the beginning, we will describe the ideal conditions for entry, and at the end we will indicate some possible deviations.

Conditions for BUY under the Forex Strategy «Absorption with confirmation»:

1) At the minimum of the downward movement, an “absorption” candlestick pattern is formed, then the network of the last white candle absorbed the previous black candle with its body.

2) After that, we wait for confirmation of purchases in the form of an explicit rebound candle (doji or a candle close to it) with a tail from below, or another engulfing model in the same direction. Under no circumstances should the low of the first engulfing pattern be rewritten, it is even better for the price to be as far away from it as possible.

3) At the opening of the next candle, open a buy deal.

4) Stop-loss below the low of the confirmation candle/second engulfing pattern.

5) There are two ways to fix profit:

A) the size of the first engulfing pattern plotted from the entry point.

B) according to option “a”, only part of the transaction is fixed, and the rest is fixed when a reverse candle signal appears.

6) If the next candle after the entry knocks out a stop loss, but it also closes with a long tail from below, then you should re-enter in the same direction already at the close of this candle.

Conditions for SELL by strategy:

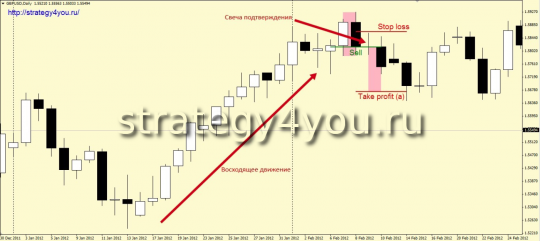

1) At the maximum of the upward movement, the “absorption” candlestick pattern is formed, then the network of the last black candlestick absorbed the previous white candlestick with its body.

2) After that, we wait for confirmation of sales in the form of an explicit rebound candle (doji or a candle close to it) with a tail on top, or another engulfing model in the same direction. The maximum of the first engulfing pattern should not be rewritten in any case, it is even better for the price to be as far away from it as possible.

3) At the opening of the next candle, open a sell trade.

4) Sop-loss above the high of the confirmation candle/second engulfing pattern.

5) There are two ways to fix profit:

A) the size of the first engulfing pattern, plotted from the entry point.

B) according to option “a”, only part of the transaction is fixed, and the rest is fixed when a reverse candle signal appears.

6) If the next candle after the entry knocks out a stop loss, but it also closes with a long tail on top, then you should re-enter in the same direction already at the close of this candle.

Additions and possible deviations under the terms of the forex strategy:

1) In some cases, an entry is possible not only when an “engulfing” pattern is formed at the maximum/minimum of the trend, but also when this pattern appears at the end of the correction.

2) It is also possible to enter on the basis of this model formed not at the very maximum, but after the start of the reversal.

In the figure below, at the first entry, the order was closed by stop and, according to the conditions, after the appearance of the second bounce candle, another order was opened in the same direction, which reached the goal.

An engulfing pattern was formed on the reversal. A confirming signal was also formed, but it did not satisfy the MM rules, since the stop was larger than the profit. The deal was ignored. Further, since the formation of an “absorption” model is allowed a little later than the reversal itself, the second model was perceived as a separate signal from the first one. Therefore, it was necessary to wait for the appearance of a confirming candle. After its formation, the market was entered.

I do not attach templates and indicators, as they are not used in this strategy.