Price Action PPR Pattern trading strategy [Signals, Formation, Trade Examples] — today we will look at another Price Action pattern — PPR.

This is a fairly simple but strong signal for making a deal in any market: forex, cryptocurrency market, stock market. It tells us that the trend may change after its formation.

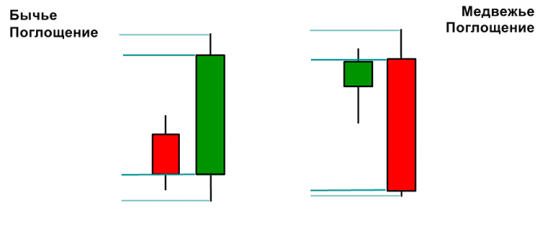

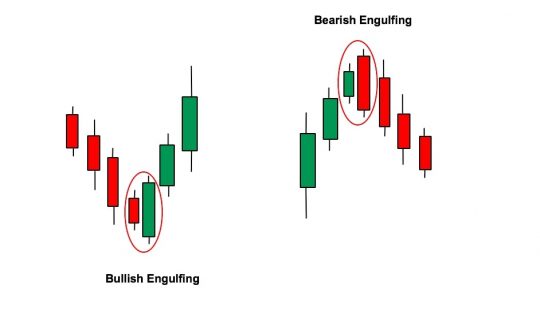

We have already considered similar models on this site, but they were simply called a little differently and were considered on the absorption model, here they are:

and although these are slightly different models, they are still very similar and the principle of trading is the same.

What is PPR?

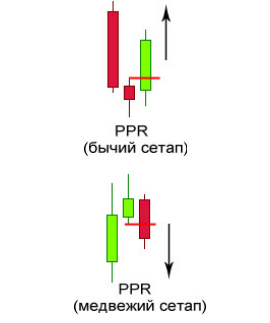

Pivot Point Reversal (PPR) is a pattern that usually forms at the moment of trend reversal in financial markets, as well as at the end of corrective movements on the charts of any financial instruments. The model consists of 3 candles (see the example below):

The deal is opened after the close of the 3rd candle of the pattern.

But there are 2 trading options:

1) Open a trade immediately after the candle closes.

2) Open a trade on a limit order, which we put a little higher (for sales) / lower (for purchases) APPROXIMATELY by the spread from the 2nd candle. And as for me, this is the best entry option, it’s even better to skip the deal, but enter with minimal risk on the limit, than trading the 1st option.

Stop and Profit:

1) Stop loss — above (for purchases) the high of the 2nd candle or below the 2nd for sales (this is the best option).

2) Profit — there are options:

- 1 to 2 or 1 to 3 in relation to the stop loss.

- On important levels (1st and 2nd profit).

- We expose on Fibnacci from the last movement.

- Other methods are channels, trend lines, Fibo extensions, etc.

For more detailed examples, see the screenshots below and in the video (at the end of the article).

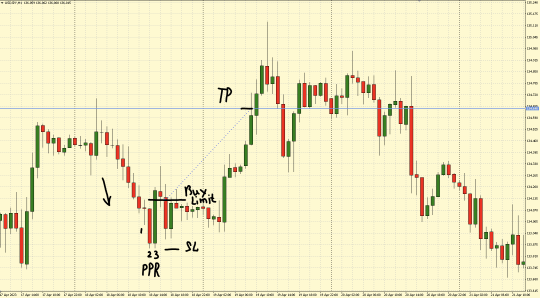

Buy trade — USDJPY (H1):

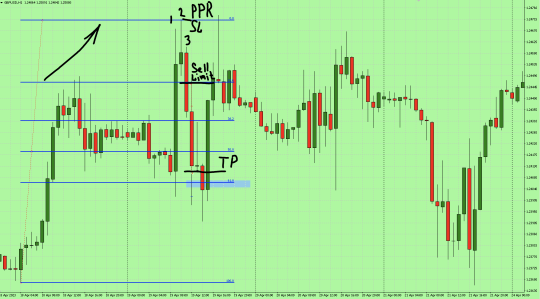

Sell trade — GBPUSD (H1):

Difference between PPR and Absorption:

In absorption, we need both the shadows and the body of the candle to be absorbed, but in PPR this condition is not necessary!

The main thing in PPR is closing below / above candle 2:

Sometimes PPR is formed:

- With a pin bar.

- With a release from an important level.

- Then this signal is considered better for entering the market!

That’s all I wanted to tell you about the PPR Pattern, then I attach examples of trading in the video:

- Example 0

- Example 1

- Example 2

- Example 3

- Example 4

- Example 5

- Example 6

![Price Action PPR Pattern trading strategy [Signals, Formation, Trade Examples]](https://strategy4forex.com/wp-content/cache/thumb/df/f9f46f1d2bba0df_320x200.png)