PIN BAR + INSIDE BAR = Combination of patterns [New Signal Price Action — Forex & Crypto Trading Strategy].

A pin bar is a pattern that shows price deviation and indicates a likely potential price reversal on the chart.

An inside bar is a pattern that shows price consolidation in the market and an imminent potential breakout in the near future.

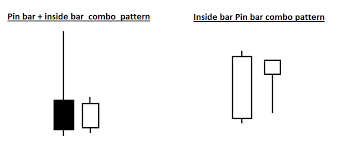

When these 2 signals are combined, we get the result either as a pin bar and inside bar combo pattern or as an inside bar and pin bar combo pattern.

And this means that there can be 2 types of «combined templates»:

- Pin bar + inside bar

- Inside bar + Pin bar

Pin bar + Inside bar is a pin bar followed by an inside bar towards the nose of the pin bar (i.e. towards the real body

pin-bar), which is also an inside bar.

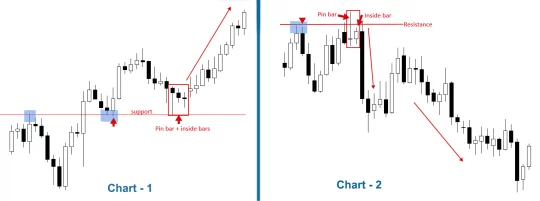

How to Trade Pin Bar + Inside Bar

1) We trade only if there is an important level, and we trade from it.

2) We are waiting for the closing of the inside bar within the nose of the pin bar.

3) Place a pending buy order if the pin has a tail below and a pending sell order if the pin has a tail above.

4) We are waiting for the activation of the order.

5) Stop loss — for an inside bar or even a pin bar (if the price is not very different).

6) Take profit — 1 to 2 or even to 3 in relation to the top loss. It is also possible to close in parts — profit 1 and profit 2.

Video with trading examples:

How to Trade Inside Bar + Pin Bar Combo Patterns

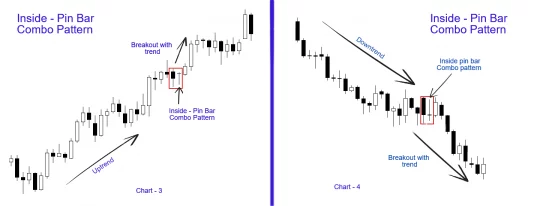

Inside pin bars are exactly what their name implies: pin bars that are also inside bars at the same time.

This setup works best on trending markets and D1 charts.

Let’s look at 2 examples:

Buy trade example

1) In Chart 3, we see a fairly strong uptrend before the combination pattern formed — an inside pin bar.

2) As a signal to enter the market, we see a price break above the high of the mother bar, and this is the entry point into the ongoing trend.

3) It is recommended to place a pending buy stop order just above the high of the mother bar in a combined setting with an inside pin bar.

4) The stop loss is below the low of the inside bar or even the mother bar.

5) Profit can be fixed at important trend levels or at least at a distance of 1 to 2 or even 1 to 3 in relation to the stop loss.

Sell trade example

1) On chart 4 we see a strong downtrend

trend until the formation of a combined pattern — an inside pin bar.

2) As a signal to enter the market, we see a price break above the low of the mother bar, and this is the entry point into the ongoing trend.

3) It is recommended to place a pending sell order just below the low of the mother bar in combination with an inside pin bar.

4) The stop loss is above the high of the inside bar or even the mother bar.

5) Profit can be fixed at important trend levels or at least at a distance of 1 to 2 or even 1 to 3 in relation to the stop loss.

![PIN BAR + INSIDE BAR = Combination of patterns [New Signal Price Action]](https://strategy4forex.com/wp-content/cache/thumb/8b/c062592e7fb0a8b_320x200.webp)