Forex strategy at Candlestick patterns designed to trade on Japanese candlestick at time intervals of 30 or 60 minutes in the direction of the prevailing trend, and allows traders to the forex to determine their risk levels and to take profits, taking advantage of the specific structure of the pricing model, forex.

There are a large number of candle models, which include one to six candlesticks, trading signals and feed on emerging bullish or bearish developments in the forex market. These price patterns appear on the market often enough, and they are easy to define and identify.

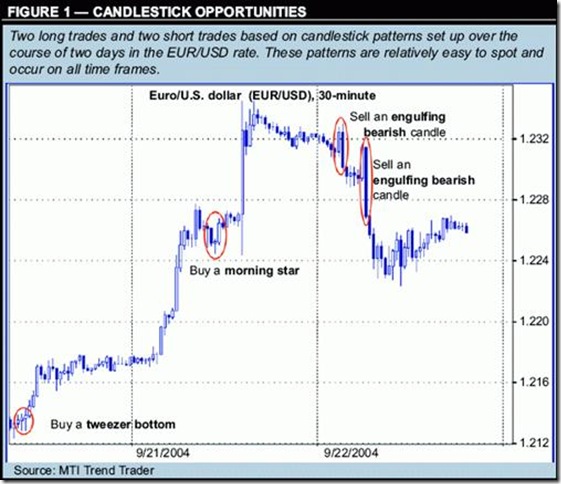

Figure 1 shows the 4 basic and well-traded «candlestick patterns», which were formed on the 30-minute price chart currency pair EURUSD.

Figure 1. 2 trading signal for the opening of trading positions for the purchase and 2 trading signals for the opening of trading positions.

Regardless of your chosen time span and the chosen candle model, all the candlestick patterns the same principles of risk management. Before you open a long trading position, place a protective safety stop-loss order 10 pips below the current model and a candle warrant for the fixation of the desired profit of 10 pips below the high of the previous candlestick, which has a maximum above the 2 previous and 2 subsequent candles .

This rule applies for work with short trading positions. Protective safety stop-loss order placed at 15 pips above the high candlestick patterns, and therefore warrant profit at 10 pips above the low of the previous candlestick, in which at least below the minimum of 2 previous and 2 subsequent candles.

This forex strategy addresses risk measurement and management of available capital at work with candlestick patterns on the example of 2 well-known pricing models: the morning star in a bull market and bear the «peak tweezers» — tweezer top.

Bullish morning star

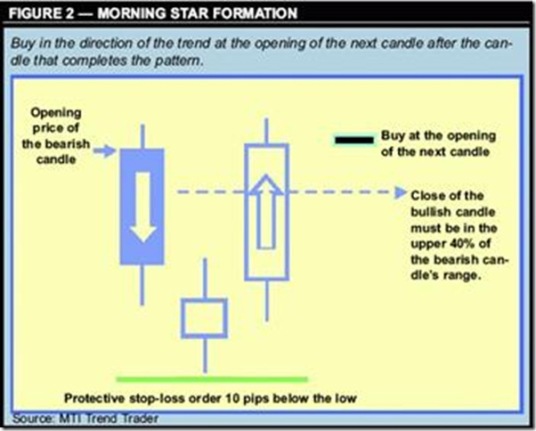

«Morning Star» — the pattern of the bull market, which often appears on the chart at the end of a downtrend. «Morning Star» ideally consists of 3 candlesticks (Figure 2). The first of them — it’s a long bearish candle. The second candle — a small, similar to the top: it can be black or white, which forms a «window» under the previous candlestick body. The third candle — a long bullish candlestick, she rose to the top of the range of the previous bearish candle. 1-I long bearish candle points to force a turn down. 2-I also pointed to the fact that the strength of the bears is temporarily exhausted. And finally, a long white candle shows that the strength of the bulls once again returned, and provides control over the market. Usually, this pattern will most likely indicates a reversal in the market and heralds the rally.

Figure 2. «Morning Star» — the purchase must be implemented with the opening of the next Japanese candles. Closure of the same bull candle should be at the top of the bearish candle — in Ryan from 0 to 40% from the top.

The rules for opening trades

When you are in the market of the candlestick patterns:

1. Trading position for the purchase should be opened at the opening of a candle, which follows a long white candle. Note: sometimes the candlestick patterns «morning star» contains much more than three candlesticks. In this case, between 1 st and last longer bear the long bullish candlestick occurs more than 1 second (somewhat) short of candles.

2. Safety stop-loss is 10 pips below the low of the generated pattern.

3. Determine the maximum of three, preceded or followed by 2 is much lower highs and place an order on profit-taking at a maximum, which provides a 1.5-2 times higher than the trade risk.

If the trend downward — this pattern is called the «evening star». For a given pricing model used all trading rules contrary to the rules, «the morning star.» Trading position on the sale opens at the end of the formation of a price pattern, a protective safety stop-loss order placed at 15 pips above the high of the pattern «evening star», thus warrants profit-taking at 10 pips above the previous minimum (which is needed to determine exactly the same way as described in Section 3).

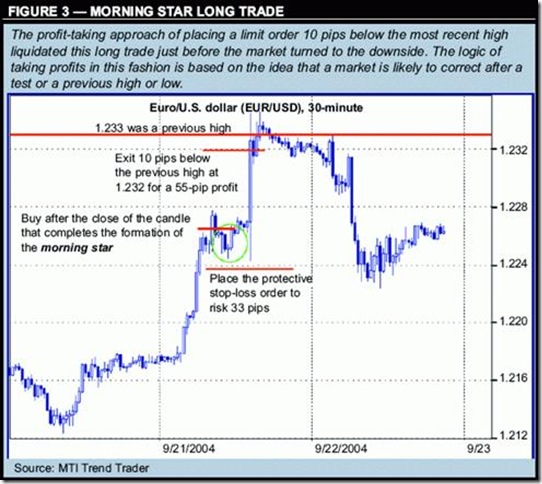

In Figure 3 you can see an example of a pattern «morning star». You should always wait until the last candle closes this pattern, if you do not, then you’ll be risking a deal on the market prematurely. Safety stop-loss is 10 pips below the pattern, because experience shows that once at such a time-frame, the price deviates by more than 10 pips up or down the bulls or bears can once again gain its strength and change the situation on the foreign exchange market. A warrant for the closure of profit is 10 pips below the last maximum (or minimum over the latter), because the bulls are trying to move the market price to the last maximum. Once the new maximum will be tested with a high probability we can expect the rollback on the market.

Figure 3. «Morning Star» — the purchase is made at the opening of the new candles. Protective safety stop-loss order is for 33 pips below the opening of trading positions. Old maximum 1.233, the yield on the 10 pips below the previous high of 1,232 with a profit of 55 pips.

Pattern of «Top of forceps»

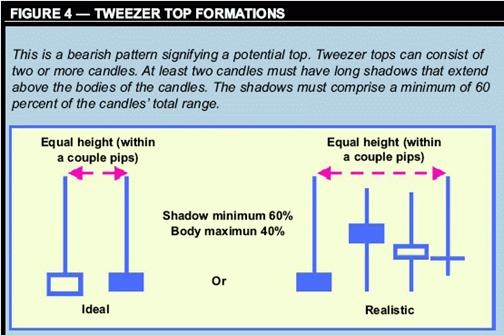

«Top of tweezers» — a pattern bear market, which often appears at the end of the trend, thus indicating a possible pullback in the market or trend reversal. Its fairly easy to identify on the chart. Model of a similar pair of tweezers — Two Candlesticks with very small bodies, while long shadows over them (Figure 4). Between the two tweezers should not be any other candles. Rules for the opening of trading positions on this pattern are the same as for the pattern «evening star».

Figure 4. On the left you can see the ideal model. Right — much more realistic model. Shadow of candles — At least 60%, and the body of the candle — a minimum of 40%.

1. Trading position on the sale opens at the close of this pattern.

2. Protective safety stop-loss is 15 points higher than the maximum graphical models.

3. On the chart are 3 recent lows, which are preceded by 2 is much higher wage and followed by two more high-wage, after which a warrant for the profit-placed 10 pips above the minimum of the Japanese candlestick, which gives a minimum return is 1.5-2 times higher than the permissible risk.

«Doña tweezers» — is the opposite pattern of «spikes tweezers» (see the first model in Figure 1). Accordingly, for trading on the model of candlesticks rule is reversed. In Figure 5 you can see the «top of the tweezers on the currency pair USDJPY. In this case, the pattern of candles consists only of two candlesticks, the reversal in the market occurred immediately after its formation.

Figure 5. Pattern of «Top of tweezers.»

Money Management for trading on graphical candlestick patterns.

Even with the best forex trading strategy, any trader will still be ruined, if not always use its capital management strategy and will not know the basic conditions for successful forex trading.

A large number of successful FOREX traders to make the right trading decisions are only 50-60% of the cases of 100%. Given this likelihood of winning the conclusion of the transaction, it is important that at every dollar that you’re going to take risks, have been at least $ 1.5-2 profit potential. The only question is how much of your capital, you can use when opening a trade position forex?

Very often the rules of risk management to risk not recommend more than 4-5% of your trading deposit at the conclusion of any transaction. A professional traders and managers of capital usually use part of the risk of about 0.25-2% of the equity for each transaction.

For example, if your deposit is 10.000 USD, and the risk you have chosen 2% of capital per Sledkov, you must use a safety stop-loss does not exceed USD 200 with the desired take-profit for each open order at least $ 400 (ie . privyshat profits should be at least 2 times your risk.) Basically USD 200 means 20-point stop-loss (at a price point — $ 10 — a deal for a lot). Correspondingly, if you want to afford to stop loss of 100 points, and the price of 1 point respectively to be 5 times smaller — that is, $ 2, and it already complies with lot size of the transaction — 0,2 lot. If you always adjust the size of each of the bargain — you will have confidence that tomorrow you will have something to trade forex.

Candlestick patterns + money management.

Trading on the Forex strategy we are considering will allow you to expose well-costed stop-loss and Take-profits on profit-taking in the appearance of these candlestick patterns.