In this article, we will talk about a pattern called the Island Reversal Top / Bottoms Pattern [Forex & Crypto Trading Strategy] and thus please fans of graphic patterns.

It is known that for the most part trading on the stock exchange comes down to searching for various patterns and identifying their features. A certain number of such models are widely used among traders (“double bottom”, “flag”, “head and shoulders”, and so on), but there are also models based on gaps (price gaps) and today’s model is based on it.

Due to the fact that the basis of the Island Reversal model is a gap, it becomes clear that the main area of application of this pattern is the securities market, indices, etc. (due to the frequent formation of these gaps). Gaps do not appear so often in the foreign exchange market, but this model has proven itself well here.

- Currency pair — any.

- Time interval — as for other patterns of graphical analysis, priority is given to daily charts, however, this model is also able to make a profit on other timeframes.

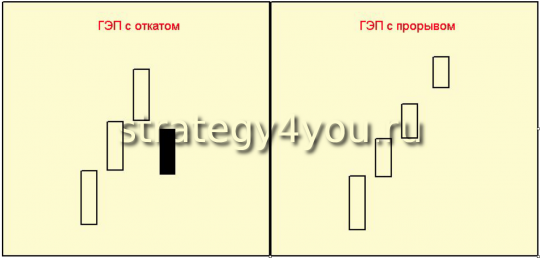

First, let’s define two types of gaps:

1) Gap with a rollback — the price gap is directed against the last nearest directional movement.

2) A gap with a breakdown — the price gap is directed towards the previous movement.

It is the second type — «GAP with a breakdown» that will interest us.

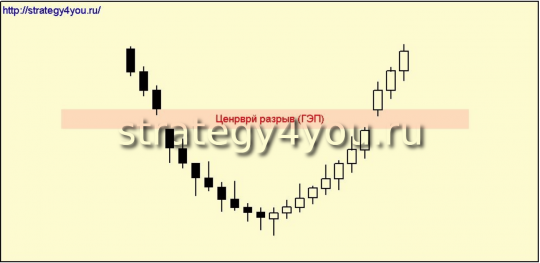

Pattern description — Bullish pattern (for purchases):

On the downward movement, there is a gap with a breakout, after which a bottom forms and the price gradually recovers (grows). Approximately at the level of the first gap, a second gap is formed, only with a breakthrough upwards. Thus, the bottom is, as it were, cut off by two gaps on both sides — an island.

Perfect formation of a bullish pattern

Entering the market, trading strategy «Island reversal»:

1) You should wait for the movement towards the closing of the gap (it happens in most cases) and at its completion we open a deal to buy. Simply put, we enter the market when the first white candle after the gap appears.

2) If this movement did not occur immediately and the price immediately went up quite far, then we will enter from the maximum price of the last candle before the gap. That is, we will wait for a rollback to the level of the beginning of the gap. We wait for this rollback no longer than 7-9 candles.

3) Stop-loss is set under the last clearly expressed minimum. If there is none and the last low is the bottom itself, then the stop can be placed behind the fibonacci level of the bottom stretched from the low to the entry point.

4) The main profit-taking target is calculated by plotting the height of the entire model from the minimum value of the previous candle gap.

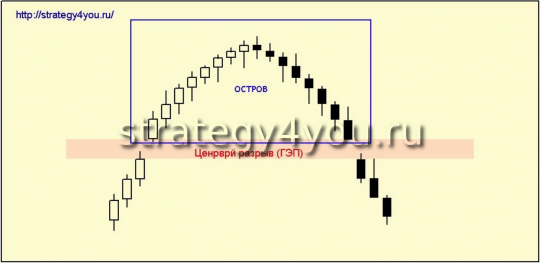

Bearish Island Reversal pattern (for sales):

On the upward movement, there is a gap with a breakout, after which a top is formed and the price gradually turns down. Approximately at the level of the first gap, a second gap is formed, only with a downward breakthrough. Thus, the peak is, as it were, cut off by two gaps on both sides — an island.

Perfect formation of a bearish pattern

Trade entry, trading strategy of the «Island reversal» model:

1) You should wait for the movement towards the closing of the gap (it happens in most cases) and at its completion we open a deal to sell. Simply put, we enter the market when the first black candle after the gap appears.

2) If this movement did not occur immediately, and the price immediately went down quite far, then we will enter from the minimum price of the last candle before the gap. That is, we will wait for a rollback to the level of the beginning of the gap. We wait for this rollback no longer than 7-9 candles.

3) Stop-loss is set after the last clearly expressed maximum. If there is none and the last high is the top itself, then the stop can be placed behind the fibonacci level stretched from the top’s high to the entry point.

4) The main target is calculated by plotting the height of the entire pattern from the high of the previous gap candle.

Additions to the pattern trading strategy:

“Wide bullish patterns work better than narrow ones.

— Narrow bearish patterns work out better than wide ones.

— When using volumes, you should know that when the second gap appears, the volumes increase.

— It is necessary to wait for the complete formation of the model.

We also recommend that you look for similar models in history and consider them in detail in order to understand the essence of trading this graphical model.

![Island Reversal Top / Bottoms Pattern [Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/2e/947da1a637fa22e_320x200.png)