The Shark [Forex & Crypto Trading Strategy] is currently a reversal harmonic pattern and the youngest pattern.

The aspect ratio of this model is also based on Fibonacci levels and extensions.

- Time interval — any.

- Instrument — any, works on currency pairs, cryptocurrency, stock market.

Previously, we have already considered patterns:

«Shark» was described for the first time quite recently — in 2011. Its author, like many other harmonious models, is Scott Carney, a student and follower of the founder of harmonious trading in the financial market, Harold Gartley.

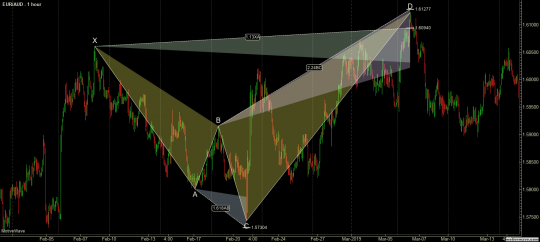

Strange as it may seem, but very often the further price movement transforms the shark into the “5-0” pattern, which we recently considered. That is, the «shark» is part of another harmonious pattern — «5-0».

It often happens that the end of the «shark» model leads to the formation of a new harmonious model — «crab» or «bat».

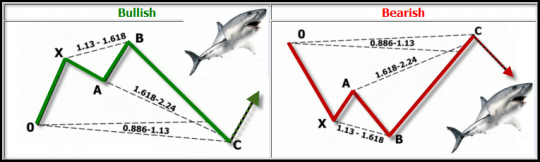

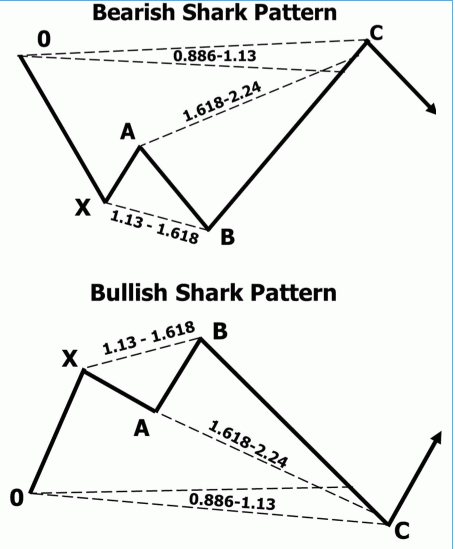

The Shark pattern consists of 5 points — O, X, A, B, C. In its shape, the pattern resembles a large shark fin peeking out from behind the waves. That is why the model is called a shark.

Shark’s aspect ratio is as follows:

- point B is in the range of 1.13-1.618 of the length of the movement XA;

- point C is in the range of 1.618-2.24 of the length of the movement AB;

- point C is a local extremum and is located at the level of 0.886-1.13 of the Fibonacci grid built on the segment OB.

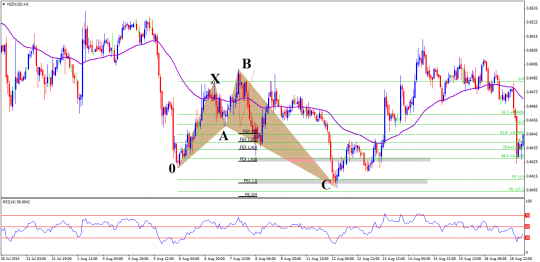

How to trade the Shark pattern — trading strategy:

1) First of all, you need to make sure that the ratios of the constructed points of the «Shark» meet the requirements for building the model, which we described above.

2) And after that, make a deal at point C or wait for a rebound from this point and only then open an order.

3) Stop loss is placed behind the next Fibonacci level/Fibonacci extension or below the low/high when trading after a bounce candle has formed.

4) Profit:

- Profit 1 — point A.

- Profit 2 — point B.

That’s all I wanted to tell you about the Shark.

![Shark Harmonic Pattern [Forex & Crypto Trading Strategy]](https://strategy4forex.com/wp-content/cache/thumb/0f/82a8737a6a1af0f_320x200.png)