3 Candles/ Three Candles [Forex & Crypto Trading Strategy] at one time gave rise to quite heated discussions on various English-language sites and forums dedicated to forex trading, it is very simple and cannot be put into practice work even for novice traders

Forex indicators are not used when trading on it, and the market is entered based on a certain combination of three candles. The direction of the trend doesn’t really matter.

- Currency pair — any. As a recommendation, currency pairs with the Japanese yen are offered.

- Time interval — Daily.

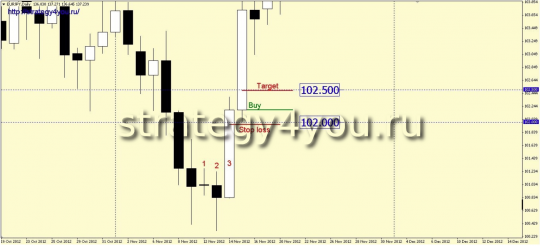

Conditions for buying forex strategy «3 candles»:

1) At the close of the next candle, pay attention to the last three candles. The size of the body of the last candle must be larger than the size of the bodies of the two previous candles, each separately.

2) The penultimate candle must be bearish:

3) The closing price of the last candle must be higher than the closing price of the penultimate one and, accordingly, the body of the last candle must be white (bullish candle).

4) If all these conditions are met, then at the opening of the next candle, we conclude a deal to buy.

5) Take profit is fixed at the nearest psychological level with the end of «00» or «50» for a four-digit broker. If the nearest similar level is less than 15 points, then the next similar level can be taken as the target, but when the nearest one is reached, the transaction should be transferred to breakeven.

In any case, when passing 30-35 points in the positive zone, the deal should also be transferred to B/C.

6) Stop loss is set for the same levels, but on the reverse side. The minimum stop order size is 20 pips.

If the price is close to the psychological level for a stop loss of less than 15 pips, you can also use the next similar level, but in these cases the trade should be checked for appropriateness in terms of your money management rules.

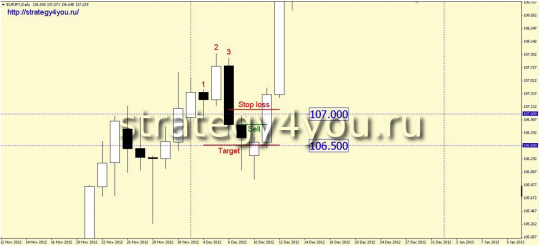

Conditions for selling according to the «3 candles» strategy:

1) At the close of the next daily candle, pay attention to the last three candles. The size of the body of the last candle must be larger than the size of the bodies of the two previous candles, each separately.

2) The penultimate candle must be bullish:

3) The closing price of the last candle should be lower than the closing price of the penultimate one and, accordingly, the body of the last candle should be black (bearish candle).

4) If all these conditions are met, then at the opening of the next daily candle, we conclude a deal to sell.

5) Take profit is fixed at the nearest psychological level with the end of «00» or «50» for a four-digit broker. If the nearest similar level is less than 15 points, then the next similar level can be taken as the target, but when the nearest one is reached, the transaction should be transferred to the breakeven level.

In any case, when passing 30-35 points in the positive zone, the deal should also be transferred to B/C.

6) A safety stop-loss order is set for the same levels, but on the reverse side. The minimum stop order size is 20 pips (again, 4 digits each, for a 5 digit broker, 10 times more).

If the price is close to the psychological level for a stop loss of less than 15 pips, you can also use the next similar level, but in these cases the trade should be checked for appropriateness in terms of your money management rules.

Additions to the strategy:

In most cases, this combination is a normal engulfing pattern, but it is not required. See an example in the figure below:

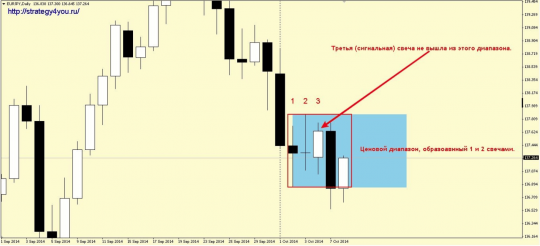

Try to avoid cases where the third (last) candle is completely inside the price range formed by the two previous candles, which in turn show long tails from different sides (pullbacks in different directions, often doji). See the picture below:

Video Forex strategy «3 candles»:

And Video — 2:

![3 Candles/ Three Candles [Forex & Crypto Trading Strategy] — an easy way to trade with the trend](https://strategy4forex.com/wp-content/cache/thumb/96/e8030549b0c9b96_320x200.png)