Today we will consider the Forex & Crypto Strategy «M Rivalanda Entry Method» — a market entry strategy based on candlestick analysis, we will not delve into the theoretical part and the history of the origin of this technique today, as it will take a lot of time and can simply confuse many traders, because Let’s consider only the practical part of M. Rivaland’s method of entering the market.

Its essence comes down to finding an entry point at the moment of completion of the correction in the direction of the main clearly expressed trend. A trading instrument (including a currency pair) can be any. The recommended time interval is Daily (D1), but the effectiveness of this technique at shorter time intervals is not denied.

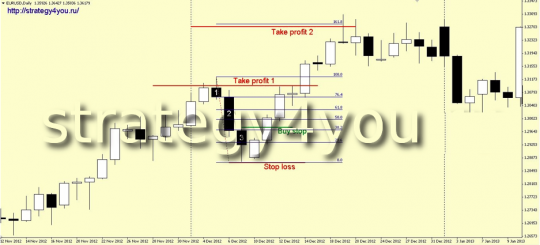

Conditions for entering a BUY (ideal formation) according to the Rivaland Method:

1) On a stable uptrend, at least three black candles in a row form. The closing price of each subsequent candle must be lower than the minimum price of the previous candle.

This corrective move should not absorb most of the main trend. That is, the movement should be clearly corrective in nature.

2) After the formation of the 3rd candle above its maximum, a buy stop breakout order is placed.

3) Stop loss is placed under the last minimum value.

4) If after the 3rd candle a candle is formed, the closing price of which is lower than the minimum value of the 3rd candle, while the order has not been activated, then the breakout order should already be rearranged beyond the maximum of the last one. The same goes for the stop loss order. Thus, the order moves to the highs of all subsequent candles that meet the main conditions.

5) When the last maximum value of the entire main uptrend is reached, the open position should be secured by moving the stop-loss order to the level of the opening of the transaction — to breakeven. If desired, at the same level, you can either fix a part of the transaction, or close the transaction completely.

6) Also, with further price movement towards the main trend, the next target level can be considered the level of fibonacci extension from the last corrective downward movement 161.8.

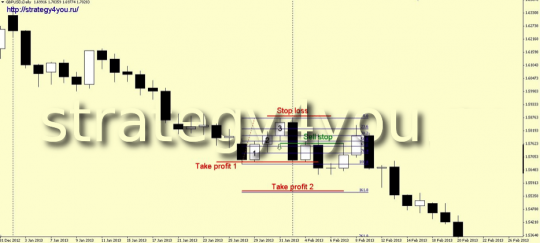

Conditions for SELL according to the «M Rivalanda Entry Method» strategy:

1) On a stable downtrend, at least three white candles in a row form. The closing price of each subsequent candle must be higher than the high price of the previous candle.

This corrective move should not absorb most of the main trend. That is, the movement should be clearly corrective in nature.

2) After the formation of the 3rd candle, a sell stop breakout order is placed under its minimum.

3) Stop loss is placed above the last maximum value.

4) If after the 3rd candle a candle is formed, the closing price of which is higher than the maximum value of the 3rd candle, while the order was not activated, then the breakout order should already be rearranged under the minimum of the last one. The same applies to stop loss orders. Thus, the order moves along the lows of all subsequent candles that meet the main conditions.

5) When the last minimum value of the entire main downtrend is reached, the open position should be secured by moving the stop-loss order to the level of opening a deal. If desired, at the same level, you can either fix a part of the transaction, or close the open transaction completely.

6) Also, with further price movement in the direction of the main trend (in the direction of the breakdown), the next target level for profit taking can be considered the level of fibonacci expansion from the last corrective upward movement of 161.8.

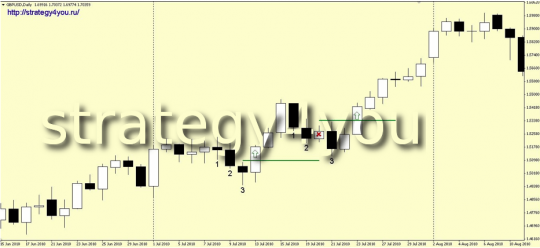

Not ideal situations and additions to the Rivalanda Market Entry Method

1) If inside the corrective movement there are candles that do not meet the basic conditions, but at the same time do not break the pattern, then we simply do not take them into account (doji, inside bar, and so on):

2) It is desirable that there are as few unaccounted bars as possible within the corrective movement.

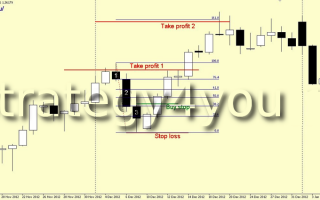

3) The movement during the activation of the order should ideally have an impulse character. You should be careful if the price moves towards the activation of the order slowly, with candles with small bodies. It is desirable that the order be activated on one or two candles following the trend.

3) Before placing an order, be sure to calculate whether the profit / loss ratio suits you, according to the rules of money management.

4) Before using this method of entry on a real account, we recommend that you practice on demo or cent accounts and look for similar patterns in history.