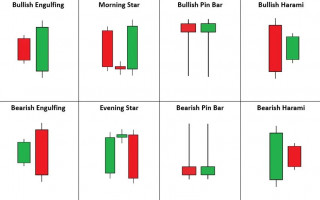

Candlestick pattern indicator is an extremely useful tool for any trader, as it allows you to automatically recognize and fix the main patterns.

Japanese candlesticks are considered one of the most effective methods of technical analysis, their formations clearly demonstrate the current situation and predict future changes in the market, they are relevant for use in a variety of strategies — for any currency pairs, for scalping and long-term trading.

The main drawback when performing analysis by candlestick groups is subjectivity. After all, in the process of its implementation, the trader evaluates the price movement chart, identifies models by certain points and indicators, which become a hint regarding the current situation and future changes.

But it happens that one person sees a certain formation, and the other identifies it in another section of the chart, or does not see it at all. Therefore, to determine the models, you need to have considerable experience or use programs whose main advantage is the maximum objectivity of the analysis, which is based on taking into account previous data.

And Video — 2

What are these types of tools for?

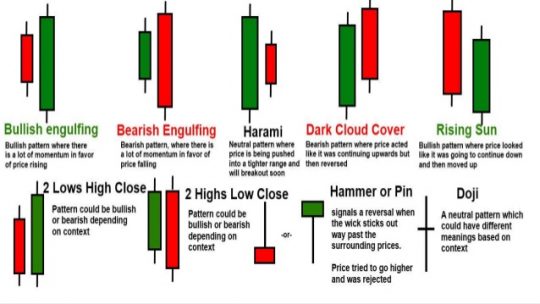

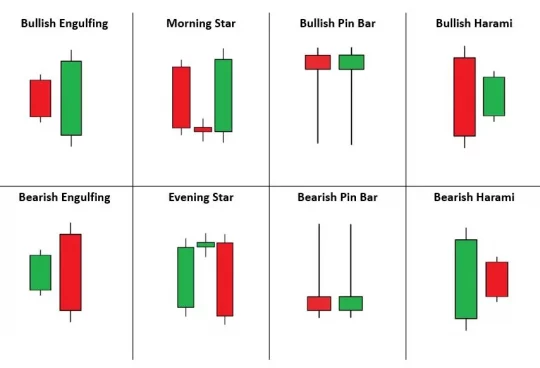

Japanese candlestick patterns are diverse and can be very different: trend continuation, reversal patterns, etc. A trader can search and identify them visually by analyzing the price movement chart, but this is not easy to do, especially for beginners and those whose time is limited.

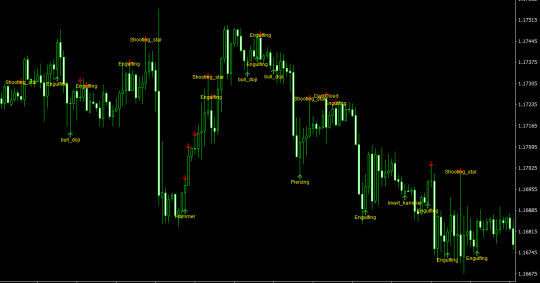

To perform analysis in automatic mode, you can use a variety of indicators that search for candle combinations, display them on the chart, and filter them according to signal strength.

Basically, indicators that recognize candle patterns are created for the most common trading terminal MetaTrader 4, but many successfully work with other platforms — Quik, MT5, etc. d.

The most common indicators

There are enough tools for performing technical analysis, so the trader has a lot of choice.

Most popular programs:

- Candlestick Pattern Indicator (CPI) – displays the main candlestick formations, allows you to configure the parameters at the discretion of the trader: turn on and off certain types of patterns, take into account a different number of candles, change color elements. You can also use this candlestick pattern detection tool with or without an alert.

- Pattern Recognition is another option that works with all currency pairs, on any time frame. You can customize the display of each model separately, recognizes most of the most common and important.

- Bheurekso pattern is a signal indicator that detects candle formations on the price chart and writes their name. It is able not only to identify patterns and give the trader their names, but also to indicate trading signals (indicate whether it is worth selling or buying now). Most often, it is used as an additional tool at higher time intervals to check the signals of other indicators.

- Pattern Options — detects patterns and visualizes them, it is possible to program it to search for specific patterns according to their strength: these can be weak or strong trend continuation patterns, its reversal or no classification at all by type.

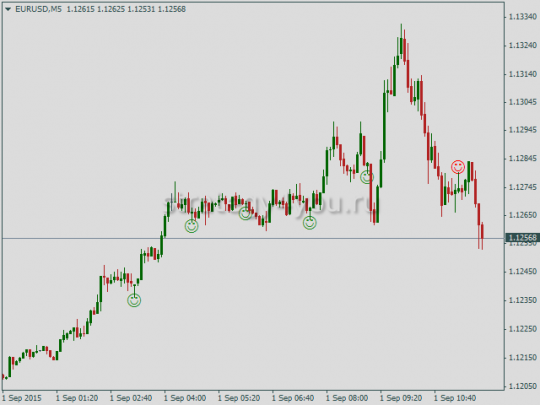

- PinBar Detector is an original signal tool that detects a pattern on a price chart and marks it with emoticons. The green color of emoticons indicates bullish formations, the red one indicates the formation of signals for sell transactions.

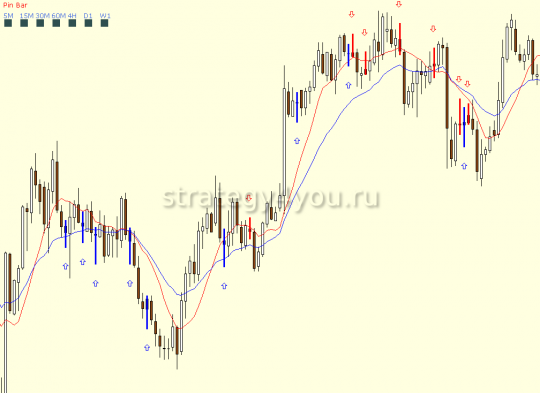

- MTF PinBar Scan – detects the appearance of a pin bar pattern for the specified currency pair on all timeframes. After a pattern appears on the chart, it draws arrows next to it, and highlights the pin bar itself. A trader can change the coloring of candles, the drawing of arrows, the inclusion of an alert, the delivery of notifications, the choice of TF, etc. in the settings.

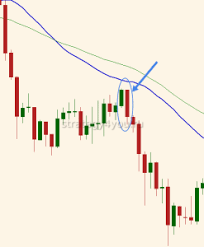

- HartF engulfing patterns indicator – looks for the most reliable and unambiguous formation on the chart. The candlestick pattern stands out with a contrasting signal, giving the exact moment to enter the market. The model is formed by two equidirectional candles, the last of which absorbs the body of the previous one.

All programs without redrawing can be downloaded for free on our website or on the Internet, just install in the trading terminal and get to work. When analyzing, you need to take into account not only the appearance of various formations and how well they formed, but also the strength of the signals: filter out false positives, check the given values yourself.

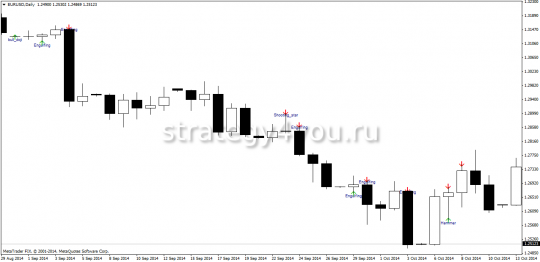

An example of a forex strategy on candlestick patterns — Absorption and Rollback:

And Video — 2: